Fever-Tree and I go back a few years. I first became aware of this wonder brand not long after the company floated in 2014 as artisan gin hit the big time. Even back then the shares looked expensive and it took me a few years to realise that the valuation stacked up and perform some in-depth analysis. With this in the bag I took a position in early 2017, intending to hold for the long term, but got shaken out last May when the company came out with an in-line trading statement.

Given that I exited at £27.68 this looked like a very poor decision as the shares continued marching upwards all the way to £40. Remarkable. However, in my update at the time, I mentioned my concerns around the valuation and the need for growth in America. With the interim results in July both of these areas remained an issue with the P/E hitting 73 and US growth an anaemic 15% due to a poor H1. Luckily growth elsewhere took up the slack and forecast earnings jumped to ~49p. Still we all know what happened in the last quarter of 2018 and by the time the price fell below £22 I suppose that in some way I felt vindicated!

Anyway with the year-end update a week or so ago indicating that results would be comfortably ahead of expectations, due to sales growth in all regions, the question I'm looking to answer is whether the current price of £26.20 is a decent entry point. It's certainly lower than my sale price, and the P/E is lower at ~52, but question marks over growth potential remain. Let's have a look at what the figures tell us.

Stock-specific Analysis

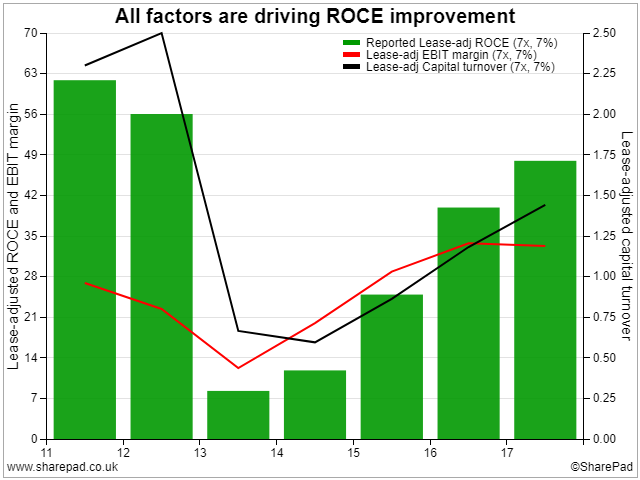

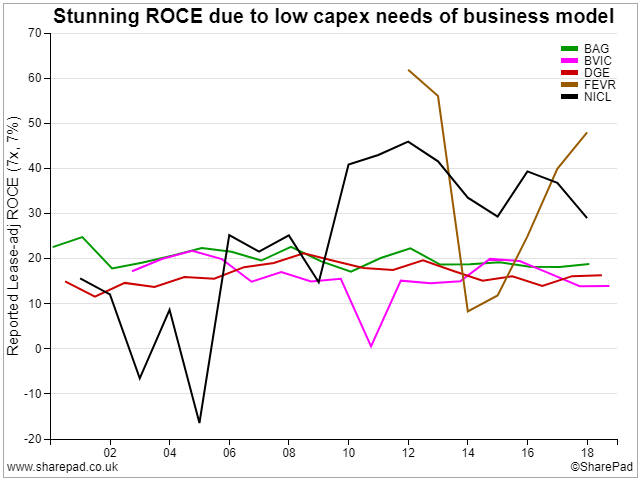

A good place to start with Fever-Tree is by looking at the ROCE progression. For a manufacturer the company is remarkably asset-light and this is because it outsources almost everything bar obtaining the ingredients. Everything else (manufacture, bottling, shipping etc) is done by third-parties and this has allowed the brand to grow at pace. As a result, with profits growing much more rapidly than capital investment, the ROCE has risen to almost 50%:

