TL;DR:

RTC Group is a recruitment consultancy that has been through some tough times and yet finally seems to have turned the corner with new management, improved focus and the recent award of a substantial new contract with key customer Network Rail.

Introduction

RTC Group listed on AIM back in June 1998, as ATA Group (est. 1963), but its interesting history begins in 1992. This was when Bill Douie, Clive Chapman and Graham Chivers clubbed together to take the best bits of the old recruitment consultancy off of the books of the liquidator and turn them profitable again. This went pretty well, in the go-go 90s, with ATA hitting the Virgin Atlantic Fast Track 100 for four successive years (1993-96) and each division (Engineering Technology, Sales, Advertising Selection and Training) becoming profitable.

A company in fine fettle then and yet, for various reasons, this pre-admission success has never been recaptured in all of the years since. Divisions, such as Training, have been shuttered or sold off while other businesses, such as Ganymede Solutions, have been acquired to add some profitable vim to the group. This activity, it seems, is now bearing fruit as Ganymede has been awarded a huge contract with Network Rail (£80-100M over the next five years) against stiff competition. This could easily be transformational for RTC Group but can they handle it?

One reason to believe that they can is that the executive board has been transformed by the arrival of Andy Pendlebury in 2007. Initially joining as a non-exec the chairman quickly convinced him to take the hot-seat with a (sorely needed) mandate to turn the group around. As such he came up with a 5-year plan to create a focused recruitment company, with improved management and profitability across the board, and by all accounts he seems to have succeeded thus far.

Why did it all go wrong?

This is rather a multi-dimensional question given how the share price has fallen unrelentingly since admission (with one major recovery) and the company has repeatedly failed to deliver shareholder value; there's more afoot here than just the knock-on effect of a global recession or a single bad decision:

Reading through all of the available financial statements what strikes me is that RTC Group is more than just a cyclical business: it's a service company that operates at the mercy of its clients. In all of the narrative I get no sense that this company can set the terms of its contracts and dictate the price that it charges; the only moat that they have is their good name and reputation. This served them well during the 90s and buoyant trading conditions in the recruitment sector at the time did wonders for the firm; in this sense they listed at exactly the right time!

After listing though every report refers to poor economic conditions, restructuring in one part of the business or another and even inclement weather conditions. In reality though I believe that this statement by Bill Douie, in 2007, hits the nail on the head: "No longer can we set out to find growth through acquisition of poorly managed compatible companies where integration and overhaul led by our erstwhile Chief Executive could be expected to lead to enhanced shareholder value." I think, in fact, that questionable acquisitions and investments played a significant part in draining cash, diverting management attention and leading the group into danger.

That said Ganymede Solutions was acquired for a nominal £1 in October 2002, as a bolt-on to the existing rail recruitment operation, and it's prospered since then. Even here though there are no guarantees; in 2005 Network Rail decided to "bring back all Infrastructure Maintenance 'in house' and thus to replace the work previously done by private sector contractors" and this dealt an ultimately fatal blow to the training divisions of the group. In the end this led to 2011, a real nadir for the group, where the company was close enough to oblivion for there to be a need to tap directors and staff for funds to cover working capital requirements; talk about paying to keep your own job!

My conclusion from all of this is that RTC Group has always offered a slightly odd mix of individual businesses as a result of management being both proactive and prone to jumping on the bandwagon. In theory this spread should help to reduce volatility but in general this hasn't been the case; instead when all of these diverse operations are doing well then something of a gearing effect kicks in and profits take-off. It's possible that the company is in exactly this happy situation now, which is the subject of the next section, but I believe that there will always be a question mark over just how sustainable the business really is in the long term.

Where are the green shoots?

