TL;DR:

A fairly priced, high yield company GVC Holdings is benefiting from competent management but may never shake off the negative perceptions that surround the online gaming sector.

Background

GVC Holdings began life in 2004 as a speculative venture to take-over the assets of CasinoClub from its private founder. This turned out to be a pretty shrewd move as the platform boasted a solid, profitable and growing audience of German gamblers who enjoyed using the product. On the other hand, as made clear in the AIM admission document, it was a high risk play due to the uncertain regulatory environment, need for a gaming licence and total reliance on Boss Media to provide all software and operations support.

In the five years following this impressive start the company churned out astonishing levels of cash-flow, far in excess of reported profits, and yet after an initial flurry of excitement the stock market remained unconvinced. Logically this might have been down to the unremitting regulatory uncertainty or it might have been because management never pulled their finger out and moved into markets such as Spain and Italy; which is what they'd promised to do on admission. Either way new management signed up in 2007/08 and not a moment too soon as the business began to fall apart in 2010 and headed towards its first ever loss.

The problem with on-line gaming companies, as I understand it, is that it's a cut-throat, and often unregulated, sector where punters have little loyalty. So brands have to be constantly refreshed, new money attracted, eye-catching jackpots financed and competitors repulsed. It's a sign of strength that CasinoClub managed to capitalise on its tailored offering for so long; but by 2010 lack of investment caught up with GVC Holdings with sibling brands Betaland, Betpro and Winzingo failing to take up the slack with their low-margin contribution.

Fortunately, in 2012, management demonstrated their acumen by buying Sportingbet in a huge, all-share acquisition; doubling the size of the business to access new markets and improve the cash generation of firm (having totally failed to achieve this organically). Harking back to the glory days of 2004 this brave decision proved a masterstroke; headline growth has returned to the business, cash-flow has recovered and the previously moribund share-price has more or less tripled in three years. The real question, now that this reverse-takeover has bedded in, is whether management can continue growing the business and expand into new regions more successfully than they have done in the past.

Trading history

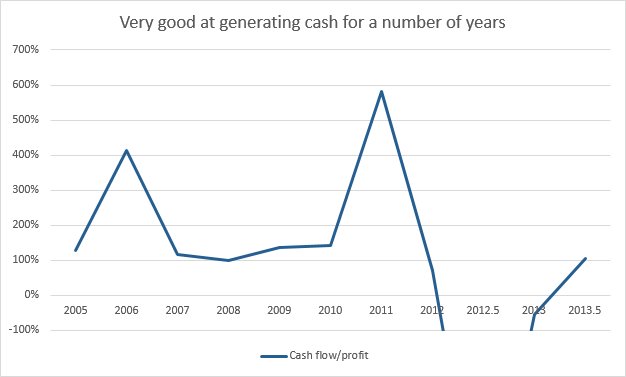

A key element of GVC Holdings' attraction for investors is, and always has been, it's outstanding ability to generate cash. Even when profits slumped in 2010/11 the cash kept accumulating although this happy state of affairs reversed in 2013 as a result of the Sportingbet takeover (driving a hike in technology expenditure and other exceptional charges to deal with its indebted and loss-making state). Either way in the first half of 2014 cash-flow returned with a vengeance and there's every sign that this trend will continue into the full-year results:

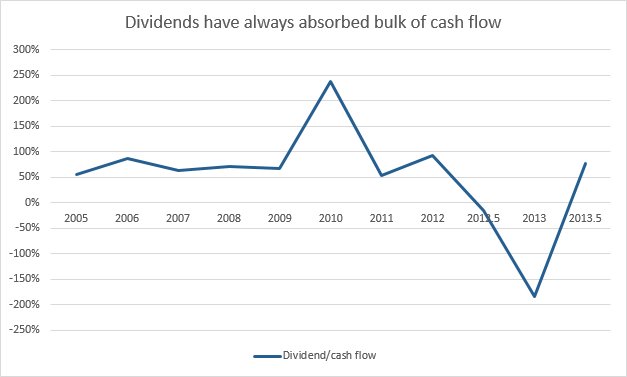

The flip-side of this cash-flow is that it has generally been matched by a cash-outflow in the form of dividends. From the outset this company has placed shareholder returns, in the form of ordinary and (recently) special dividends, front and centre. On the whole this has worked out just fine as the business model requires very little in the way of capex or working capital and 60-80% of the net operating cash-flow can be safely disbursed in this manner:

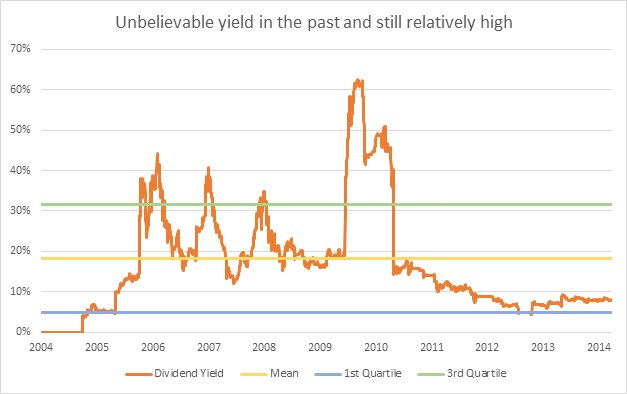

As might be expected this handsome payout has led to some quite outlandish historic yield values, as the share price has oscillated; over 40% a few times in 2007 and right up to 60% in 2010 (although the latter preceded the dividend being slashed by 2/3). This volatility makes the reasonably stable yield of 8% that has persisted over the last few years appear quite mundane! That said even this level lies in the upper echelon of all shares paying a sustainable dividend in the UK market and is something of an outlier:

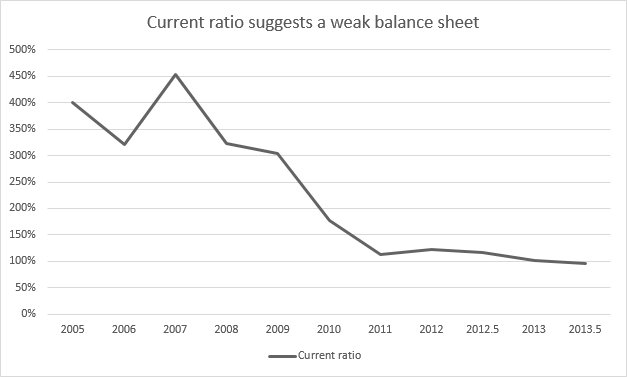

One consequence of so little cash being retained by the business is that it never accrues into a buffer and as there are precious few other tangible assets to speak of then the balance sheet remains weak; this is not an asset-backed business and the bulk of shareholder equity boils down to a mountain of post-acquisition intangible assets. So if we consider the current ratio it's pretty crummy with assets barely covering the liabilities:

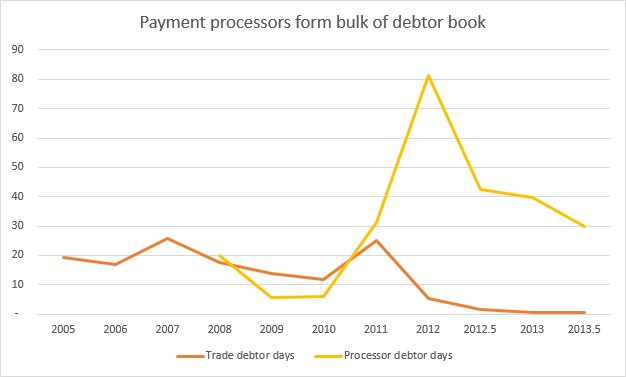

On reflection though I don't consider this to be a problem in that GVC Holdings is very much a cash-in-hand business with punters handing over their credit card details up-front and winnings only being paid out later on. A sign of this is that the vast bulk of receivables consist of funds held by third-party payment processors; these should pay up in a timely and consistent manner, assuming that the customer doesn't initiate a charge-back, and the recent downward trend in debtor days is both welcome and reflects this type of operation:

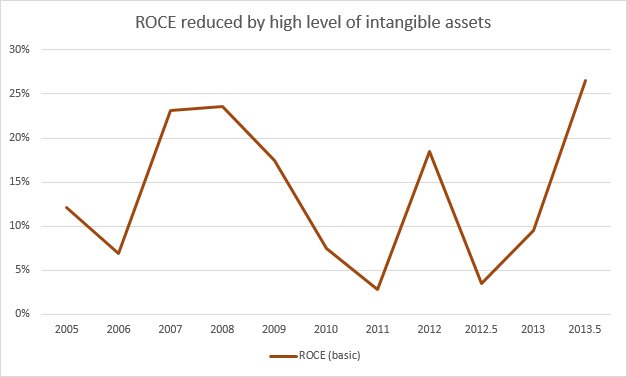

A side-effect of the weak balance sheet and acquisition led strategy is that while the business is very profitable, with little need for investment in tangible assets, it suffers from a huge overhang of intangibles. This, and a reasonably volatile profit history, is why the ROCE is neither stable nor unusually high. Even so if the full-year results for 2014 come in at twice the half-year results (or better) then we could see the ROCE heading sharply above 20%. Probably best not to get too excited about this though:

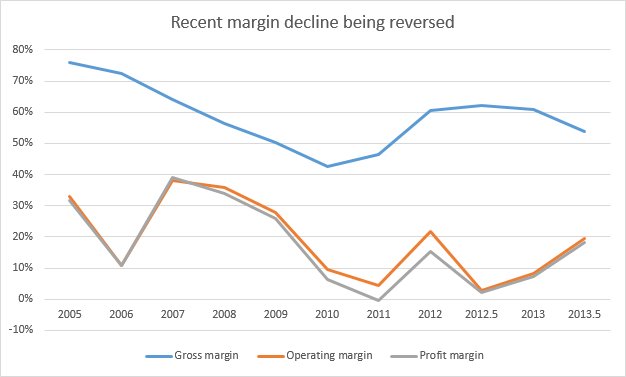

On a related note it's worth considering the margins achievable by an online gambling business since these directly feed into the ROCE calculation (via the operating profit in this case since little cash interest is either paid or made). Back in the early days the margins stood at a stupidly high level but gently declined as GVC Holdings began drumming up trade via third-party affiliates. Latterly though margins are flattening off and perhaps on the rebound to a healthy 20% or so:

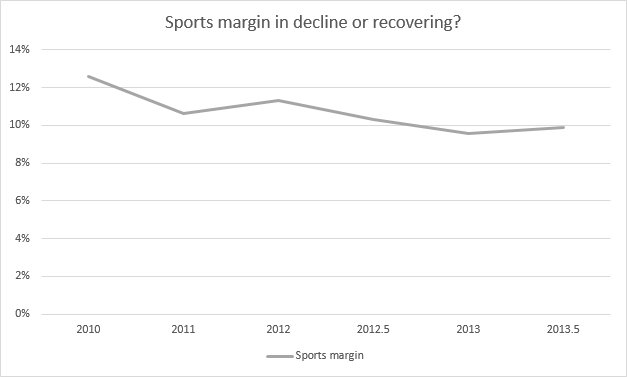

A separate margin, which is a KPI for management and worth keeping an eye on, is the sports betting margin. This metric is a composite measure that takes in both the efficiency of trading teams monitoring and pricing sports events together with the robustness by which the impact of adverse results is mitigated. On the whole GVC Holdings appear to have settled at a level of 9-10% but it's important that this remains the benchmark as sports betting becomes the dominant profit driver:

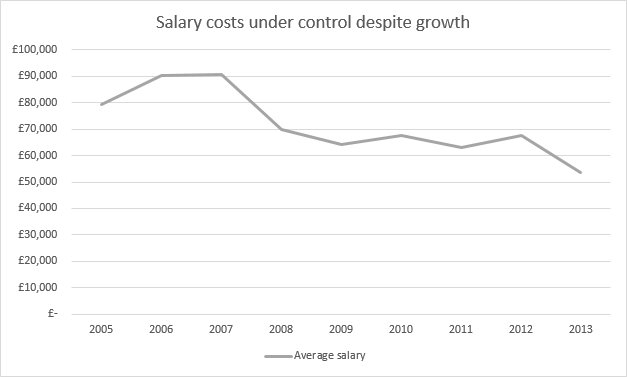

Linked to margins and profitability, of course, is just how much control the board have over costs within the business. With respect to the Sportingbet acquisition this is what the board had to say: To make the acquisition financially enhancing for our shareholders, deep cuts were needed and it was necessary to reduce the inherited headcount by around a third, which, along with property and other cost reductions, reduced the expenditure base by around 50%. A number of in-house functions were outsourced and GVC has a number of significant partnerships in cost-efficient jurisdictions. GVC sees this as a blueprint for its future expansion. While it's hard to verify the details here what I can say is that the average salary has been falling for a number of years despite the staff count increasing by an order of magnitude:

So it's reasonable to believe that the directors are concerned about minimising costs within the business and running it efficiently. In other ways they're certainly acting in the best interest of the shareholders with the high level of distribution coupled to a share count that remained entirely unchanged from 2004 to 2010; latterly, of course, some options have been exercised and Sportingbet shareholders took a large slice of equity but there's no doubt that this is a self-financing business. In addition director bonuses are directly aligned with the dividend pay-out and while the resulting bonuses are large there's a contractual requirement for them to re-invest not less than 20% of the post-tax amount back into the company. So again the alignment between executives and owners is strong.

Future prospects

The most recent trading statement in January certainly paints a very positive picture of a business continuing to grow following the World Cup: 2014 ended strongly with Net Gaming Revenue ("NGR") exceeding €20.3m for the month of December (€656k per day; up 17% on December 2013 at €535k per day) with a sports margin of 9.9% (December 2013: 9.1%).

Even better the current year has started in a similar vein although it would be foolish to draw any conclusions from such a short trading period: 2015 has started strongly. In the eight days to midnight eight January 2015, and compared with the same period in 2014, deposits made by customers grew 22% to an average of €1.6m per day (2014: €1.3m) Sports wagers grew 9.7% to an average of €4.0m per day (2014: €3.6m). Sports margin was a strong 12.8% (2014: 9.4%), leading to a pleasing daily NGR of €779k (2014: €534k).

