A pretty decent month all round with more shares going up, rather than down, for once. As mentioned below I bought, or topped up, a few more shares where the fundamental and technical signals both appeared to be pointing in the right direction. It's too early to say whether this tactic is helping but it is stopping me buying any shares where the share price is on a downward trend (such as FeverTree). The big winner this month was Haynes Publishing, which is really flying as investors warm to its digital attractions, while SimplyBiz has reversed recent share price weakness and yet still remains good value at the current price.

In contrast Quartix has fallen back on next to no volume with the rest of fallers dropping by single-digit percentages - which is well within the ordinary volatility of any share let alone those at the smaller end of the market. Now I know that some people use moving averages to decide whether to buy or bale and quite a few of these fallers are distinctly below their 100-day and 200-day MAs. However it seems to me that for every instance where it was right to buy or sell on a crossing event there are equally as many cases where it didn't work out. I'd be interested to hear whether any readers have a different experience in this area?

Anyway the scores on the doors are:

HYNS 23%, SBIZ 15%, SDI 13%, SPSY 8%, GAMA 8%, RFX 7%, BUR 7%, WJG 4%, PCA 4%, NRR 3%, BOWL 3%, KETL 2%, IGR 2%, PPH 2%, BOOT 1%, DOTD 1%

FDM -2%, KWS -3%, RWA -3%, III -3%, LTG -5%, GAW -5%, SCT -6%, CRW -6%, K3C -7%, QTX -10%

All in all this led to a 1.1% rise in the portfolio in October with the YTD performance now a little greater than 10% (which is a nice psychological support level). Of course with a General Election on the horizon I've no real sense of whether this level will be sustained, cut drastically or doubled. It feels crazy to me that we're living through such uncertainty but then I've thought that for a while now.

Purchases

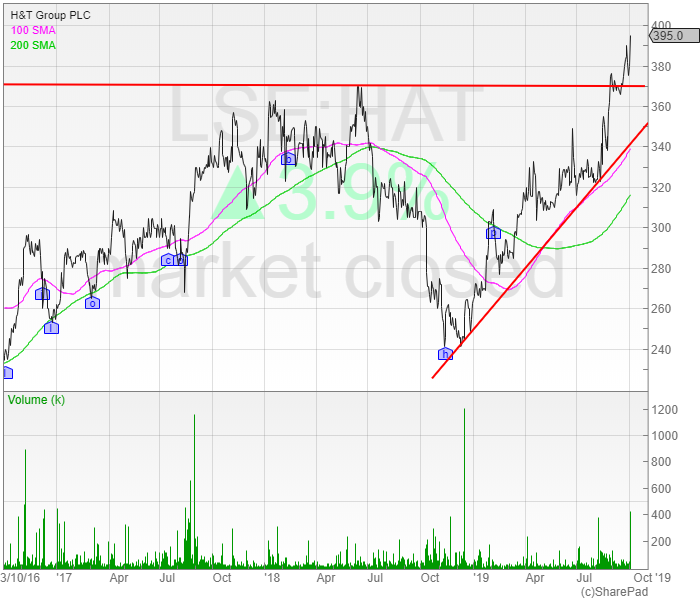

H & T Bought at 379p - October 19

As picked up in September's report H&T put out an after hours trading update right on the last day of the month. Usually this is a ruse to shove some bad news under the carpet but not in this case. Instead the company has picked up 113 pledge books from the wreckage of Albemarle & Bond; hopefully for a bargain price. In addition the group has already been trading ahead of board expectations and these new assets are really the icing on the cake. A further attraction is that the share price has been pretty perky over the last fortnight with a decisive break above strong resistance at the 360-380p level on decent volume. So, to my eyes, this looks a lot like the perfect setup with both the technical and fundamental aspects lined up nicely. Add on the chance that the market makers might neglect to mark up the opening price, due to missing the late RNS, and I made sure to be topping up my position right at the opening bell. Fun times.

AB Dynamics Bought at 2280p - October 19

To some degree this has always been one of those companies that got away: high quality, high profit growth and debt free yet always fully valued by the market. The past six months have been a period of consolidation though with the share price hovering at the 2500p level without any momentum either way. That said in September it broke out to an ATH of 2815p (very positive) before sharply reversing back to under 2200p (pretty negative). This 20% fall definitely caught my attention and I kept a watch on ABDP to see if the price might start forming a base of support. In the event this never happened because the company put out a strong FY trading update indicating that results would be ahead of expectations and that the outlook remains positive across the whole group. My expectations were that this update would forcefully reverse the recent trend and so I bought in at the open (especially as the price was near the 200-day SMA). In the event a very weak market created a bit of a headwind but for now the trade is going in the right direction.

