For many years consumers were quite happy with their G&Ts. A shot of Beefeater gin with a hefty splash of Schweppes tonic and that was enough. Then the small-scale premium gins emerged to shake up the market and suddenly they were in every bar. However, the tonic market lagged this evolution until 2005 when Charles Rolls and Tim Warrillow launched their natural mixer range. Now Fever-Tree is well known, in certain circles, as the brand which kicked off the premium mixer market and converted a generation of discerning gin aficionados.

Riding on the back of this trend Fever-Tree, as a stock, has exploded upwards from its cautious IPO price of 134p back in November 2014. In just 2½ years the price has multiplied by over 12x, as profits have roughly quintupled, with investors ascribing an ever-increasing earnings multiple to the business - now at an eye-watering 60x or more. That said every trading statement since flotation has revised trading expectations upwards, often materially, and so the business is living up to the hype.

With such a fast-growing business there are real question marks over the sustainability of this growth, both qualitative and quantitative, and whether such a trajectory can be maintained. My plan is to take a look at both sides of the business to see where the weak points reside and to consider whether Fever-Tree is a flash-in-the-pan or an FMCG brand icon in the making.

Analysis

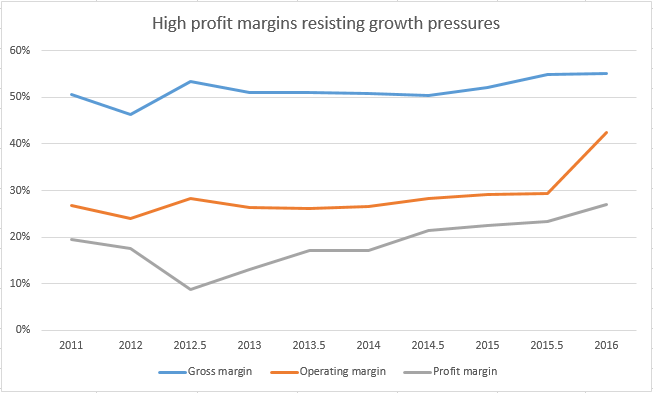

A notable feature of Fever-Tree is that it makes excellent profit margins and has managed to do so for the last five years despite sales multiplying almost 10 times. Specifically the gross margin has remained above 50% while the net margin has been improving for the last three years and is currently heading to the 30% level. I put these excellent characteristics down to the premium nature of the brand combined with excellent cost control as the business has scaled up:

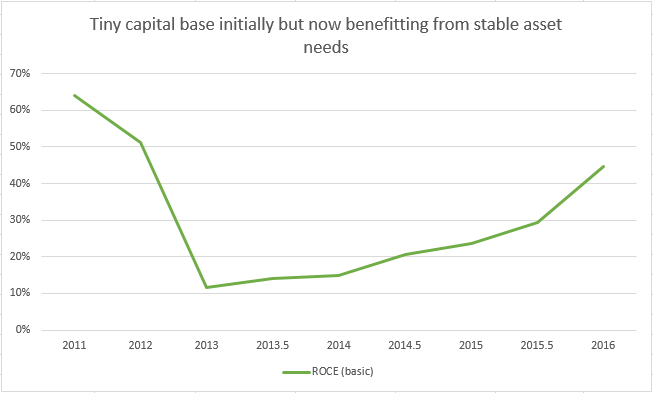

At the same time as profits have grown the return-on-capital of the business has improved and now stands at a remarkable 45% (compared to 12% in 2013). This is a recent high-water mark though and back in 2011 the ROCE hit 64% - although the capital base at the time was extremely small and this, in fact, acted as a brake on performance. In 2013 much-needed capital was injected into the fledgling business and it is this which enabled Fever-Tree to expand. That said the company intentionally outsources almost all operations and thus no longer requires additional capital to fuel expansion; so I expect the ROCE to remain unusually high:

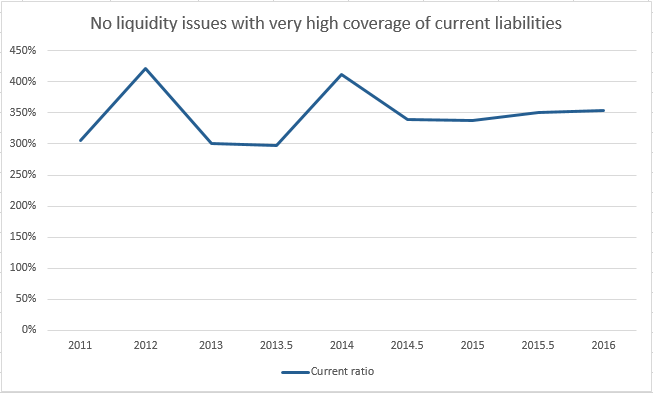

As you might expect, for such a cash-generative business, with little in the way of liabilities, there are absolutely no liquidity issues to concern investors. All monies owed by the group, both current and non-current, are covered by cash put aside and the current liquidity position has been excellent for at least the last five years:

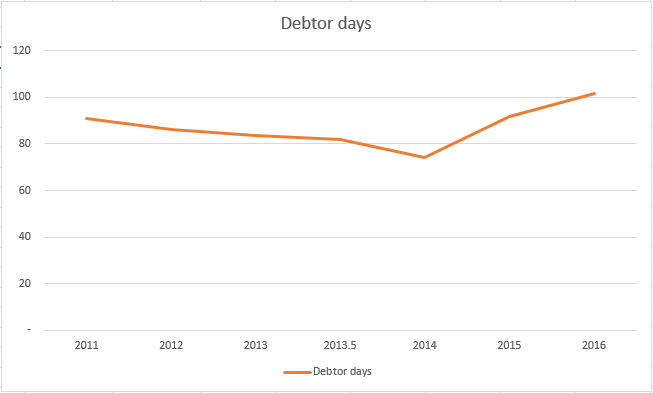

Of course not everything is perfect with Fever-Tree, thankfully, and one metric that gives me some concern is the debtor days figure and its upwards trend. Simply put this is a measure of how much of the company turnover is owed by customers at the reporting date; so if a quarter of the annual turnover is owed then the company is getting paid after roughly 90 days. For Fever-Tree this figure used to hover around 80-90 days but recently breached the 100-day level:

This isn't necessarily a concern and may simply be explained away by very strong UK trading at Christmas and resulting debts being outstanding at the end of the year (with all of these converting into cash by now). Nevertheless I'd like to keep an eye on this although it's a little tricky as trade receivables aren't reported separately in the interim results; so I'll have to use total receivables as a proxy in order to figure out whether these are continuing to rise more quickly than sales.

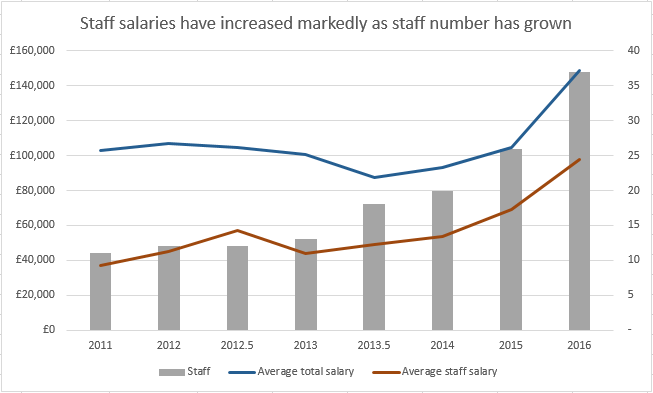

The final, financial, aspect of Fever-Tree which made me look twice concerns staff salaries. Remarkably this £1.8bn outfit gets by with just 40 employees, including directors, and as a result the director remuneration tends to bias any average salary calculations - even though they aren't paid extortionate amounts (Tim Warrillow takes home £725K inc. bonus). With director pay removed the average salary of the other 37 employees is now almost £100K with a CAGR of 21.6% over the last five years:

I don't particularly begrudge staff members taking home such a salary - they've chosen a good employer and must all be contributing to the firm's success - but I do wonder how much key man risk there is here and whether the company are having trouble recruiting? As with the debtor days increase I don't feel that this is a significant issue but I wouldn't like to see it get out of hand either.

Business risks

On the corporate side of things Fever-Tree has a very simple business model which requires minimal capital expenditure as so much of the supply, bottling and distribution is outsourced. The USP here is their brand-name, reputation, market position and (perhaps most importantly) ability to execute. In the latter area I take some solace from the fact that the directors were farsighted enough to see an opportunity, lend the company significant sums when necessary, partner with LDC for both funds and advice at the right time and then IPO the company to throw off the yoke of private equity. There's nothing inevitable about this progression and yet Charles Rolls and Tim Warrillow have steered the company well so far.

