Introduction

Medica Group is the market leader in the provision of teleradiology services to the NHS servicing over 100 Acute hospitals. The company offers three primary services to radiology departments to meet varying demands: Nighthawk, Routine cross-sectional (Routine CS) and Routine plain film (Routine PF). These services help departments manage their workflow more efficiently and provide rapid access to specialist Consultant Radiologists.

Nighthawk is an out of hours emergency reporting service focused on short turnaround times, which average 25 minutes, and typically covers reporting on CT scans. Routine CS and Routine PF are both for less urgent daytime reporting. Routine CS covers a combination of CT and MRI scans (both forms of cross-sectional scan) while Routine PF covers plain film images and both services typically have a 48 hour turnaround time.

To make this all work the company has invested in a bespoke IT platform that links customers to Medica radiologists in a secure manner. In theory this is a scaleable platform that allows for growth in existing service lines while also allowing new lines to be added. Nevertheless most of the business capex is around maintaining this platform and providing the hardware which accesses it to hospitals and radiologists; hence further capex will be required as the business expands.

NB: If you're interesting in understanding why someone would become a teleradiologist then this is a good series of articles - one, two, three, four

Stock-specific Analysis

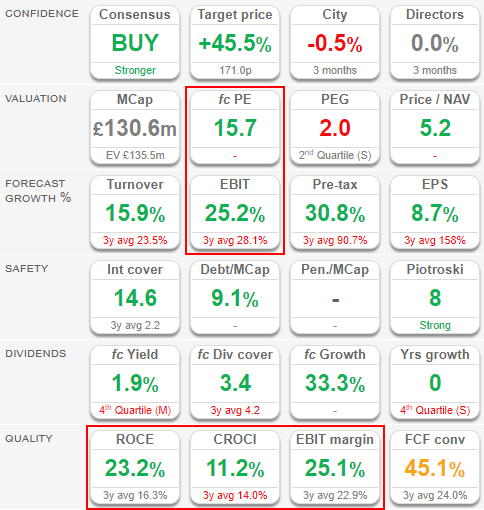

I first stumbled across Medica Group last year when I was looking for a share to talk about at the inaugural Stockopedia StockSlam. At a glance the company seemed to match most of the QARP (quality at a reasonable price) criteria that I look for in an investment and this remains true today:

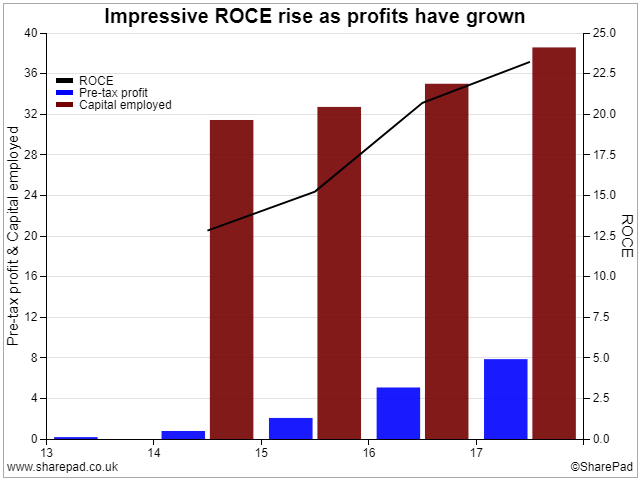

Specifically profit generation looks solid with a high, and improving, EBIT margin and ROCE (where an absolute value >20% is excellent). In addition forecast growth of 25% in EBIT compares very favourably with a PE ratio of just under 16 (although it's fair to say that EPS growth of 8.7% is less than I'd expect given the top-line growth rates). One particular feature which I like is that the ROCE of 23% is greater than the 3-year average of 16%. This suggests returns on capital investment are improving and this is a great place to be for a company:

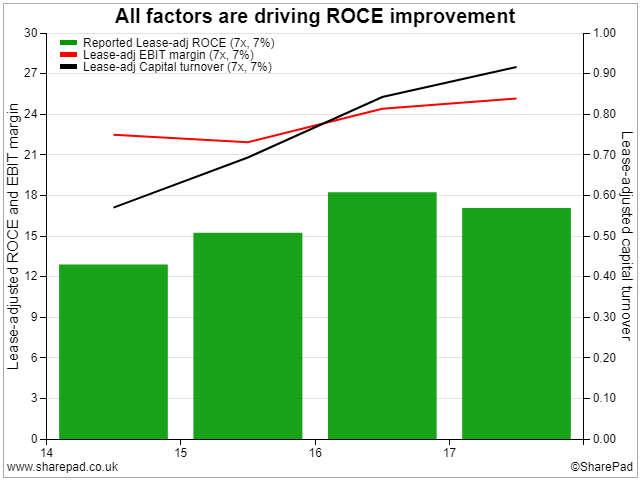

A good way to understand the factors behind this improvement is to use the DuPont analysis technique which decomposes ROCE into profit margin, capital intensity and leverage. For Medica Group leverage is reducing, as debt gets paid off, but both capital turnover and margin are on an improving trend:

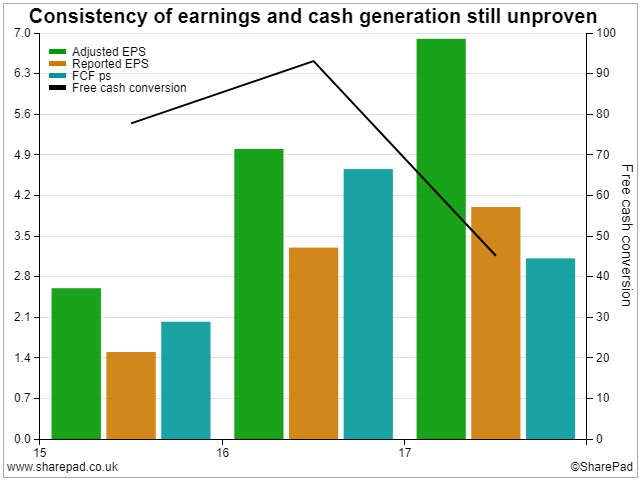

That said a pre-tax profit margin of ~25% is impressive for any company and particularly one which works with the NHS. The latter is a tough customer and (even if it weren't) such high margins are guaranteed to attract competition (which reduces profits for anyone delivering the same service). So I think that it's reasonable to question whether or not the margin is really this good. On this score my curiosity was aroused by the fact that for the last 3 years reported EPS has only come in at ~60% of the company adjusted EPS figure:

At first glance it seems that, at best, the board are prone to managing the headline earnings figure upwards rather than reporting the numbers warts and all. At worst they could be intentionally fudging the earnings to make them look of higher quality than they really are. However I've dug into the adjustments and they seem reasonable with the bulk being down to IPO and financing costs plus an element of acquired intangibles being amortised. That said with these one-off costs behind them I expect the basic and adjusted EPS values to be much more in-line going forwards; if the variance remains as high in the results published on 25 March 2019 then I'll be very unimpressed!

On a similar note I'm expecting the free cash conversion ratio to stabilise at a reasonable level (i.e. a lot more than 50%) from now on as all outstanding debt has broadly been paid off. Acting against this improvement will be extra cash used for working capital purposes and ongoing capex but hopefully the effect of both of these will reduce as the business matures.

Still if you're happy with the adjustments made to earnings then the current year forecast for an EPS of 7.5p (9% growth y-o-y) implies that the company is starting to look cheap - especially as management have confirmed that they'll meet this forecast. The reason I say this is that when the company floated expectations were very bullish and so was the P/E ratio at >35; however a minor profit warning has bought this ratio right down to a fairly reasonable 15.7 (although the yield still remains low):

You're probably thinking wait - what? - is this another one of those over-hyped IPOs that warns on profits within a year of listing? Why yes it is. A year ago the board informed investors that capacity constraints and moderately reduced demand would lead to profits being slightly below expectations. As a result the share price roughly halved (peak to trough) although there have been no further warnings over the last 12 months. On the flip-side there haven't been any upgrades either which is probably why the consensus forecast has drifted down a few percent from 7.74p to 7.5p over the same period.