Alpha FX Bought at 898p - October 19

Over the past few years I've heard a reasonable amount of chatter around a new breed of FX broker looking to shake up the FX industry. However it's always a worry when a number of similar companies list at the same time, since they might be riding a temporary wave of profit, and short track records don't tell you whether a business is robust in all conditions. That said it seems that Alpha FX is one of the better run brokers with six "ahead of expectations" announcements since listing with three already this year. That's quite some business momentum and the share price has reacted strongly by gaining over 50% YTD pushing the P/E ratio to ~35 (although I expect this to fall as brokers upgrade their FY numbers). So why buy now? Well operationally AFX is going great guns and rising customer volume suggests that they're winning business from incumbent FX providers. From a price perspective the share has recovered strongly after its post-summer weakness, on decent volume, and there's nothing holding it back from hitting a new ATH.

Spectra Systems Bought at 152p - October 19

As mentioned in September it was pretty clear that 140p has been acting as a resistance level for most of the year despite a number of positive updates. Just last Friday this level was definitively broken, on high volume, with the price ending up at just over 146p. The thing with these movements is that they can easily reverse, if enough sellers emerge, but today the price continued rising as trading activity continued. Unfortunately I managed to buy at the intra-day high but even so the price only closed a little lower at 150p. Topping up in this way isn't a tactic that I've pursued before but it seems reasonable to me that combining technical and fundamental signals in this way can only help my odds of success - even if nothing is guaranteed. So it'll be interesting to see how this situation plays out.

Things I thought about buying (but didn't)

Auto Trader

In September I watched as Auto Trader continued its fall from 600p with the intent of taking a position when the trend reversed. However the sudden change in market sentiment on 11th October, as No Deal looked to be off the table, caught me out. With the price gently rising since then, and no updates from the company, I've remained on the sidelines and will continue to do so with HY results coming out shortly on 7th November.

Fevertree Drinks

Fevertree was a very successful and profitable holding for me up until around eighteen months ago when I sold out due to fears around growth rates. Now I definitely jumped too soon, since the price then went to £40, but I've felt somewhat vindicated over the last year as the share price has come back to Earth. More pertinently £20 has acted as a support level for 2 years now and yet the price broke through this level, on high volume, just a few days ago which is a bearish sign. Without a decent trading update (which is unlikely to appear until after Christmas) I see the price trending lower.

Greggs

This has been a knock-out investment over the past year with the share price more than doubling on the back of strong trading (and vegan sausage roll excitement). However momentum has drained away since the summer on fears around rising labour and food input costs (and the fact that trading hasn't exceeded expectations). Set against that the business is still growing strongly, both in store and customer numbers, with new menu options and opening times proving popular. In addition the price has bottomed out at the £18 support level with no clear direction either way. In recent years an update has come out in Oct/Nov and I see that as the next catalyst one way or the other.

WH Smith

Another company which has successfully reinvented itself is WH Smith with the declining High Street more than offset by trading in airports and similar travel destinations. However much of that is already in the price with this being range-bound between £18-23 for the last two years as bottom-line growth has moderated. This is probably why the board are spending $400m on the acquisition of a proven US travel retailer (Marshall Retail Group) to broaden their international travel offering (pretty much doubling its size). So this feels like a positive transaction even if it'll take a couple of years to reap the full benefit. Still on the watch-list then.

Sales

None.

Things I thought about selling (but didn't)

None.

Announcements

Ramsdens Holdings

A reassuring, in-line update here for the first 6 months of the year. A particular point to note is that while the consumer environment remains challenging they put down their good performance to having a number of different income streams. I can well believe this as demand for foreign currency, small loans and what-have-you is bound to fluctuate. Another positive is that they scrapped an amount of slow-moving jewellery stock to take advantage of the strong gold price. As a result rather than taking a write-down on the stock they've created a one-off £600K boost to gross profits. Nice. Finally the newly acquired Money Shop stores are bedding in and they're open to further acquisitions. All pretty good then. (Update)

Hollywood Bowl

It's good to receive a pleasing update and Hollywood Bowl looks to be trading well with FY profit expected to be slightly ahead of expectations (with growth of >10%). Given that sales for the year grew by 7.7% it's clear that management are keeping control of costs which is reassuring given current economic pressures. This level of focus also extends to cash-flow and since listing the operating cash-flow has always come in ahead of reported profits with free-cash flow (after capex) not far behind. As a result debt has fallen rapidly and the board are now considering returning surplus capital to shareholders. Despite this the share price has fallen back on reasonable volume in contrast to competitor Ten Entertainment where earnings expectations have fallen rather than risen. Patience required then. (Update)

