Introduction

Zytronic is a company that I first heard about on Paul Scott's blog roughly eighteen months ago. This isn't too surprising given that they're a niche manufacturer of touch screens who supply to industrial clients; hardly a household name. And yet many of us will have seen (or felt) their robust, vandal-proof products in a public space and been impressed by the sheer scale of the displays.

The problem with Zytronic is that they warned very significantly on profits back in May 2013 and the outlook appeared cloudy at the time. In the end it took the best part of a year for the company to demonstrate that this was a one-off blip and, for obvious reasons, the market in the shares remained subdued for perhaps another six months.

Now, though, the shares have reached the level that they were at before the profit warning (although still 20% down on the all-time high point) and the recent full-year results demonstrate real strength. My questions then are: is the Zytronic recovery sustainable; is there more growth left in the tank; and is it reasonable to buy at the current price as a long-term holding?

How do the numbers look?

There's no doubt that Zytronic, as an investment, is of above-average risk. It's small (£45M), listed on AIM (lax regulation), reliant on lumpy orders with limited visibility (customers order on demand) and engaged in an innovation arms race (touch screens are constantly evolving). These are all big red flags for companies with weak management or who supply high-volume, low-margin markets or those without some sort of moat.

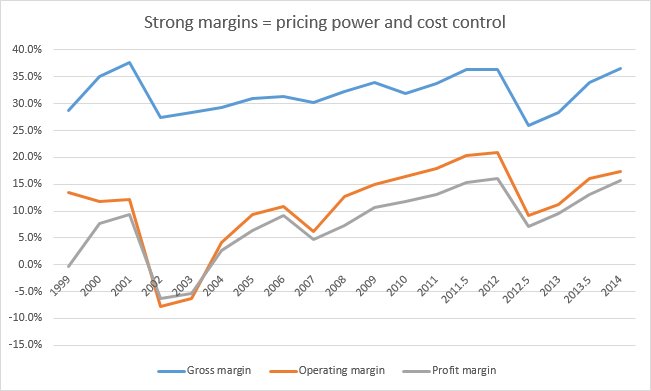

Fortunately Zytronic exhibits none of these problems and the consistently high gross margin demonstrates that they're in a sensible low-volume market. The net profit margins have proved more volatile but I think that there are two key points here: the business was badly impacted by the World Trade Center attack, and the 02/03 years were tough, but since then management have been hot on controlling costs and maintaining focus:

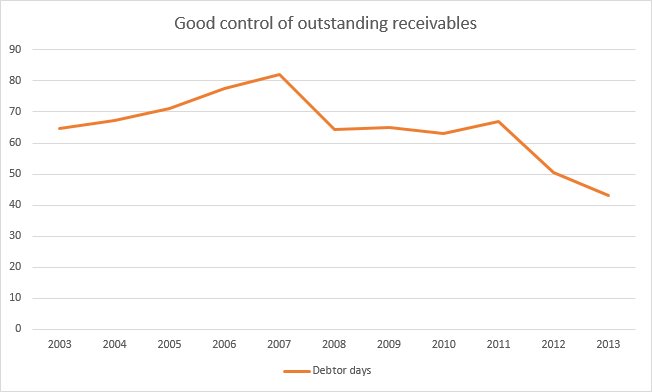

Another aspect of cost control, and clout in the market so that you don't get pushed around by the big-boys, is how effectively you manage outstanding debts. In a small firm like this you might expect to see invoices being paid within a couple of months, on average, and Zytronic are in this ball-park. However I really like the fact that the trend in debtor days has been downwards since 2007 and significantly so:

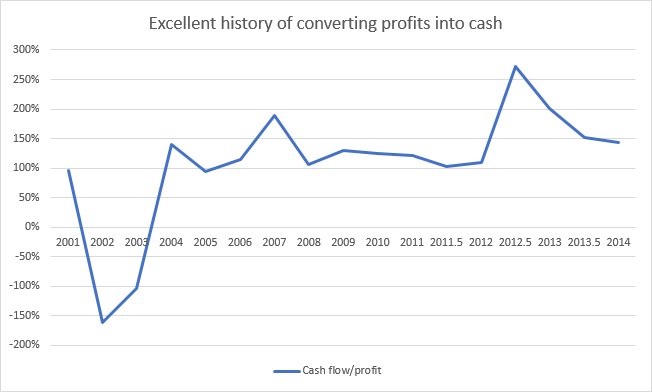

This is all great, and management appear in control, but it doesn't tell me whether the business is generating cash or if it's levered up to its eyeballs. To get an idea of this I like to compare the operating cash-flow to the operating-profit; if all is well then most of the profit should convert promptly. On this score Zytronic is more than impressive with a conversion-ratio above 100% for the past decade (the spike in 2012 is down to working-capital being released following the profit warning):

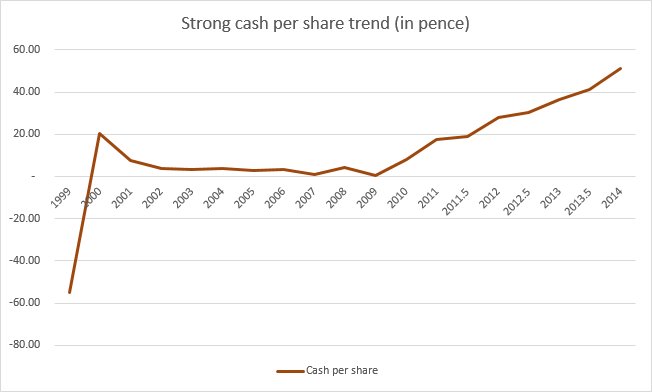

So lots of cash is being generated but we're not out of the woods yet. This cash could easily be sucked up by capital expenditure, debt servicing, legacy pension costs or over-generous dividends (to enumerate just a few options). Fortunately the company have three high-tech factories with good capacity (so capex is generally low but spikes occasionally), there's no debt, no defined-benefit pension scheme and dividends are typically over 2x covered. The payoff is an ever-increasing cash-pile of security:

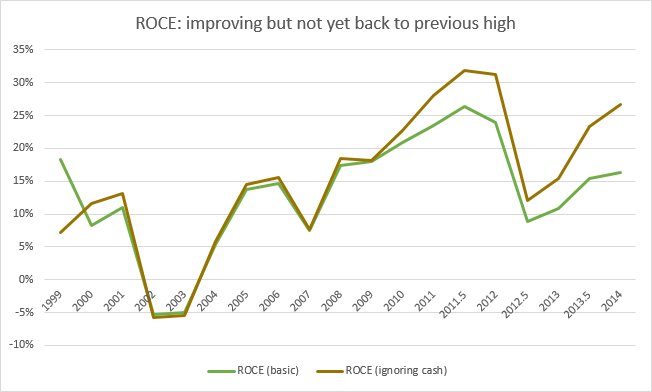

There is a downside to all of this lovely cash though. It's up to about a sixth of the market cap and yet it's not doing anything; the interest being received on it is derisory and it's not required for working capital, R&D, capex or acquisitions. The inevitable consequence of this is that the ROCE ratio gets dragged down because so much equity isn't paying its way; even so the ROCE history (lower line) for Zytronic is really very positive:

It's amazing really that the ROCE rose to 26% in 2011 but since then the return hasn't been so rosy what with the profit warning and cash-drag effect. If the cash is naively stripped out then the impact on ROCE can be seen in the upper line; before the order-gap last year the company was really flying. That said the recent trend is excellent and I can see how a return of 25% might be achieved next year.