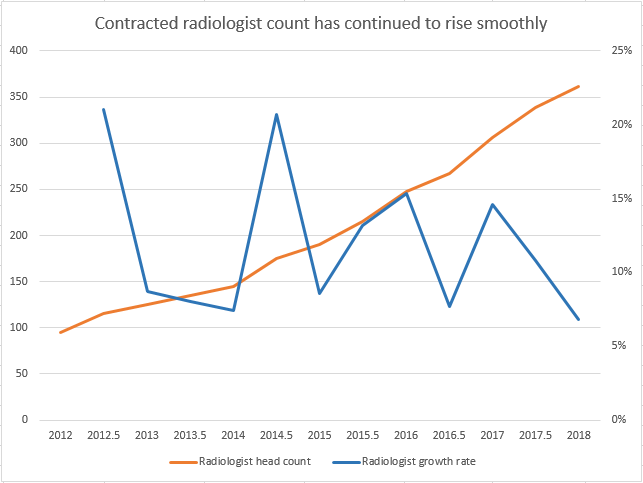

Now capacity constraints, which means having enough radiologists on hand to cope with the work available, are a top concern both for me and the board. In their words: "A key component of the Group’s business strategy is its ability to source experienced, high-quality Consultant Radiologists to provide its Teleradiology services." I see this as the biggest obstacle to growth since Medica is competing with the NHS, other similar providers and private hospitals for staff and radiologist numbers in general are lower than the health service would like. Still contractor numbers continue to grow and the rate of growth is acceptable:

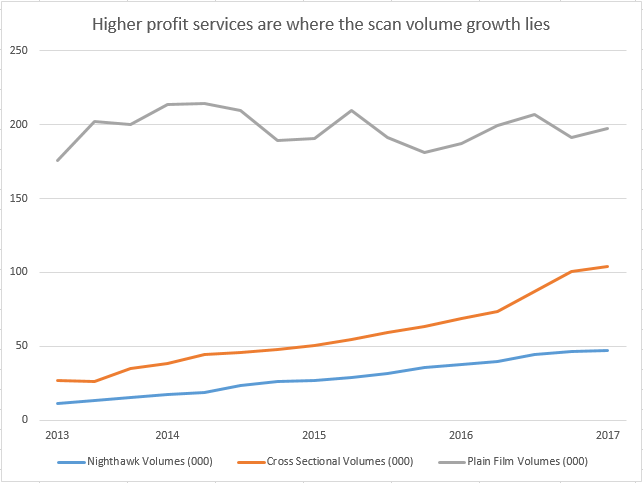

A consequence of the difficulty in finding new hires is that Medica seems to be offered more business than it can handle at times; especially in the Plain Film department. As a result they're inclined to turn down the latter business in favour of, presumably, routine Cross Sectional work since both take place during normal hours (unlike Nighthawk). As a result Plain Film volume has remained flat for a number of years while higher profit work has grown nicely:

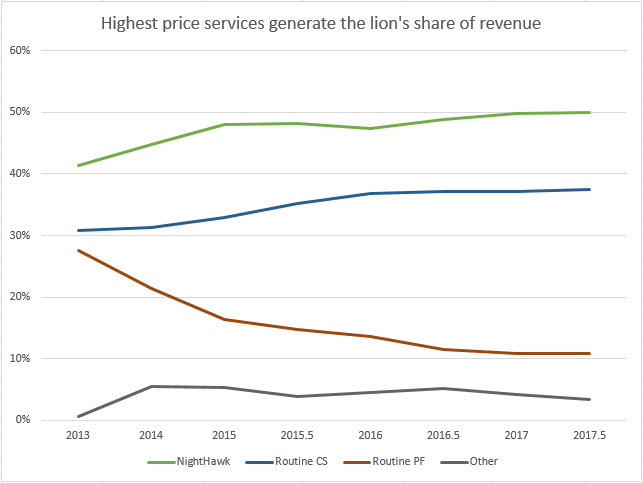

An interesting comparison to this scan volume graph is one which looks at the relative revenue split between each of the three main business areas. What's blindingly obvious here is that Nighthawk and Routine CS bring in over 85% of the top-line revenue even though they account for less than half of the actual scan volume. To my mind Routine PF is the bread-and-butter business which keeps radiologists occupied but it's the more high-tech scans that are the key to Medica's success:

As an aside I've used the scan volumes and sales figures to derive a rough price for each of the three services. At the bottom of the pile sits Routine PF with each result costing ~£5, which looks like a bargain, while each Routine CS result comes in at ~£30. A bit of a jump but that's nothing compared to the out-of-hours service with a single Nighthawk result costing not much shy of £80! With gross profit margins more or less the same for each service it's obvious that both Medica and their radiologists make most of their money providing the lower-volume night-time service for hospitals.