That said the previous trading statement in December drew a slightly more cautious picture, while remaining encouraging overall: This positive outlook is set against a background that includes the commencement of the UK Point of Consumption tax and the fact that 2015 does not include a major sporting event on the scale of the football World Cup. The Board views the future with confidence.

What goes unmentioned in these statements is any reference to CasinoClub and the fact that the customer base has matured; leaving GVC Holdings to either swallow the decline in NGR or step up marketing efforts in a bid to reactivate lapsed customers. Perhaps, given recent increases in the Gaming NGR over successive quarters, this is less of an issue at the moment but I can't help feeling some concern about the loss of such profitable business in Germany. At the same time I wonder how much of this NGR growth will drop through to the bottom-line when an increasing proportion of new business is being sourced through affiliates? These middle-men take a hefty chunk of the profit but I suppose that it's better to have 40% of something rather than 100% of nothing?

Either way all will be revealed on Monday 23rd, with the full year results, and we'll discover just how closely management have stuck to their given strategy of:

- investing in and using management expertise to develop highly cash-generative internet gaming and gambling brands

- providing these services to third parties for a share of revenues

- running multiple brands across diversified jurisdictions, where each brand is run separately with its own highly incentivised and motivated managers and employees

Conclusion

On the face of it GVC Holdings presents as a turnaround success story with management reporting strong growth and high expectations for the future. Even more appealing the price being asked for the business is not outrageous (although on-line gambling operations tend not to achieve a warm rating) and the yield is high. So what's the catch? Well to try and avoid over-exuberance I've started looking at the reasons why I shouldn't invest before trying on the bull case and this is how I see things:

Reasons not to invest

- constant threat of government legislation and litigation

- weakness in Euro against Sterling impacting dividend payment

- lack of major sporting events of a similar scale to the World Cup in 2014

- total reliance on third-party contracts for software offering

- potential for third-party lawsuits to resolve contractual difficulties

- poor record of generating commercial organic growth

- continued decline in profitable ClubCasino gaming

- financial risk of a significant jackpot(s) being won

- unknown impact of 15% point of sale tax on profits in UK

- low level of director holdings

Reasons to invest

- low price and high dividend yield (even after conversion to Sterling)

- continued momentum in sports revenue growth and raising of expectations

- successful integration of Sportingbet from unpromising material

- expansion into new regions such as Scandinavia

- recent management track-record in operations and acquisitions

- actual management action to resolve ongoing lawsuits with Boss Media

- focus on cost-control and managing outgoings despite growth

- alignment of management rewards with absolute level of dividend payout

- good control of share count with no dilution of shareholders

- simple business model

It has to be said that I find the decision here to be quite finely balanced; there are so many macro considerations where GVC Holdings could be destroyed as a business and yet this hasn't happened. At a micro level the board are acting effectively and re-building a profitable enterprise. Whether it has a long-term future I don't know but I guess that the same can be said for any company no matter how stable their niche is.

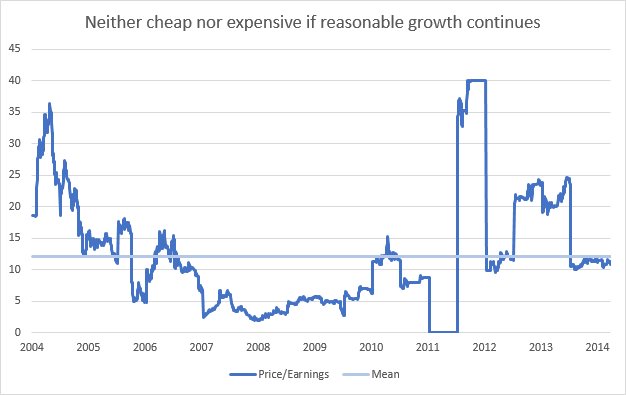

It's also true to say that while the firm was once shunned by investors, and left on a very low P/E multiple (<5), this is no longer the case. That was definitely a time when online gambling companies active in unregulated markets were viewed in the same light as Chinese companies on AIM are today! However now GVC Holdings sits on a sensible P/E rating just above 10:

Given that the full-year results will be released on Monday, and it's now impossible to trade before then anyway, then both my gut and my head are telling me to wait with GVC Holdings. If the outlook is convincing, with momentum in sports betting driving higher revenue and gaming betting stable, then I may well be tempted to add this stock to my income portfolio. Based on the trading statements this feels like a plausible outcome but if the outlook for 2015 contains elements of uncertainty then I'll probably hold off and respect the share price fatigue so evident over the last nine months.

Disclosure: the author holds no shares in this company