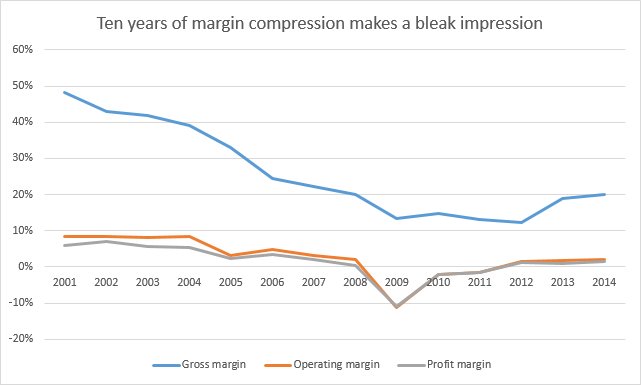

There's one very good reason why RTC Group has gone nowhere since listing and this is the company's inability to price their work correctly, relative to costs, and so maintain margins. In any business I like to see pricing power in the market, and a management that's aware of where they're leaking money, but neither of these strengths are apparent in the long-term trend:

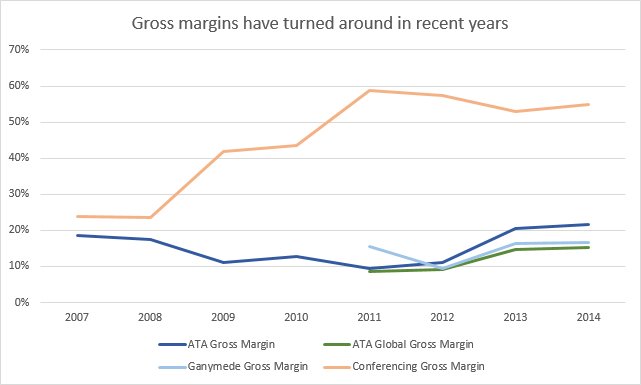

However if we focus on just the years since the GFC, over which the company provide segmental profit splits, then a different picture emerges. At the gross margin level, where the two factors are turnover and the direct costs of achieving sales, then we have a clear recovery taking place since 2011 with the Derby Conference Centre (DCC) being a stand-out performer (although this is the smallest part of the group):

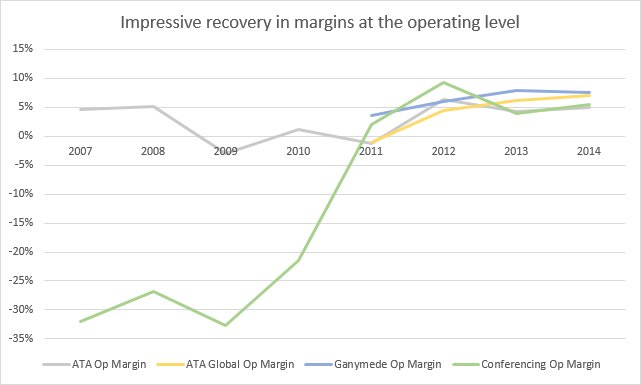

A similar, but equally interesting, story can be seen in the recent operating margin trend (where other business costs are subtracted but before non-operating costs such as interest payments and tax). The DCC was a loss-making drag on the group for years but it, and the ATA recruitment arm, have both been transformed by management actions. Given the volatile history of this company I'm impressed that all parts of the business are now profitable:

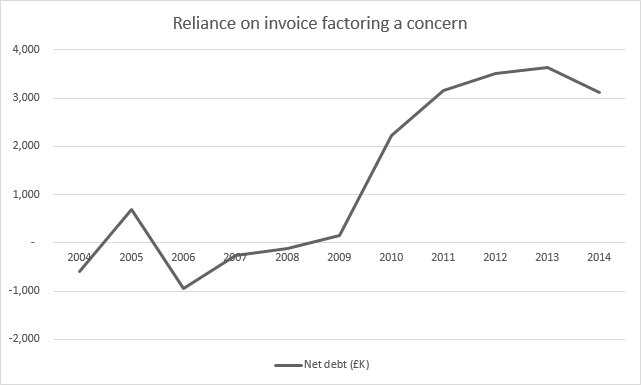

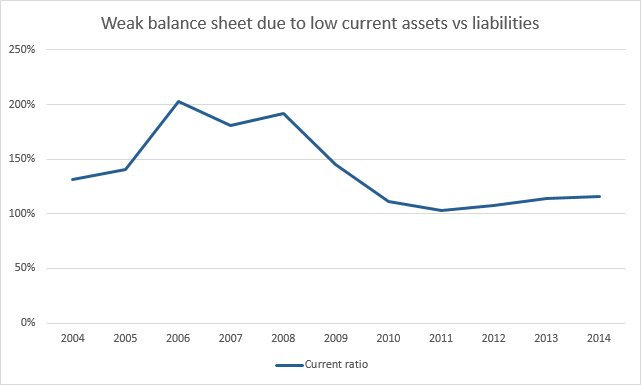

While the recent move into profitability is welcome the balance sheet remains an area of concern for RTC Group. Before the GFC the company operated with a decent level of cash, little need for even overdraft debt and a very healthy balance of current assets and liabilities (i.e. a current ratio > 120%). Unfortunately in the market contraction following 2008/09 the firm suffered several years of losses where these margins of safety, and more, were consumed and the company wound up reliant on invoice factoring to pay the bills, with little equity remaining and not much in the way of current assets. A perilous situation for sure and I'm quite surprised that the board weren't forced to throw in the towel.

Either way the company made it through these dark days and while they are still very reliant on invoice factoring (as a means to meet cash-flow demands) it looks like this cost might finally be coming under control:

At the same time the current ratio, as mentioned above, remains weak and below a comfortable level but at least the improving trend is heading in the right direction:

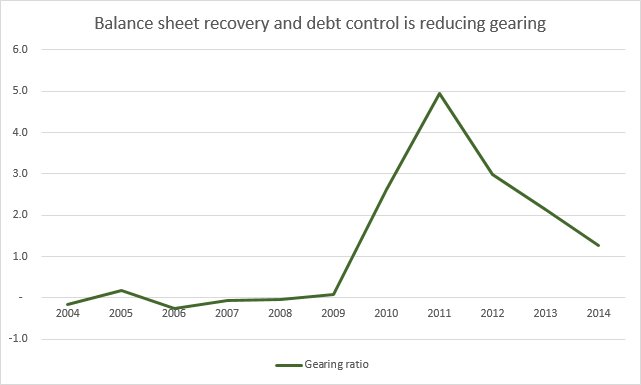

Another aspect of some interest here is gearing and just how bad this became for RTC Group. Up until the GFC the company was negligibly geared, even as profits faltered, but this happy situation soured rapidly as net equity in the company fell through the floor (at its lowest just £637K compared to £4.2M in 2008) and more than £3M of short-term debt came into play. Fortunately these factors have reversed in recent years and the gearing level is now much more sensible:

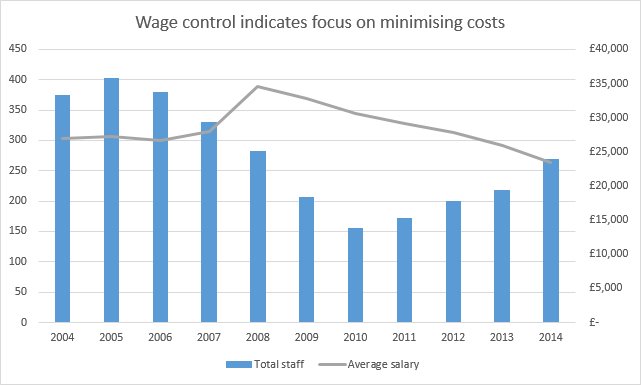

One of the reasons why RTC Group fell apart, in my view, is that management lost control of costs and let operations become bloated and loss-making before taking decisive action. One measurement that I like to use to illustrate this is to consider the average salary being paid by the company across all of its staff; this and the total head-count trend can be very informative. What's revealing here is that the group blew out to over 400 employees, at worst, and paid these staff well; it must have been a painful process cutting this excess although it seems that management tried to retain the most experienced staff at first since the average salary went up substantially in 2008. Either way the group is leaner and more efficient now with headcount growth being proportionate to sales growth:

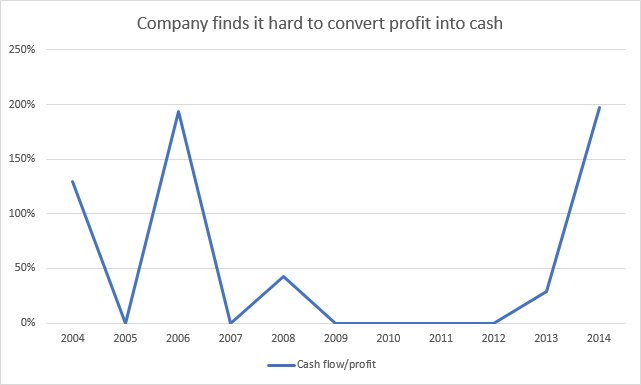

A different area of concern for me with RTC Group is their lack of cash generation and how much of a weak spot this is. They've really struggled to generate sustained, positive cash flow from operations and this, along with a lack of distributable reserves, is why no dividends were paid out for 5 whole years. Recently things have looked up on this front, although beneficial working capital movements flatter, but it remains to be seen whether this cash-flow can be maintained:

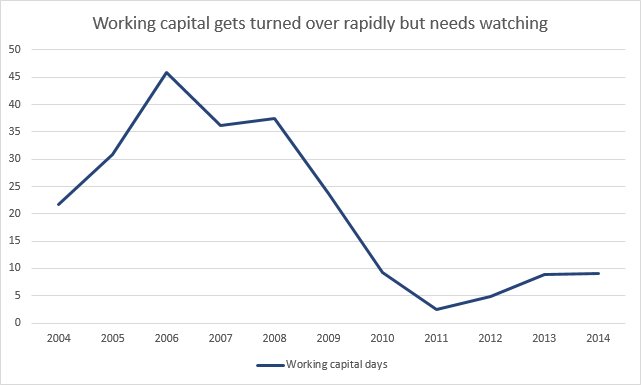

This leads nicely onto another area where RTC Group have had problems in the past but are showing promise: working capital. For many years the company didn't produce much cash because it was all being sucked into increasing working capital levels with this rise out of step with the level of sales growth; a worrying trend since this can mean that invoices aren't being collected efficiently. Much of this imbalance has unwound since the GFC though and now the working capital level is more reasonable - as indicated by the number of days of sales which the working capital level represents:

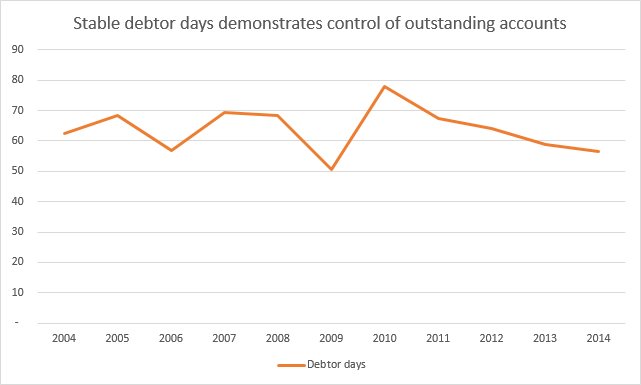

Another metric worth pondering when looking at balance sheet stress is the debtor day trend; if this is heading the wrong way, and a company claims profits but proves unable to collect on the invoices, then this is a real warning sign. Fortunately the management here have an impressively tight hold of their debtor book and have maintained this control through good times and bad:

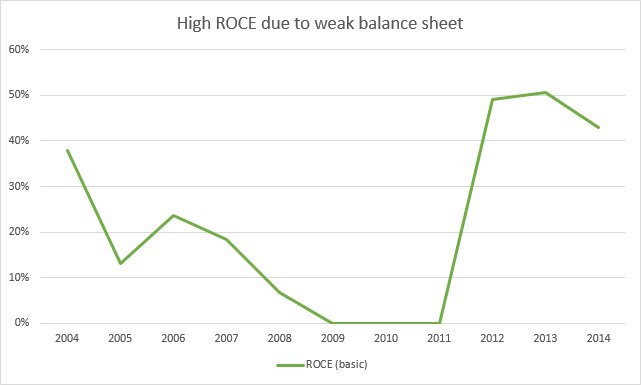

The final angle that I'm going to examine here is the ROCE for RTC Group and how it looks markedly excellent right now at over 50% - but this is something of an illusion. While profits are improving, for sure, and this is a very capital light enterprise, which is also good, the fact is that the balance sheet has been destroyed by years of losses - so there just isn't much equity left to make a return on! As such the company isn't in a steady-state, as the balance sheet recovers, and it's impossible to guess at the underlying ROCE of the company:

What could the new contract be worth?