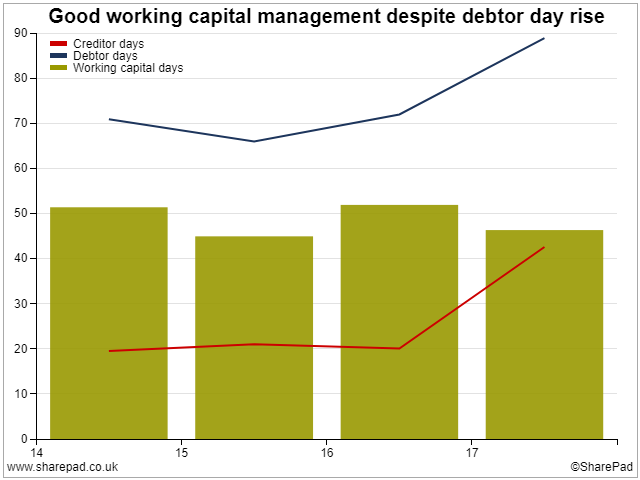

Actually, thinking about this growth in scan volume there is an impact on Medica in that the company has to pay its radiologists before hospital invoices are settled. This means that there's a funding gap, which has to be filled by working capital, and this gap is increasing as the business grows. This is a great problem to have but it does reduce the conversion of profits into cash and can lead to issues if clients take longer to pay their bills (or don't pay them at all). Fortunately I see the NHS as a pretty dependable customer and Medica are managing to offset any relaxation of billing terms by taking longer to pay their own creditors:

Overall then Medica appears to be a pretty solid business that generates a decent return on the capital invested (whether from debt or equity) while taking advantage of a growing

teleradiology market. The big question now is whether the company looks like a sensible investment compared to similar outfits in the same sector - which is the purpose of the next section.

Peer-group Analysis

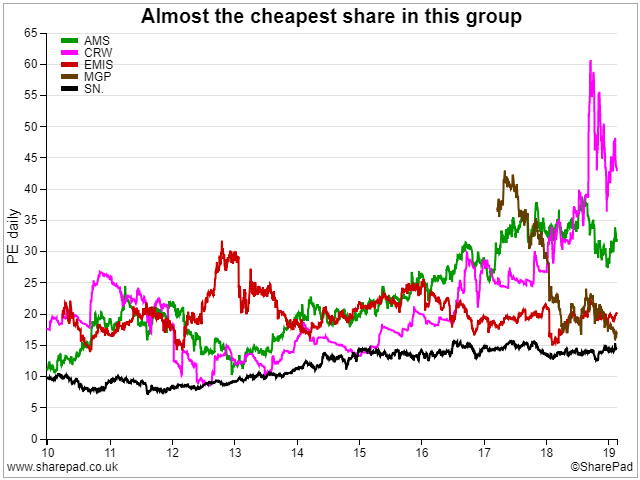

In identifying a reasonable peer-group for Medica I've tried to find medical companies which supply hospitals in some manner but aren't trying to discover new drugs (since biotech is a whole, separate sector). The list that I've come up with is this: Advanced Medical Solutions (AMS), Craneware (CRW), EMIS Group (EMIS) and Smith & Nephew (SN.). First off it's fair to say that Medica is near enough the cheapest share in the group but it's also been listed for the shortest period of time and is still getting over its profit warning a year ago:

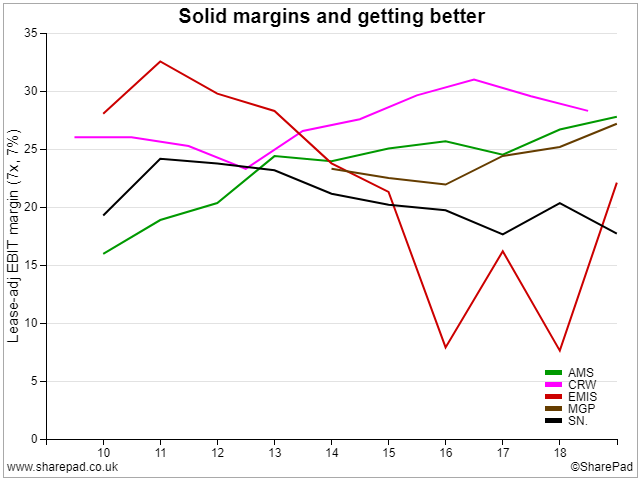

This low rating is somewhat at odds with reported profitability in that EBIT margins started high and are trending towards the upper part of the group (so the profit warning in 2018 was all about volume rather than pricing):