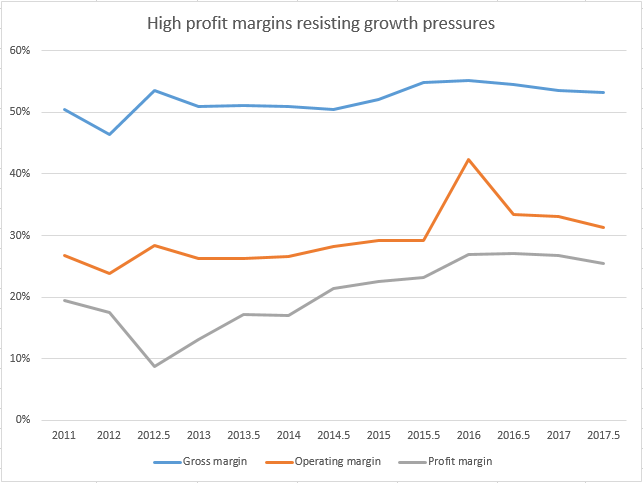

The clear drivers here have been a near-doubling in capital turnover (in that sales have increased twice as quickly as capital) with profit margins more than doubling. I'm personally impressed by how well management have both grown and sustained these profit margins, given undoubted cost pressures as sales have gone up by 10x, but the facts do speak for themselves:

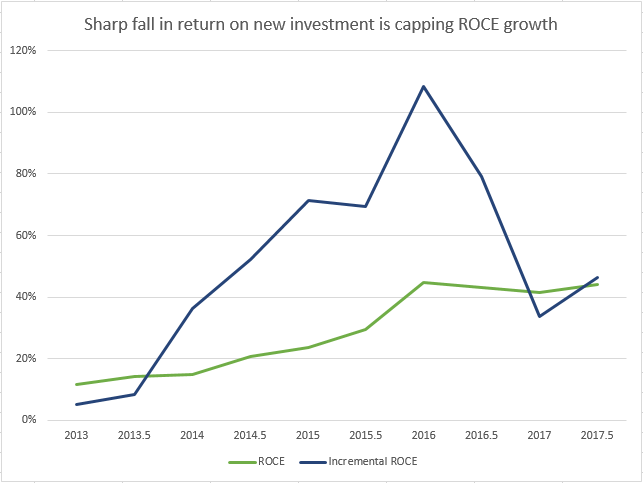

That said the half-year numbers did see a softening in margins across the board and this got me wondering whether the business might be running out of steam. One way to examine this is to look at the incremental ROCE - which means looking at each reporting period and seeing how much additional profit was generated by new capital poured into the business. If the incremental ROCE is above the current value then you'll see the overall ROCE dragged upwards but if later investment isn't producing the same return then the reverse will hold true:

So now we have a dilemma. Clearly investment over the last couple of years hasn't packed quite the same punch as in 2014-16 but the actual return is still monumental. What we're possibly also seeing is a maturing of the business as returns revert to a sustainable level. More will become clear with the results in March and over the next few years.