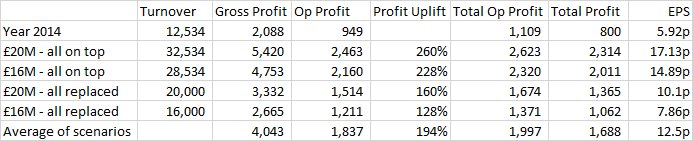

Last year Ganymede Solutions did £12.5M of business at an operating margin of 7.6% and contributed significantly to the bottom line: 25% of total turnover and 30% of operating profits before group costs. If the Network Rail contract provides £16-20M of extra revenue per annum then the big question is how much is this worth? If it's all additional then we're looking at a significant uplift but if it replaces some or all of the current trade with Network Rail then the impact will be diluted (never mind whether the contract has been won on the back of reduced margins).

So I've done a few back of the envelope sums to calculate the additional profit that might have arisen in 2014, had the contract been fully operational, from the additional revenue of the best and worst case scenarios, i.e. where £20/16M is all additional work and where it replaces all existing work:

Obviously there are a number of assumptions being made here: I've assumed that the margin of 7.6% applies, that central costs remain the same, that the additional work has no debt or tax impact and that Ganymede Solutions can cope with the additional headcount. On the other hand with the worst case scenario I've ignored any non-Network Rail sales and any additional work that might be generated from this publicity.

Anyway given all of these unknowns I can imagine that the average of these scenarios might be in the right ball-park once the contract has bedded in - which implies a doubling of operating profit for this part of the group, to just under £2M, and a group EPS of 12.5p. Knock off 10% for increased central costs and another 10% for extra tax and interest costs and that takes us down to 10p; in fact maybe it's worth taking off another 10% for unknown unknowns and then we're down to 9p.

Now given that RTC Group have just achieved 5.92p of earnings for 2014 you've got to wonder just how much they can beat this figure by this year and in future years? In the past the average P/E comes in at about 8.5, although recent price strength has pushed this up to a heady 12/13, and some form of re-rating might be on the cards:

Just 7.2p in 2015 would put them on a P/E of 10 while an EPS of 8.5p would bring the P/E ratio back towards the historical norm. So my view is that the share price needs some tangible news from this contract for it to push higher, and fuel a re-rating, but if the news-flow continues to be positive then I can imagine 90p a share being on the cards (given an EPS of 9p and a positive tailwind bringing a P/E of 10). For comparison Allenby Capital, the NOMAD and broker, have just released a research note where they forecast an EPS of 6.6p for 2015 and 8p for 2016 as the incremental benefits of the contract kick in.

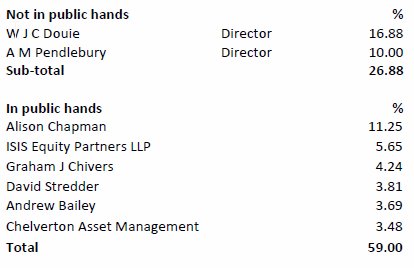

Director Shareholdings

It always gives me a warm feeling to see directors holding significant stakes in a company relative to their salary; there's a real sense of shared purpose, especially so if the shares have been held for a long time. In the case of RTC Group the shareholder register exhibits just this quality but with an unusual twist:

The names of the directors are certainly no surprise; Bill Douie has been part of the company from the start and while Andy Pendlebury only joined in 2007 he has amassed a pretty substantial stake. What's interesting is that a large number of these shares came from option awards, at what seems like a ludicrously low price of 9p, and the special placing that the company did in 2011 to raise £400K for working capital purposes; desperate times. The thing is that the shares really were trading at this level at the time and so such investments were a real sign of confidence for the future.