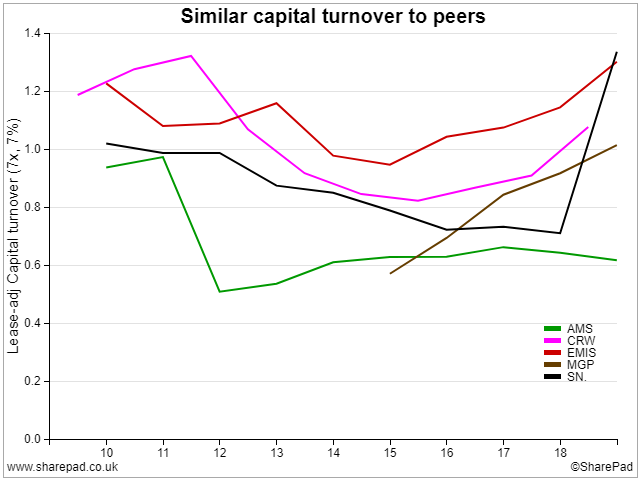

Thinking about the other element that drives ROCE it's fair to say that Medica operates with a similar capital intensity to its peers with the trend being very positive (which suggests that sales growth isn't limited by capital):

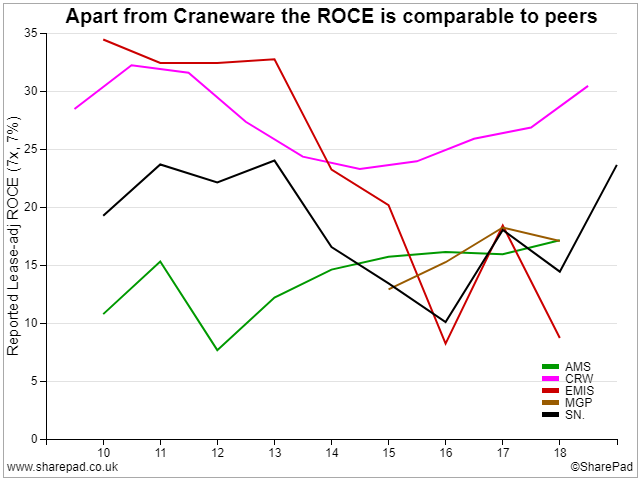

Put these two values together and it's no surprise that Medica has a ROCE right in-line with the group apart from outlier Craneware. Since the latter is a pure software company it's perhaps no surprise that the return generation is so healthy (although you're certainly paying through the nose for this quality with a P/E of almost 50). Either way the ROCE of all these companies is very good at 15 or more:

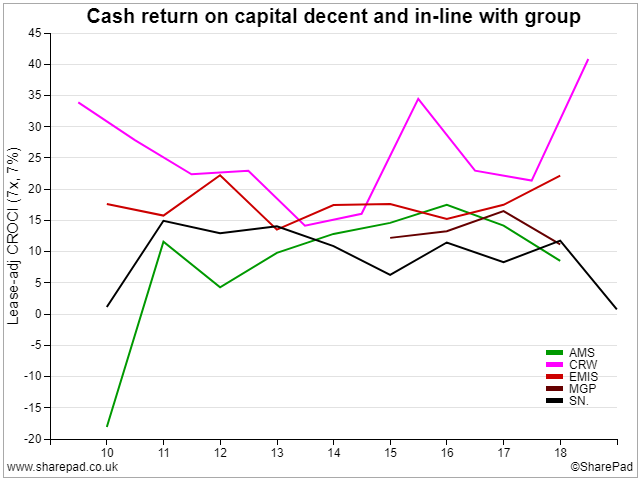

Another excellent way of unpicking earnings quality is to look at CROCI (cash return on capital invested) where this is the ratio of free cash flow to the firm and the capital employed. Typically anything above 10% is worth having and most of the companies in the group just about make in excess of this level (with Craneware again looking outstanding with an average CROCI above 20%):

