Introduction

I've watched the gruesome saga of Quindell with a certain amount of prurient interest over the last 8 months. From Paul Scott highlighting it, two years ago, as a stock with a bad smell to Gotham City publishing their research note in April and then Tom Winnifrith coming out all guns blazing. I'm just glad that I've never had an investment here; it's exciting enough watching from the sideline.

While the fat lady hasn't put in an appearance yet I can't help feeling that, one way or another, we're in the end game now. So my ambition in this post is to see how far back the cracks started appearing in the accounts and decide if I would have seen them as red-flags at the time. Obviously there's rather a lot of hindsight involved but if I can learn some lessons for the future from this analysis then it'll be time well spent.

NB: In the last annual reports the issue of IFRS 10 surfaces and a consequent need to restate the accounts for 2012. I can't say that I understand all of the details but the change appears to be related to acquisitions and how and when they should be combined with the group accounts. Needless to say the impact is material and so all of my graphs include a restated column to illustrate the impact.

The Good

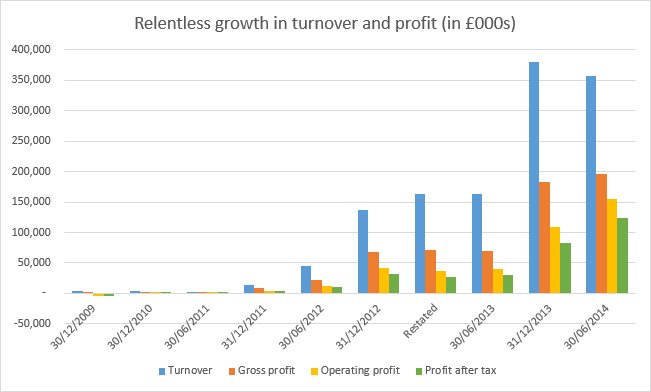

The profit growth of Quindell, since it completed a reverse-takeover onto AIM, has been nothing short of extraordinary. I don't know that I've ever seen a company multiply it's profits by 10x in 4 years but that's what we've got here; in fact in each half-year it has managed to equal, or beat, the prior full-year so far!

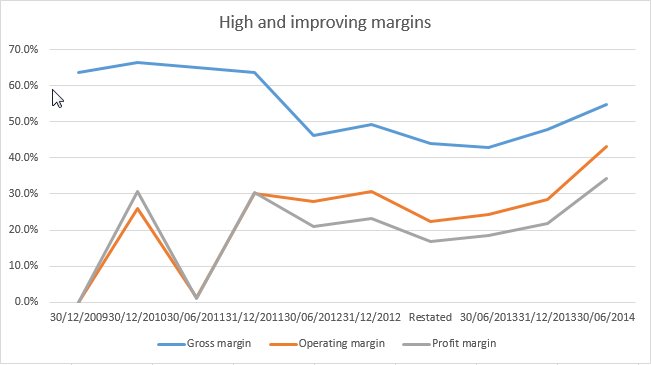

Even more impressively this growth hasn't been achieved at the expense of margins and these have actually improved over the last couple of years. So Quindell are keeping a tight hold on costs which is remarkable given the pace of acquisition and number of business areas covered by the group.

All of this has been achieved with a decent and stable ROCE (return on capital employed) which indicates that new capital in the business is being deployed effectively. Given the fact that acquisitions often lead to return dilution, as a premium is paid for the business bought, this stability is remarkable.

The Bad

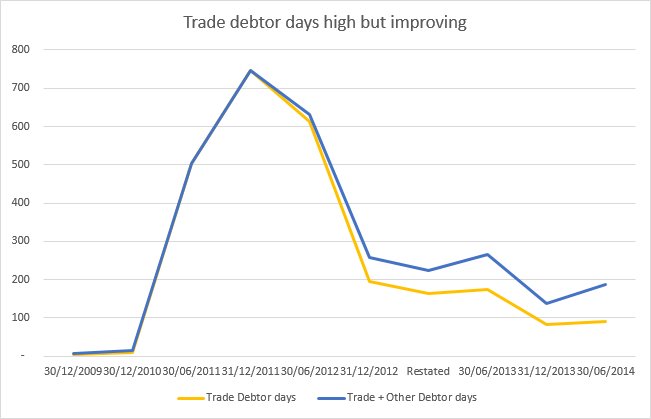

Quindell has demonstrably undergone a transformation in the last 3 or 4 years; part of this change is a piling up of debtors (trade and otherwise) on the balance sheet. This is most clearly seen by checking the debtor day figure (a comparison between debtors and turnover) across time; bear in mind that a value of 30-60 days is considered reasonable with this being the delay incurred to receive payment from customers.