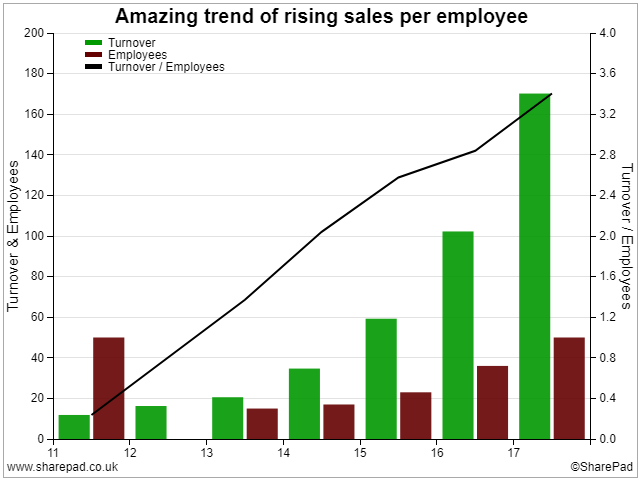

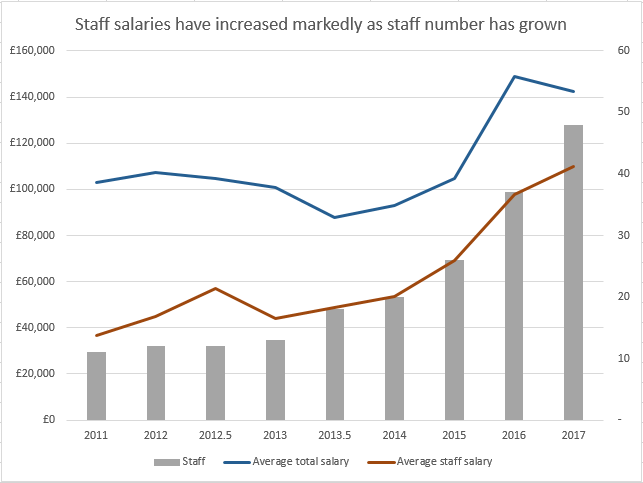

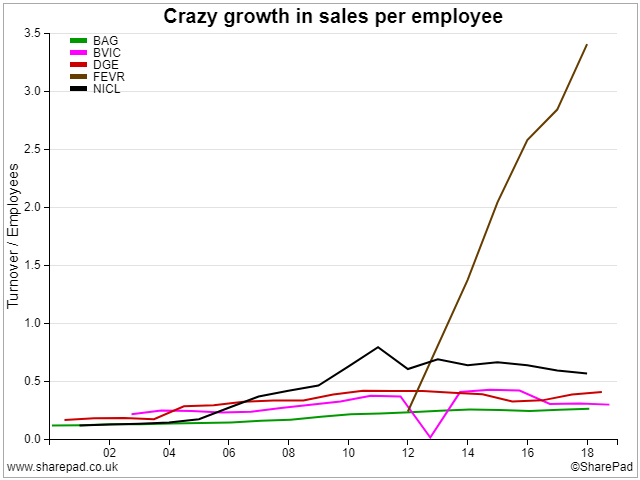

One factor that will help the business remain highly profitable, and efficient, is the low staff count. Even now there are only around 50 employees (probably a few more with recent hires in America) despite, as mentioned before, sales increasing by 10x. As a result the level of sales per employee is materially over £3m per person which is really something:

The flip-side of this efficiency is that staff are very well paid with a rather dramatic improvement in remuneration over the last five years. I can only imagine what it must be like to see such a succession of salary hikes! Still the employees have done a good job at Fever-Tree so I don't mind them sharing in its success:

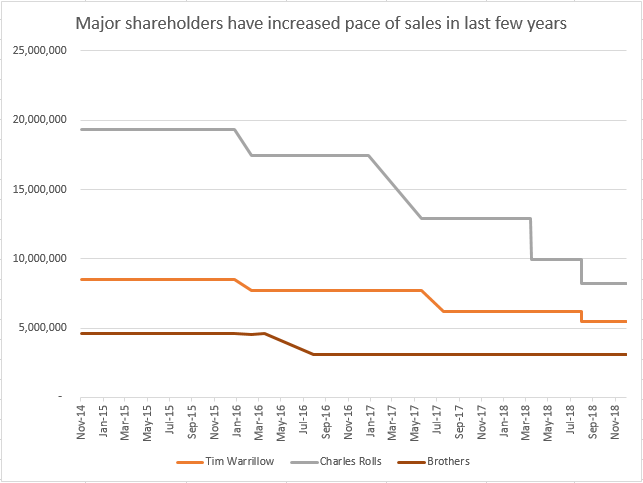

Actually thinking about employees and directors sharing in the success of Fever-Tree brings to mind some interesting facts when it comes to shareholdings. As is well documented Charles Rolls and Tim Warrillow started the company back in 2005 and, as a result, maintained large shareholdings through both Private Equity investment and the IPO. However over the last 4 years they have both regularly placed large numbers of shares into the market and this process seems to be accelerating:

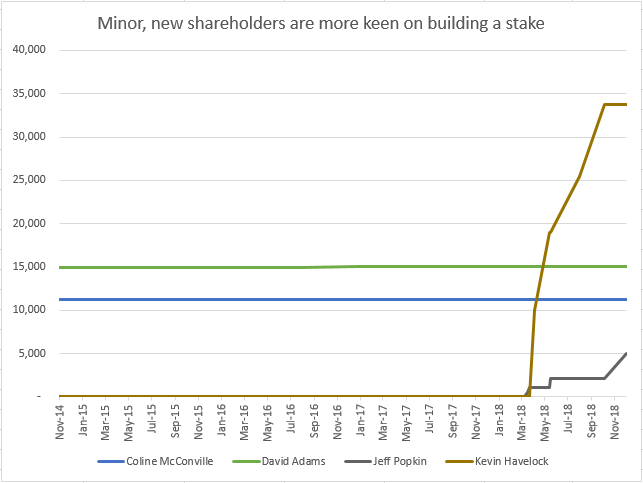

It does make you wonder if they're both trying to get as much money out of the company as possible before growth hits the buffers? And I suppose that there can't be any bidders for the company sniffing around either otherwise why would you reduce your stake? On the other hand there has been some real activity from smaller shareholders with Kevin Havelock in particular, a new non-exec director, building up a £750K stake in the last year:

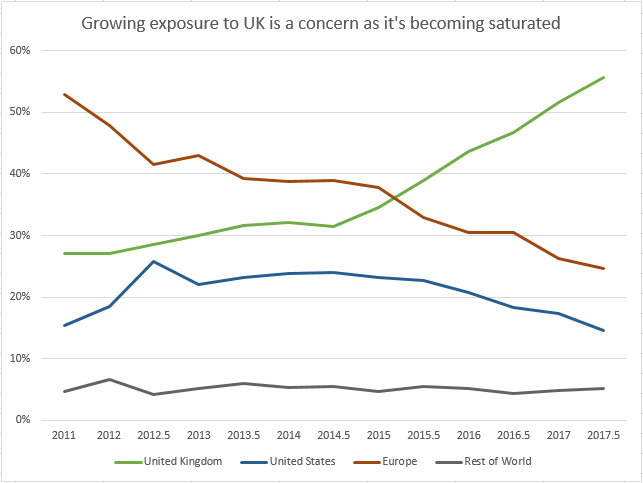

These contradictory actions from directors, who should know more than we ever will about the business, are a cause of some concern. I also think that they reflect the major prevailing concern with Fever-Tree: has it grown as much as it can in the UK and will the brand ever take off in America (or elsewhere) with the same sort of meteoric trajectory? When I looked at the accounts back in 2017 I was concerned about the UK accounting for over 40% of sales but this trend has only worsened - now the home territory provides over 55% of revenue:

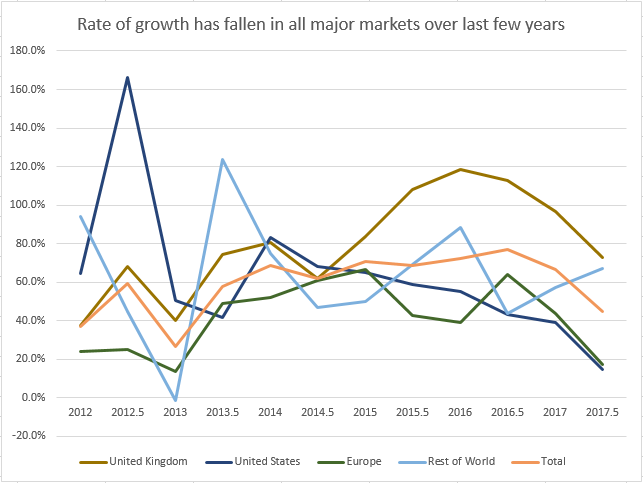

I don't think that this is a healthy state of affairs even if profits are still rising. In fact I'd rather see the opposite with other regions growing more strongly than the UK to provide much needed diversification. Unfortunately rates of sales growth have fallen in all markets over the last couple of years with the US in particular producing ever lower levels of growth in every year since flotation:

I've got to be honest; having got this far with my analysis I'm starting to feel a bit disheartened. It seems clear to me that Fever-Tree is a very profitable business but it's priced as if historic growth levels will be maintained (with high returns on capital) and I don't think that the accounts support this optimism. Still one bright point is that in the last trading update we learnt that US growth has risen to 21% (up from 15% at the HY) and that Europe is up to 24% (from 17%). So while total growth is down to 39% (from 45%), with the UK dropping to 52% (from 73%), there's a suggestion that management efforts in America are starting to pay off.