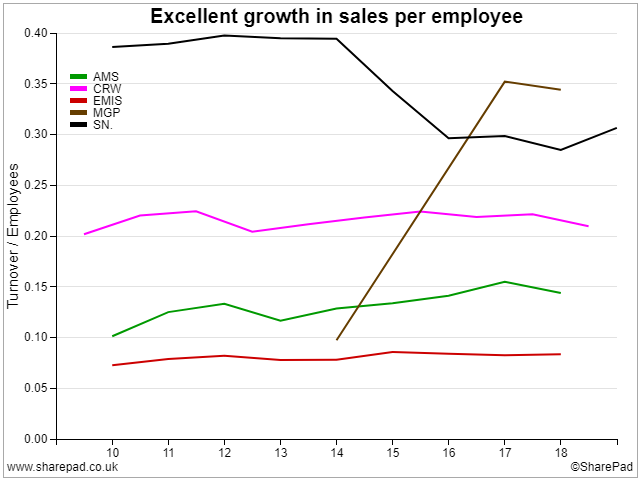

One final graph that I find interesting is that showing the level of sales generated by each employee. In a scaleable business that's growing you'd expect this KPI to be improving, as is the case with Fever-Tree, since it should be possible to make more from your human assets over time. We can see this happening with Medica but what I hadn't expected was the stark contrast to everyone else in the group:

I'm sure that this trend won't continue but it's nice to see Medica look outstanding by at least one measure!

Conclusion

It's clear, from just a glance at the share price chart, that Medica is out of favour with investors and this article provides a good summary of why this is the case. Despite being in a promising sector, with some excellent financial characteristics, I think that Medica needs to demonstrate that it can continue to grow and remain consistently profitable. Solid FY results in March will provide a start to this recovery but it'll probably take another year for Medica's trajectory to become more apparent.

While business expectations recover I think that investors will have additional time to get comfortable (or not) with the key risks for Medica going forwards:

- substantially all of the revenue comes from the NHS through NHS Trusts

- revenue is not subject to any minimum purchase commitment from the Trusts

- it may not be possible to pass costs on and, in fact, scan prices are decreasing

- a key component of the business strategy is sourcing experienced, high-quality Consultant Radiologists

- these individuals may choose to work more in the NHS or to work in the private hospital sector or with competing teleradiology providers

- increases in the cost of recruiting and retaining radiologists may arise as a result of the demand for their services

- AI solutions are getting better and may soon cater for a large chunk of the business

- the bespoke IT platform needs to work flawlessly 24-7 and remain fully secure with top-notch support

Still these are all risks for any teleradiology provider and Medica certainly has the benefit of scale by being the largest provider (by sales) in the UK. This probably means that there are other providers doing higher volumes but this will be in the plain film arena where prices are rock-bottom.

A final, unusual point that I've noticed with Medica is that management make quite a point of how cash generative the business is with operating cash conversion (before capital expenditure) of more than 90% of EBITDA. Sure this is great in that capex can be funded but this cost isn't going to go away if expansion continues. I've also noticed a more subtle point around cash-flow which relates to how their debt funding arrangement changed significantly during the IPO.

The key here is that I was having real trouble reconciling the operating cash flow back to operating profits until I noticed that the finance costs being charged to the P/L statement were much larger (roughly double) than the actual interest costs being paid out of cash flow. With some digging I found that the reason for this is that the group used a loan note facility from CBPE Capital and that interest accrued onto the capital for eventual repayment. In other words this was a non-cash expense with the result that the cash-flow (and cash-flow conversion) looked much better than might otherwise have been the case!

As it happens this loan facility has been fully paid back (March 2017) and so this discrepancy in the cash-flow will no longer be a feature of the accounts. This is positive considering that they were at a fixed rate of 12% pa! As a result I think that going forwards it'll be more clear if there's capex in excess of depreciation or cash being sucked into working capital without being matched by a similar rise in sales.

Overall then there's a lot to like about Medica and its financial progress will become apparent now that the post-IPO results will be a lot cleaner. And yet I believe that it'll take a while for investors to start to believe in the story again which probably means that there's no rush to get involved until we have more concrete information on the company's trading outlook.

Disclosure: the author does not hold shares in this company