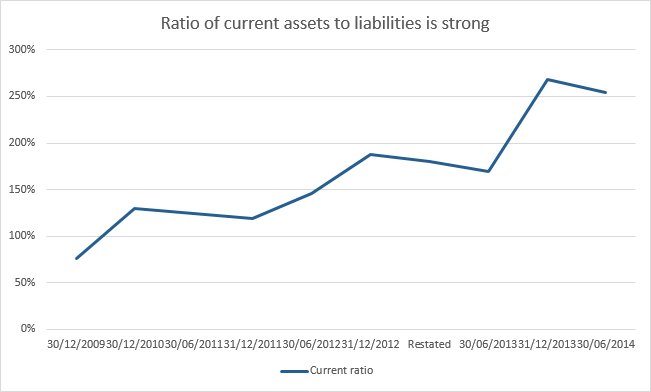

Given the way in which long payment terms are a feature of the Quindell business model it seems reasonable to check the liquidity of the company by comparing current liabilities to current assets. On the whole a ratio of 100% is an acceptable lower limit but anything higher, say 150%, is to be preferred in case some assets don't convert to cash. Here the ratio has improved year-on-year and is now absurdly high at more than 250%.

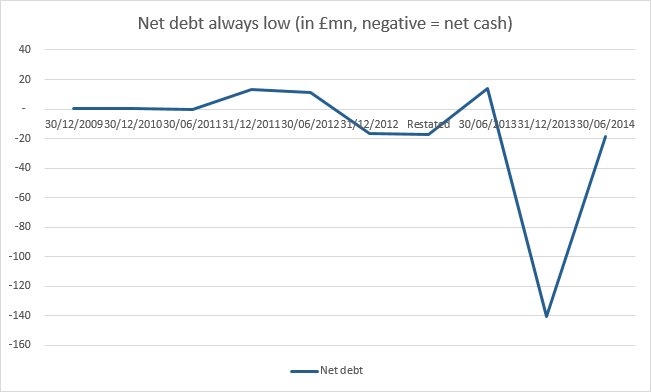

For an outfit so driven by growth through conquest it's hard to believe that Quindell has managed this with no net debt for much of its public life. That said debt instruments clearly play a role as (well covered) interest payments are present in every set of accounts. Also a very large net cash position at the close of 2013 has slumped dramatically this year and this makes me wonder if outstanding debt is about to become a problem.

The Ugly

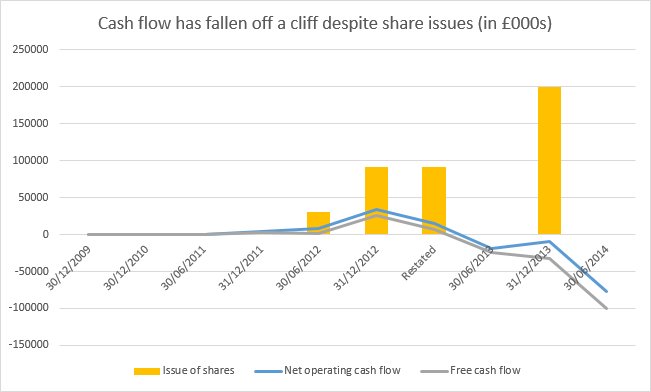

Possibly the biggest red flag with Quindell is the manner in which cash-flow has simply collapsed in the last two years. Profits are all very well but I want to see real cash being generated by the continuing operations of the company and that's a big fail here. In fact considering just how much money has been raised by issuing shares (i.e. loads) the cash-flow history is even more negative than it looks!

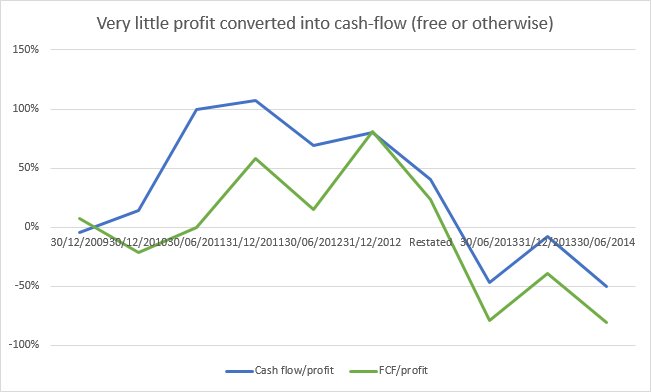

Another measure that I like is to compare the net operating cash-flow to the reported operating profit. Despite the latter being calculated on an accruals basis the two numbers should be broadly similar; if they aren't then there must be a good reason for the profits to be out of whack in one direction or another. Over time though the trend should always be for profits to convert to cash in a consistent manner - which isn't the case here.