Peer-group Analysis

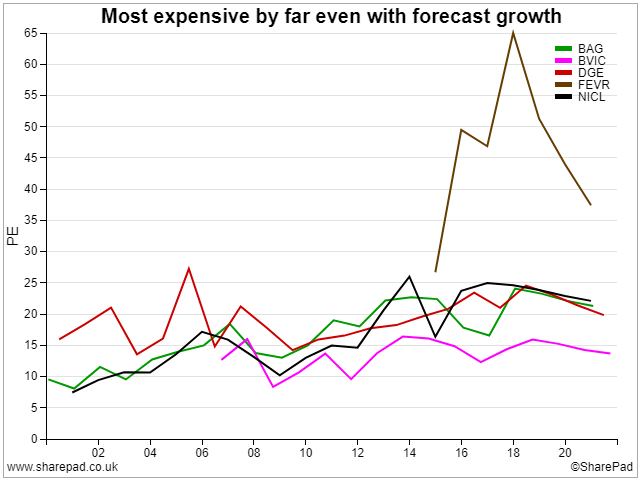

Right enough of the pessimism. How does Fever-Tree stack up against its peers? These are all familiar companies (AG Barr, Britvic, Diageo and Nichols) and I think that it's useful to see whether Fever-Tree is much of an outlier. First though let's knock off the valuation question. Ever since listing the shares have been expensive and they remain utterly out of step with everyone else:

Still this tech-stock valuation is somewhat justified by the firm making just so much profit per unit of capital invested. Its business model feels much more modern than that of the old-school drinks manufacturers and in theory this should allow it to be much more agile (although this may not matter when you're selling a brand and consumers expect that brand to consistently meet their expectations). Either way most of the peers are happy with a ROCE of ~20% (apart from Nichols which also outsources its production):

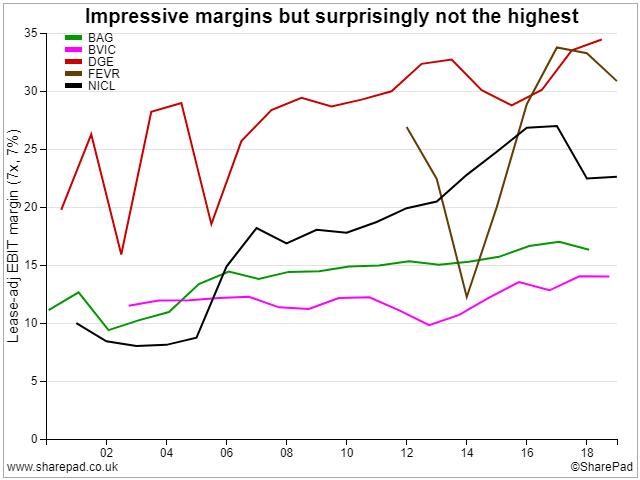

Curiously though Fever-Tree doesn't have the best margins of the group with that trophy going to Diageo. I suppose that this makes sense though as Diageo are primarily selling alcoholic drinks, mainly spirits, and the margins there must be eye-watering. I'm also reasonably pleased that Fever-Tree aren't making a suspiciously high margin since that might lead one to wonder if the accounts are being manipulated:

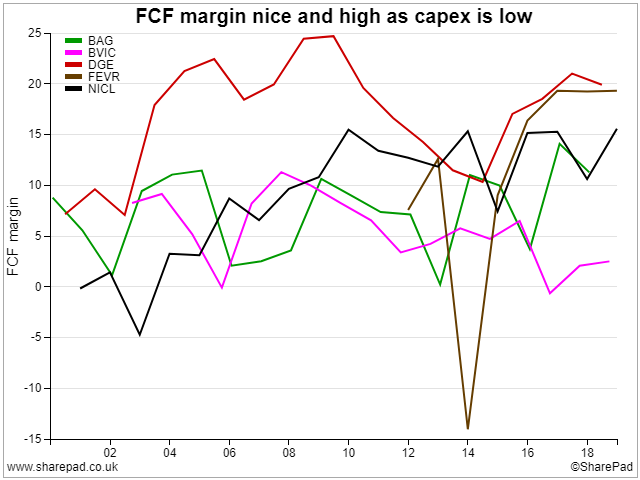

On a similar note it's reasonably well known, as mentioned in my last report, that the business is a bit of a cash-cow (which is why net cash has gone from zero to >£50m since IPO). However the free-cash flow margin of 10-20% is right in line with the peer group and I find that quite reassuring; this is a strong business but it's still operating within a sensible range of values for the sector:

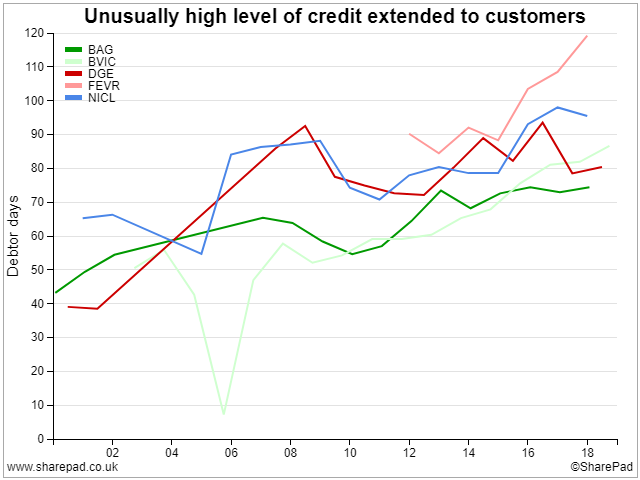

One metric where this doesn't quite hold true is that for debtor days (which is a measure of how much of customer sales are yet to be collected at a period end). Typically 60 days or so is a reasonable collection time for receivables and it's clear that all of these companies have struggled to get even close to this level in the last decade. Perhaps this is a reflection of customers, such as supermarkets, taking their own sweet time to pay invoices? Even so Fever-Tree is unusual with debtor days heading towards the 120 mark (or around 4 months). Now this could just be down to rip-roaring Christmas sales sucking up working capital at the year-end but you've got to wonder (see Phil Oakley's article from 2016):

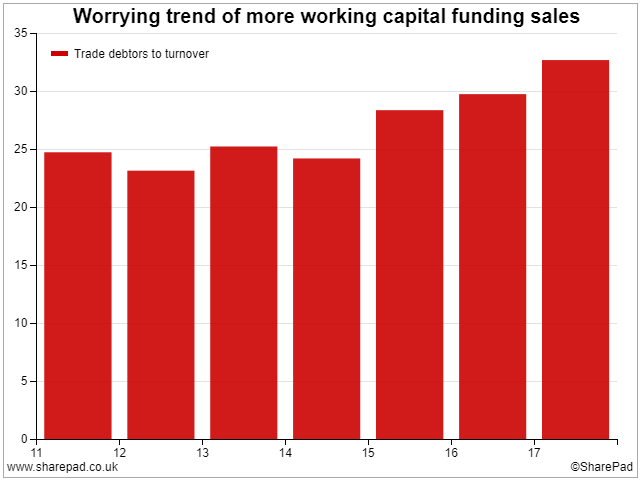

Something which Phil Oakley picked up in his article is that the proportion of trade debtors to turnover was high but stable. Looking at this now it's clear that the trend has taken a turn for the worse with receivables coming in at over 30% of total sales. Still Nichols and Britvic show a similar rise in outstanding debtors so, perhaps, this is a sector-wide change:

Anyway on a happier note I've got a nice chart for the Fever-Tree bulls which demonstrates just how well the business is able to scale. From a previous graph it was clear that each employee was "responsible" for ever larger levels of sales but here Fever-Tree really does leave its competitors in the dust:

Conclusion

I have to say the my feelings about Fever-Tree are a lot more lukewarm now than they were before I started this analysis. I was mostly expecting to confirm my belief in this being an outstanding company with excellent growth prospects but now I'm not so sure. The directors really do have a lot of work to do to maintain a high growth rate and the numbers are telling me that they're not managing to do this. On the other hand the law of large numbers means that it's impossible for the company to keep growing at 50% or more per year but that actual growth in profits will still remain high in numerical terms. So I am in two minds about this and feel sure that I'm suffering some cognitive bias from this being a previously successful investment.