Robert Walters

Well this Q3 update was about as welcome as a plate of week-old fish with the already cheap price coming off another 10%. The driver for this reaction was the surprise that earnings this year will only be in-line with those for last year (~46p) rather than meeting expectations of ~50p. Bit of a shock really with management blaming this on Brexit and Chinese tariff wars along with protests in Hong Kong and France. I can kind of see their point and it's possible that these issues will pass without tipping us into recession (which is where recruiters really get hammered). On the upside Q3 did see 4% growth in net fee income (NFI) with Europe and Asia Pacific doing the heavy lifting while the UK business shrank by 11%. I do wonder just how bad Q4 must be looking then for it to reverse all of the growth seen in the first 3 quarters? On the upside RWA have net cash of £81.6m at the moment (double the amount that they had in September) so there are no concerns on the balance sheet front. (Update)

dotdigital Group

This has been something of a challenging year for dotdigital with the continuing integration of Comapi (acquired in Nov 2017) and sales hit by a number of retail clients falling into administration. On the Comapi front it was announced in May that main platform integration was complete and that the non-core parts, Dynmark and Donky, would be wound down. This makes strategic sense but it did have the knock-on effect of reducing forecasts as these are based on continuing operations. Hence it's not too surprising that the share price has been weak since the summer. Anyway these results are pretty much in-line with expectations with sales of £42.5m, EBITDA of £14.7m and post-tax profit of £10.9m. A side-effect of excluding discontinued operations, which generated a £2.5m loss, is that earnings have come in above expectations with an EPS of 3.9p (3.4p expected) while it's just in-line at 3.36p when everything is included. Looking forward the board have good earnings visibility, with 86% of sales recurring, average revenue per user continues to climb and foreign markets are all growing strongly. So I think it's very likely that the 2020 forecasts for just 3.8p in earnings will be upgraded to perhaps 4.3p (just 10% growth) putting the company on a P/E of ~23. Not cheap but not over-expensive. Still it's fair to point out that dotdigital pay almost no tax, courtesy of hefty and ongoing R&D credits, and that £4.4m of development costs were capitalised in FY19 (rather than putting these through the P&L). So there are legitimate factors at work here which act to improve profits and yet may not be around forever. Nevertheless dotdigital is serving a clear customer need in a growing market and has real scalability given that they are all about software and services - so I can understand why the board are confident for FY20. (Results)

IG Design Group

A pleasing H1 statement here with the business being on track to meet expectations. These aren't too onerous though, with just 4% growth pencilled in, probably because the second-half of the year (which includes Xmas) is where the real profits are made. That said they have a high level of orders going into H2 and so far they've delivered double-digit growth in sales and operating profit. So I have a sense that analysts will up their forecasts at some point when it becomes clear how well the business is growing organically. In addition cash generation has been strong and it's clear that management are continuing to assess acquisition opportunities to bolt onto the group. Given their track record on this front I don't believe that the board will destroy shareholder value by making any vanity purchases and that's a key attraction here. (Update)

Softcat

What a lovely set of results these are with sales, operating profit and EPS all up 24% for the year - the sort of growth rate that sits well with a P/E of ~25. I like the fact that margins have obviously held steady all the way to the bottom line and cash conversion remains high at just over 92%. As a result enough excess cash has built up for it to be distributed as a special dividend of 16p (more than doubling the yield for the year). On this front it's notable that Softcat have declared a special dividend for each of the 4 years since listing; an excellent discipline. Looking forwards analysts have come up with undemanding earnings growth of just 5% but I have a strong suspicion that this forecast will be steadily upgraded throughout the year since this is exactly the trend seen over the past 2/3 years. Usefully the board feel that market conditions were good this year, unlike just about every other UK business, and that they see this trend continuing as clients require ever greater digital infrastructure. I don't think that this is wishful thinking either since software, hardware and services sales all grew by pretty much the same amount in FY19 and all customer segments saw organic growth in the period - so it's a broad-based tailwind that's helping Softcat. That's a quality which I can appreciate. (Results)

PPHE Hotel Group

Despite all of the current Brexit uncertainty this hotel group is bucking the trend with Q3 like-for-like sales up 5.6% led by strong UK growth. Part of the reason for this is that several years of investment and disruption, in the UK and Netherlands, have now come to an end and all of these hotels are now fully open. Still it's great to see this investment bearing fruit with RevPAR up 4.3% across the group. It's no surprise that I really rate the management here and see coming development in London and New York as very positive. Overall trading is in-line with expectations and hopefully Q4 will continue with the momentum built up so far this year. (Update)

Disclaimer: the author holds, or used to hold, all of the shares discussed here