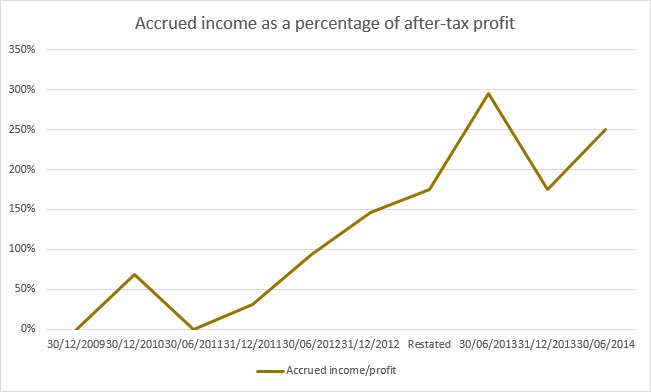

Part (maybe all?) of the reason for profits not translating into cash is the huge growth in accrued income. This inability to get hold of the riches that they're apparently owed is a huge klaxon for me; it just seems ludicrous for there to be the equivalent of 2.5 years of profits tied up on the balance sheet in this way.

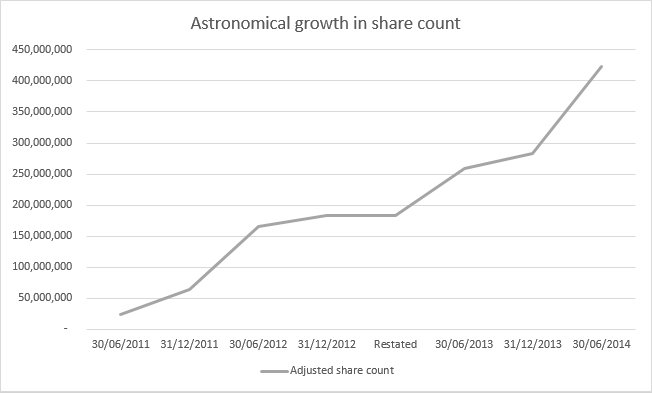

The final element that really bothers me with Quindell is the eye-watering inflation in share count in just three years. There are almost 18x as many shares in circulation now and that's bound to dilute anyone's holding as well as retard earnings-per-share expansion. It's no wonder that a 1 for 15 share consolidation was required back in June!

Conclusion

It's a familiar adage, "turnover is vanity, profit is sanity but cash is reality", but it's never felt more appropriate than with Quindell. The gigantic disconnect between profits being reported and dough actually being collected from customers is an outstanding warning of trouble ahead. That said even the cash numbers didn't look too bad right up to end of 2012; or at least they looked ok until the IFRS 10 restatement blew the reported values apart.

A clue that all wasn't well actually came with the 2013 mid-year results and a big fall in cash conversion, a doubling of accrued income and a swing into a net debt position. Hopefully this dramatic reversal of fortune would have shaken me out of this company if I'd been holding; up to this point though I'd probably have gone along with the growth story. So Paul Scott was on the money just by being massively sceptical of the business model!

Having gone through the accounts what's interesting is just how many seemingly minor issues there are; individually acceptable but somehow damning en masse. For one thing in the final year audited accounts the unaudited half-year results always seem to be slightly different to those put out at the time; sometimes to a material extent. I wonder how many people actually check back? Then there's the crazy pace of acquisitions; bad enough in its own right but a perusal of the takeover document reveals just how incestuous this process has always been with related party interests all over the place.

Maybe the last point is the worst of all; how can any management keep track of so many changes and integration challenges? It's just not possible. So the only reason for such a spending spree must to be burn through as much over-processed stock as possible in a bid to spread the largesse to chums and make the accounts as impenetrable as can be. No wonder the company history has been short and volatile; just like all of Rob Terry's other companies! I doubt that he's short of a bob or two but his companies certainly have been.

Disclosure: I have never had an interest in shares in this company