Still it's quite amazing that all of the manufacturing and distribution is outsourced, with Fever-Tree providing just the raw materials for assembly, and it's here that the key risk resides in my opinion. The company uses specialist suppliers, and works with commercial flavour houses to develop new flavours, and the number of these is limited; continuity planning, redundancy and insurance help to mitigate supplier risk but without ingredients there is no company. In addition the business is fully dependent on partner companies for bottling, storage, distribution and sales; these firms could probably survive without Fever-Tree but the reverse is up for debate.

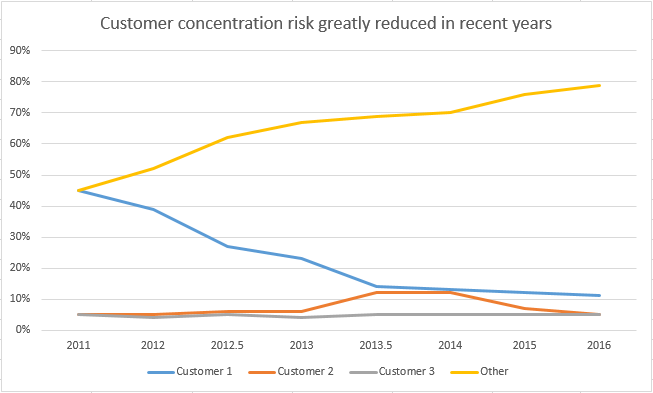

On the client side Fever-Tree started, as so many small companies do, with one or two key customers. This is fine when you're starting out but the directors have worked very hard to reduce customer concentration risk and this has certainly paid dividends - with the largest customer now providing no more than 11% of total sales:

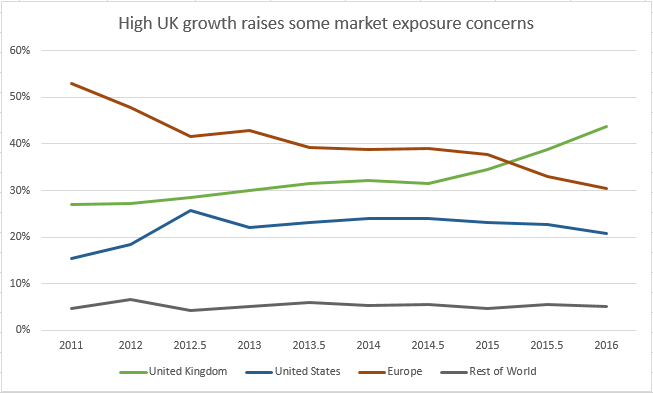

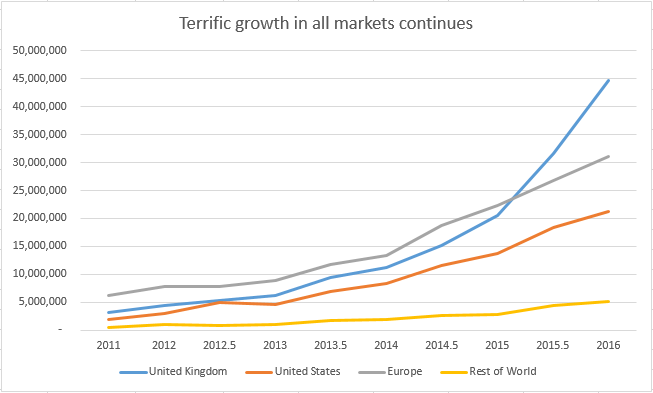

At the same time the markets which Fever-Tree serve have changed somewhat and when you compare these it's clear how dominant the UK market has become with over 40% of sales (at the expense of European sales). In comparison the US and Rest of World sales look to have stagnated with their unchanged fractions of total sales:

However this graph is a little deceiving as the astonishing acceleration in UK sales, more than doubling over the last year, thoroughly overshadows that of other markets - and yet these other markets are all growing at a rate that would make any other company proud. So it's worth remembering that the board are delivering on their strategy to expand on all fronts with seemingly minimal competition from fragmented brands such as Schweppes:

Interestingly this is not sufficient for Fever-Tree and they've identified a whole new market: dark spirits. Right now gin accounts for only 6% of premium spirit sales while dark spirits take up a whopping 60% - which explains why the company wants to move into this sector now that they have established themselves as a brand. There's clearly an opportunity here for co-promotion activities and new product lines leading to a step-change in growth; I don't think that the founders are ready to sell out just yet if this is their plan!