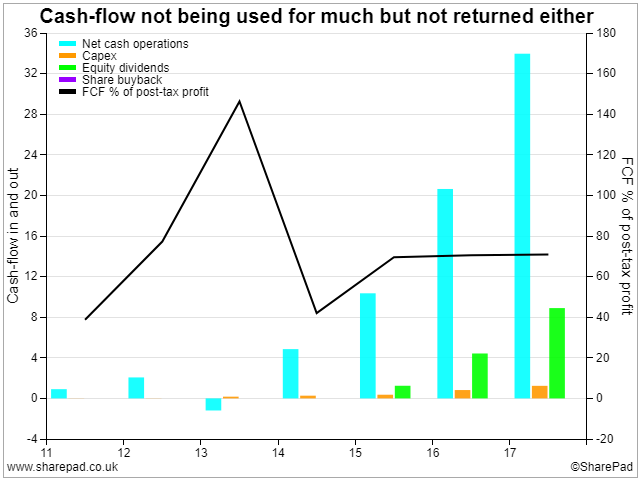

Another point which slightly worries me is that the company seems to be generating a lot of cash, and this appears to be piling up on the balance sheet, but very little of this is being returned to shareholders and it doesn't seem to be earning much interest in the bank. In fact last year the company paid almost as much interest on its £6m bank loan as it received on its average cash balance of £45m (with an implied interest rate on the latter of just 0.22%). I have no idea why there is any sort of loan in place, why a better return on the cash isn't being achieved and why shareholders are getting a miserly 0.5% yield and no share buybacks:

This apparent disconnect between there being pots of cash in the bank but no real return on that cash either as interest for the company or given back to the shareholders is a real concern for me (following the Patisserie Valerie debacle). I know that this is a young, growing enterprise but with all of its peers paying a healthy 2-3% yield and there being no other obvious use for the cash I can't see why the board are being so stingy. I'm not implying that the cash isn't there, and that the accounts aren't correct, but I am bothered by the situation.

Now to return to my original question - does the current price represent a decent entry point? If growth really starts to kick off in America then, yes, the valuation right now will probably look like a bargain in a few years time. However none of the indicators are suggesting that this is about to happen and the large, persistent sales from Tim and Charles implies that they don't believe in this scenario either. Add on to this analyst forecasts for sub-20% EPS growth in 2019 and 2020 (although I know that these are often upgraded) and it's hard to see how a P/E of ~50 is justified.

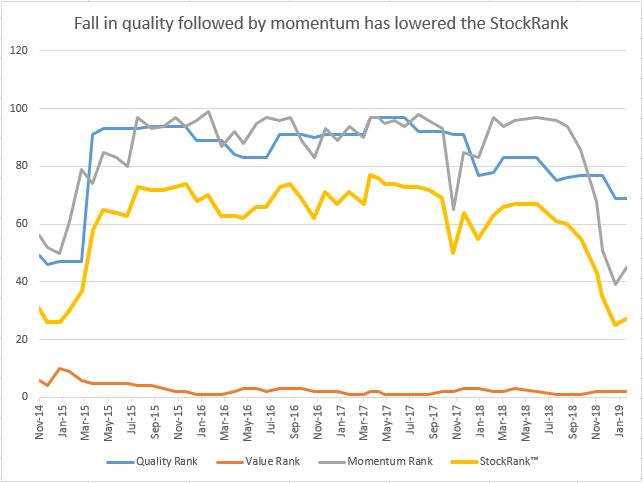

Finally if you're influenced by the Stockopedia StockRanks then it's fair to say the Fever-Tree is no longer a convincing purchase (although a great deal of the decline has been driven by falling momentum):

Disclosure: the author does not hold shares in this company