I last looked in detail at Next back in the autumn of 2015 and felt that it was a decent proposition even at £71.20 and quite frankly I couldn't have called the top more effectively if I'd tried. Over the next 18 months the share price more than halved from £79 to £36, as the retail environment turned nasty, even though profits fell only by just over 6%. So what caused the damage? Expectations. At its peak the P/E hit about 18-20 while at the nadir this deflated by over half to a very low 7-8 (compared to ~13 now). In retrospect the phenomenal pessimism around Next last year offered a tremendous buying opportunity but it's hard to go against the market.

Back in 2014 and 2015 I found Next to be a prime example of a well managed, quality company with an excellent trading track record. However I vacillated about buying into the business as I couldn't make my mind up about whether I was looking for free cash-flow to be spent on share buybacks or special dividends. In the end I decided that the company was just too good to resist - especially as the high share price inclined the board to direct a lot of their spare cash at shareholders and this provided a very good yield on top of any capital gain. The question now is whether Next still looks like a good purchase especially with its share price recovering by more than 50% from the lows of last year.

Analysis

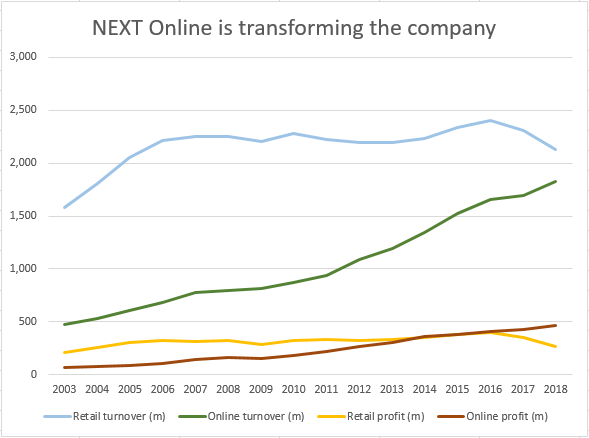

In my mind the key graph to consider is one that compares the retail and online arms of the company. On one hand the retail business has been stagnant for 15 years although that's a more than charitable interpretation since it ignores the effect of inflation (~42% for the 2006-2018 period). In other words £2.2bn of retail sales in 2006 is equivalent to £3.1bn in sales now and that's around 1/3 more than the actual turnover last year. Fortunately Next Online sales have roughly tripled over this time and the margin on this business is much higher:

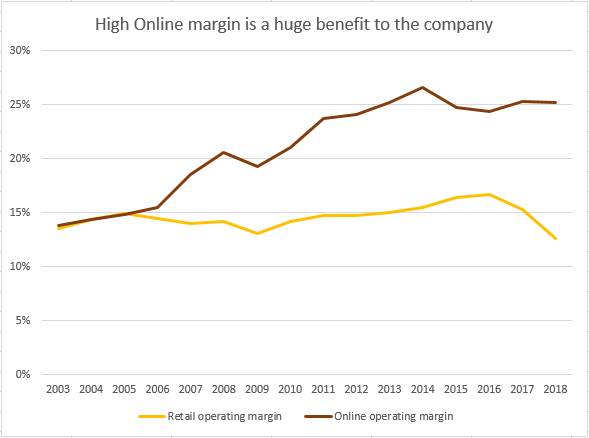

In fact the margins being made with the online business are better than just good, at around 25%, even as the retail margin has dipped below its long-term average of ~15% (although from a long-term perspective this margin has been remarkably stable). This is a really excellent return which benefits from the ability of Next to buy clothes at scale, giving their buyers bargaining power, combined with the profit that they make on giving people nextpay credit so that they can buy these clothes. This finance angle is perhaps the secret sauce of Next Retail and bears deeper scrutiny.

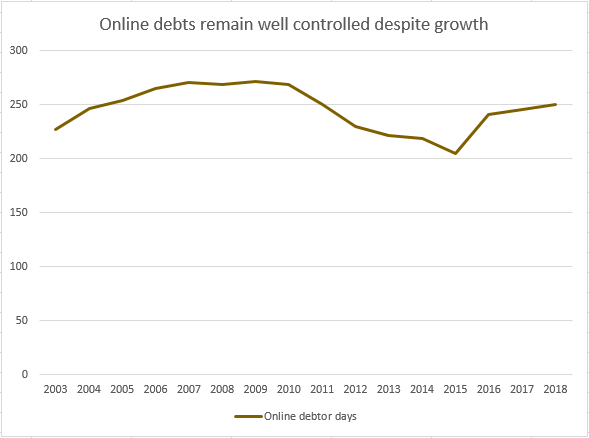

In earlier reports I became concerned about how debtor days (a metric that compares outstanding customer receivables to turnover) seemed to be increasing sharply over time. Such a trend can often be a warning sign since it suggests that a business is only growing sales by extending ever longer credit terms and often these "sales" end up getting written off and not converted into cash. However I then realised that I should only have considered Online turnover since retail customers pay up front (and usually before the supplier of the goods ends up getting paid). When looked at this way it's clear that Online debts are stable despite high underlying growth:

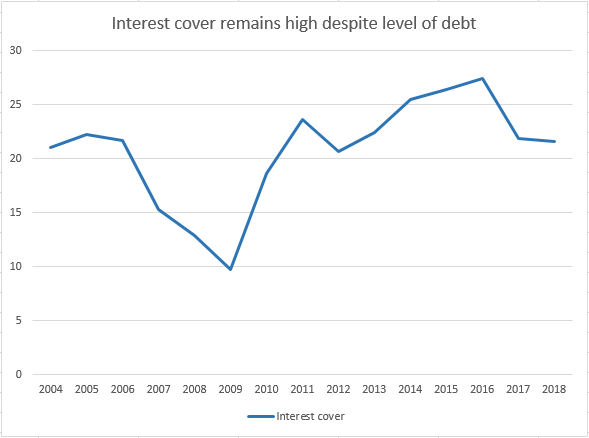

A feature of the Online debtor book is that, at a casual glance, the company operates with a frightening level of gearing - often ~200% although it has been up to 450% at times! However in this case it's not particularly useful to consider gearing since Next intentionally operates with a relatively low equity base and most of the debt is related to customer receivables (where impairment levels remain controlled). It's more useful to look at the interest cover level since that indicates how affordable borrowing (from bonds and overdrafts) is compared to earnings. For many years now the cover level has been >20x and so the debt level is really not a concern:

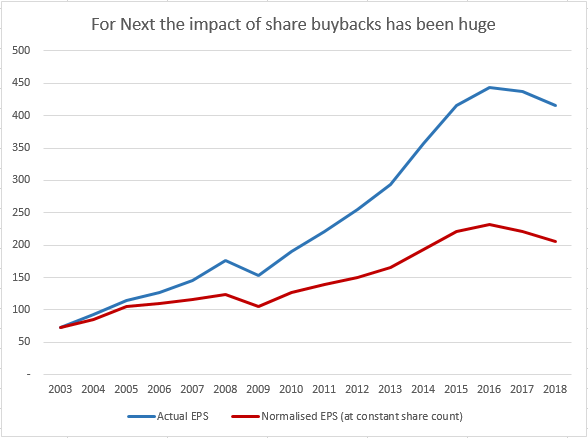

Thinking about equity levels a feature of Next over the years is that the board have consistently used excess cash to buyback shares and cancel them. The net effect is that while there were 286m shares in 2003 there are now only 142m in circulation and this reduction has had a dramatic impact on EPS. Note that the board haven't just been buying shares regardless of price though; instead they have a well-designed threshold (updated every year) that only allows for buybacks where the return on capital is high enough. The result of this process can be seen quite dramatically here:

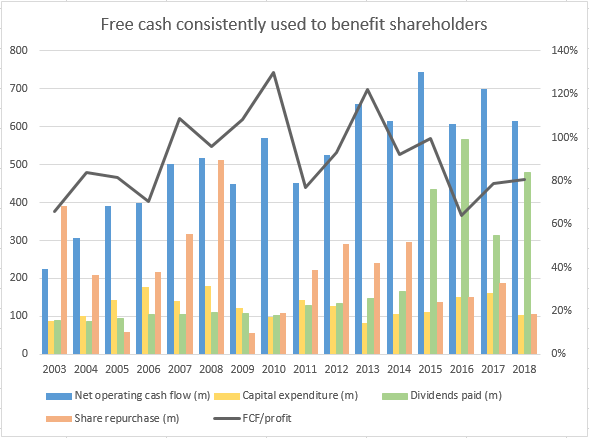

A company decreasing its equity base in this manner doesn't happen by accident and I'm struggling to identify any other large companies doing this; if anyone can think of candidates I'd be happy to hear about them since I consider this to be a sign of strength. The reason why Next has been able to operate in this way is that it generates operating cash flow far in excess of its capex requirements for stores, warehouses and systems and doesn't hold any freeholds. This leads to a very high conversion level of profits into free-cash flow and leaves plenty left over for rewarding shareholders with share buybacks and dividends:

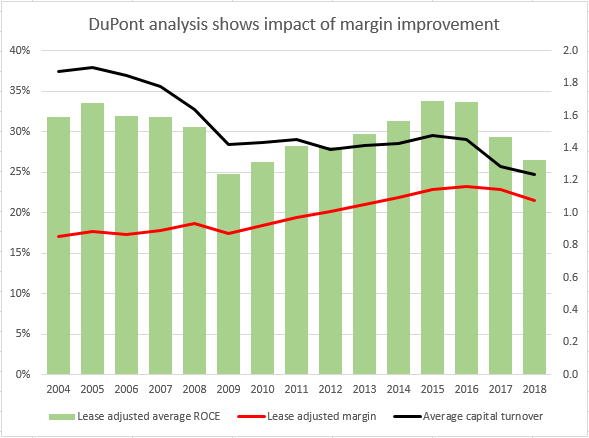

However it's fair to say that the high level of leases makes it look as though Next achieves better returns on capital than similar businesses with freeholds on their books. I calculate that Next's leases equate to an asset value of around £1.6bn and that's material compared to the total reported asset value of £2.6bn. I believe that new accounting rules will place these leaseholds on the balance sheet but for now we have to adjust capital/income values ourselves to derive a lease-adjusted ROCE. The result of this analysis is that Next still commands a very solid ROCE of 25-30% but it's not the outlier that I'd previously imagined:

It's worth noting from this DuPont analysis, which separates out the contributions to ROCE from profit margin and capital turnover, that Online margin improvement has been a key driver of ROCE strength. Without this the increase in capital required to support a more slowly rising level of sales, which depresses capital turnover, would have brought ROCE down to ~20%.

I think that it's reasonable to conclude, from this analysis, that Next is a remarkably successful, high-quality business. From reading the latest annual report it's clear that the board believe that they're operating from a position of strength and have many levers for improving retail profitability.

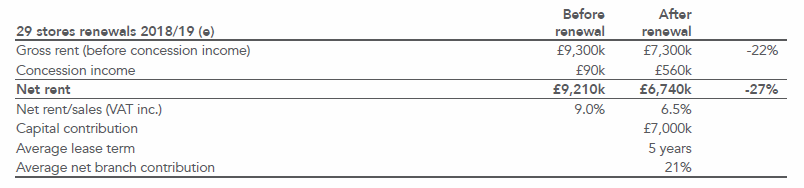

In essence these are mostly about reducing costs, and improving efficiency, although there are areas where Next can improve retail income (through increasing store concessions and offering nextpay in-store). A key plank involves negotiating lower rents and shorter leases when these come up for renewal; last year a 25% reduction was achieved on average from 19 renewals and 240 leases (32% of the estate) are up for renewal over the next 3 years. If the 29 leases being renegotiated this year go to plan the savings could look like this:

In addition the board are aiming to leverage their retail and distribution capability by integrating elements of their online business with the physical shops. More than just delivering orders through stores this involves locating out-of-stock items in stores, re-balancing stock between stores and offering nextpay credit directly to retail customers. I can see some clear wins here, without significant extra cost, and I'm impressed that the board have managed to distil some clear improvements from their strategic review.

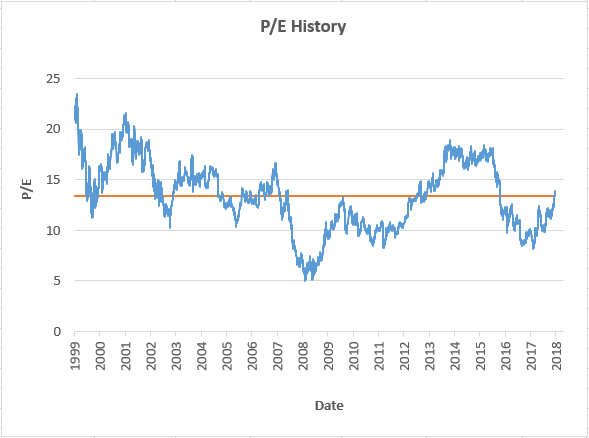

Still none of this answers this question: is Next a good buy at its current price of £57-58? With the current forecasts this equates to a P/E ~13 and a dividend yield just under 3%. In the past special dividends have doubled the received yield but with share buybacks on the cards, due to the relatively low share price, I don't see any additional income coming our way for a while. Now I happen to have a graph of how Next's P/E ratio has varied over the last 15 years and remarkably the average ratio comes in at ~13:

Conclusion

From this perspective Next is fairly valued I'd say given that future growth is likely to be muted, despite management's best efforts. So the P/E doesn't deserve to be < 10, which is where it fell to last year, but neither does it deserve to be > 15 which is the level reached during the group's best years. The current yield of 2.75% tends to support this assessment since this is just a little below the mean level of 2.9%. That said the P/E history for Next suggests that dips below 9-10 can offer a buying opportunity.

Disclosure: the author holds shares in this company