At the top of the non-director list stands Alison Chapman and there is both a sad and an interesting story here. The sad part is that her husband was Clive Chapman, one of the original founders and CEO, but he died unexpectedly in 2006 and she has held onto the shares ever since. So it strikes me that the current directors may feel something of an obligation to Alison Chapman (and other previous directors Graham Chivers and Andrew Bailey). This could explain their determination to keep the company going and reluctance to dilute existing shareholders into oblivion. Maybe this really is a stock for widows and orphans?

Conclusion

RTC Group obviously remains a recovery situation despite the sterling work of the board, over the past 5 years, in cutting loss-making operations, reducing costs, rationalising businesses and taking on only profitable contracts. The big question, though, is how are they going to manage the new Network Rail contract and whether it's a game-changer in fortunes. If it allows them to attract further contingent labour work, and raises the profile of Ganymede Solutions, then it's quite possible that this is just the start.

My worries are that Ganymede Solutions could struggle to find enough workers of sufficient quality to meet the contract (if you go to their website it's clear that they're on a recruitment drive) and that the working capital needs of this deal will reverse recent improvements in cash generation and balance sheet strength. That said it's a five-year contract and so demand is likely to ramp up slowly and the security of this demand means that short-term cash-flow issues should wash out over time.

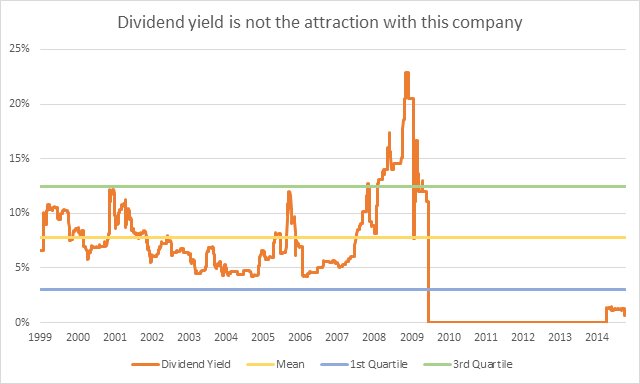

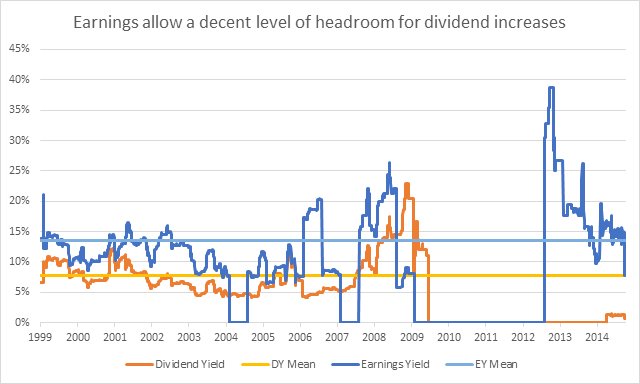

Thinking along these cash-flow lines a decision that I appreciate is the recent return to paying a dividend and the statement that this makes: that the company is sufficiently strong and stable to start returning earnings to the owners of the business. Obviously it's early days yet, and the yield is nothing to write home about, but if the company can even get close to the payout level that it once enjoyed then it'll be a keeper:

On the up-side the recent firming of earnings means that the company has plenty of scope to increase the dividend while moving to a more normal level of dividend cover:

I can certainly see that such an increase will be on the cards with Bill Douie and Andy Pendlebury at the helm. Not only have they managed to turn the group around but they've both amassed significant stakes while doing so and have largely protected the stakes of existing shareholders. In this sense they've acted almost as if this were a family business and from this perspective an increased payout will feel like a reasonable reward for anyone who has stuck with the company. Of course they might start to treat the group like a lifestyle company, with excess pay and bonuses, but so far all looks in order.

So far so good then and I just hope that the board are able to keep the group on its current trajectory of improvement; all of the signs that they can are there but it never hurts to benefit from a little luck!

Disclosure: the author holds shares in this company