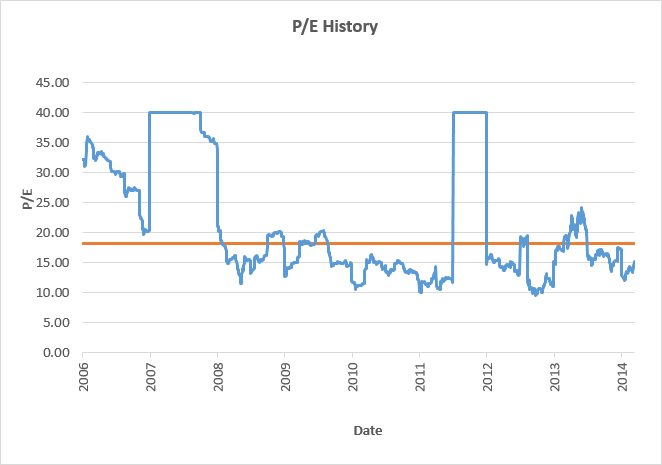

Up until this point I can't think of anything I don't like about Zytronic apart from, perhaps, the nasty order-book gap last year. Since this juncture management haven't put a foot wrong and the share price has entirely recovered. So it's worth considering whether the company is now fairly-valued, if not perhaps over-valued, given the strength of the rehabilitation. Looking at the historic P/E ratio since 2006 (before this time profits were small and/or negative as the company grew) the average is around 18 but with extended intervals spent in the 10-15 range:

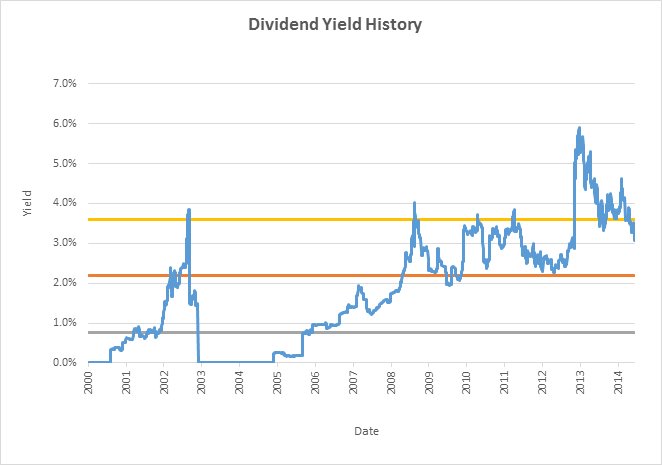

With a current P/E of 15 then the price is pretty much bang on trend and at about the right level. From a yield perspective the picture is more rewarding; for the last decade the payout has grown impressively and without pause. The consequence of this commitment to shareholders is a well-covered current yield of 3.5% - impressive for a small firm on AIM:

Given the size of the current cash pile management could easily increase the payout ratio or, if that feels improvident, a special dividend would also go down well. Either way the company is paying a healthy income without any strain on the balance sheet. As such I have no problem with the valuation of the company right now and can easily see the share price continuing steadily upwards if the business maintains momentum.

Conclusion

I must admit that I like Zytronic a lot and I particularly appreciate how transparent and direct their shareholder reports are. There's no spin or attempt made to adjust away bad news; when the poop hit the fan in 2013 there was no easy way to soften the blow and management didn't try. Instead they described the problems and, more importantly, laid out a plan to get the company back on course with a sensible recovery strategy.

In line with this plain speaking there's also no sign of the directors sticking their snouts in the corporate trough. The executive salaries are very reasonable for such a well-run company and the share options available are quite modest; just one reason why the share count has increased by less than 5% since 2001! This is indeed a self-financing, tightly-run ship.

Ironically this leads onto my most pressing concern with this firm; the management have negligible stakes in the business and when options vest they're as likely as not to sell their shares immediately. I admire this steely resolve not to feather their own nest but I wouldn't be averse to awarding the directors a few more options to align their interests with ours; rather a rare situation I'd say!

The other worry is the on-demand nature of orders, with limited visibility, and the reliance on three major customers for almost 50% of sales. I'm sure that these are fine clients but it would be pretty painful if one of them decided to move their business to a competitor. On the other hand the company is trading well and seems to occupy a high-end niche with a fair moat of technical expertise.

Overall I'm very impressed by both the management and Zytronic itself. There's nothing that I dislike about their stewardship of the company, the financial stability of the firm and the impressive comeback from last year's shock. I think that the brand has further to go in terms of expansion and in the meantime there's a healthy yield to enjoy. Not all AIM shares are rubbish I guess!

Disclosure: The author now holds shares in this company