Conclusion

Ordinarily I'm quite wary of companies with a short public history as there's no proof of either the company or management being able to navigate stormy waters - and Fever-Tree is just 2½ years into its quoted life. However the brand has been around since 2005, with accounts available from Companies House, and managed to move into profit during the depths of the financial crisis. Since then, as we've seen, the business has performed staggeringly well with a serious level of cash generation.

So operationally the business has nailed its market but, perhaps more importantly, the strategy so far has been spot on. Whether taking capital and advice from LDC at the right time, choosing which partner companies to stick with or getting onto the Hairy Bikers TV show (the video is well worth watching - it's a fine advert) the directors have made many smart business decisions. Looking forwards the opportunity in the dark spirit market could make everything up till now look like small beer and Fever-Tree already know how to work with the big distillers; so there really is everything to play for and any resulting product diversification is very welcome.

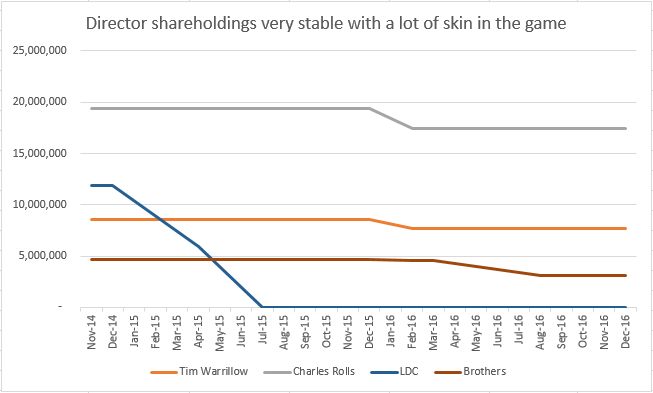

Now while the directors did sell 10% of their respective holdings last year I can hardly blame them in taking some money off of the table and they still own more than 20% of the company (Charles has 15.1% while Tim gets by with 6.7%). So I believe them when they say that they're in for the long haul and, apart from LDC, this appears to be the prevailing attitude of the founder shareholders:

Also the directors aren't choosing to abuse their position by awarding themselves huge option packages or obscene salaries - right now the outstanding options stand at <1% of the total share count and the award scheme is quite straightforward. So I see very little to dislike about Fever-Tree apart from the fact that it's, essentially, a single-product company and thus vulnerable to interruptions in ingredients, bottling and distribution or some quality-related disaster that damages its luxury reputation. Risks which shouldn't be idly dismissed but I have no doubt that the board are fully aware of them too.

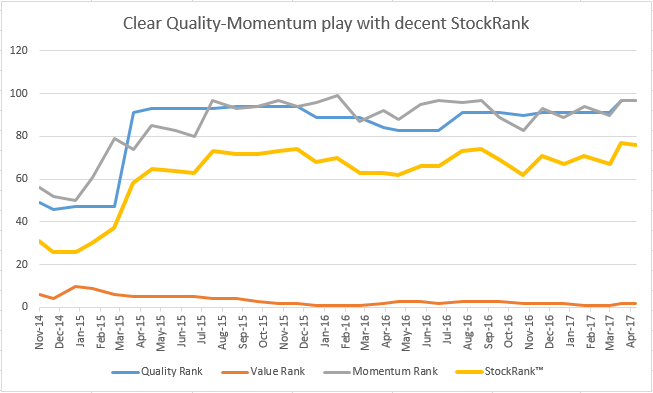

Finally, from a Stockopedia perspective, Fever-Tree is outstandingly a Quality-Momentum play: strength in earnings and price momentum combined with high margins and returns have been present from flotation. However the overall stock rank is second-quartile because the value rank is abominably low and likely to stay that way:

I don't particularly mind stocks having this QM bias but there's no doubt that Fever-Tree is an extreme example. Still, if the company continues to upgrade analyst estimates and grow in all targeted markets then it'll surely grow into its valuation.

Disclosure: the author holds shares in this company.