Empresaria is a specialist recruitment company that's positioned for bottom-line growth, after many painful years of restructuring, and this opportunity is yet to be recognised by the market.

Introduction

Empresaria was founded in 1996, by Miles Hunt and David Telling (who also set up MITIE), with a brief to develop a specialist recruitment business operating within diversified, growing market sectors. In the first decade all of the growth occurred in the UK but in 2004 Empresaria transferred to AIM and set out on a path of international expansion. So far so normal but what sets the company apart from its peers is its philosophy of management equity and oversight. In this there are two main elements; firstly key employees retain, or acquire, a meaningful minority stake in the business that they manage; secondly the board allows them full operational freedom while providing financial security and rigour. In other words they have skin in the game and are allowed to remain entrepreneurial.

Now the company operates in 18 countries (grouped into UK, Europe and Rest of the World) across six key sectors (up from 5 at flotation). However this apparent simplicity hides the fact that Empresaria is an umbrella organisation that operates through a multitude of individual companies. The reason for this is that recruitment expertise is very location and sector specific; thus each business performs best if local managers run their team as the local market demands and brand themselves with a locale-specific identity. In a sense the board are investment managers and shareholders are relying on them to select successful private firms worth bringing into the fold.

Unfortunately this unique focus hasn't proved particularly profitable for shareholders; the initial offering on AIM took place at 65p and the price now, drum roll please, is a heady 64.5p! Hardly an earth-shattering performance. There are a couple of good reasons for this dismal outcome though; the first is, reasonably enough, the global financial crisis and the huge staff cutbacks that this led to; the second is that just as Empresaria recovered then Germany moved to certain new collective labour agreements and this unleashed years of struggle and liability for retrospective pay and social security costs. An initial provision of £3M was made for this liability, later reduced to £1.7M, and this has only just been cleared.

There are signs though that the business has put these difficulties behind it and, across all sectors, is preparing to engage with growth once again.

Recovering nicely

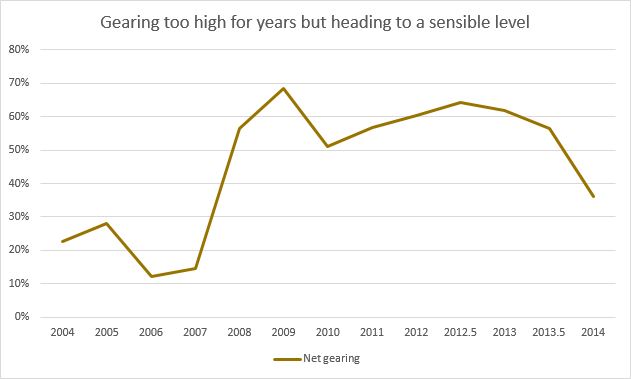

As mentioned the share price of Empresaria really hasn't done the business since listing, despite revenue and profits quadrupling, and it remains a small company; at 64.5p the market capitalisation is just under £30M. A key reason for this, apart from economic difficulties, is that the firm has laboured under a substantial debt load since 2008. In fact for much of the last six years the net debt figure has exceeded the entire capitalisation of the company and it's only in the last year that serious in-roads have been made into the gearing level:

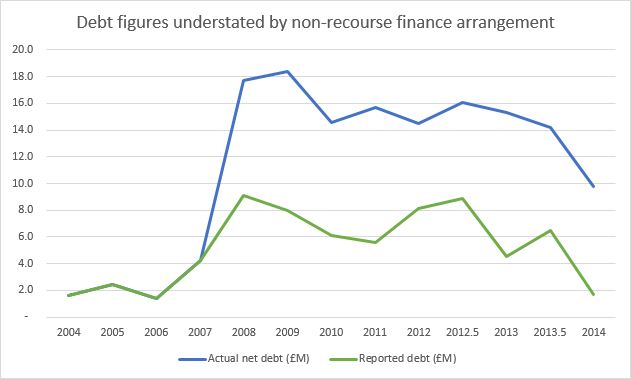

Related to this is the fact that Empresaria has, from some points of view, played down its debt burden with a financial sleight-of-hand. The way this works is that the board used invoice factoring to accelerate their cash-flow and for many years the lender took invoices on a non-recourse basis. So if the customer went bust, and didn't pay, then the lender couldn't force Empresaria to make up the bad debt. As a result management excluded this factored debt from their reporting (although the figures were all in the notes) and the company appeared relatively healthy:

So for most of the firm's listed history the underlying debt figure has been roughly twice the headline debt figure. This practice has only stopped because the factoring lender has changed and now the invoices are handled on a 'recourse' basis - which means that Empresaria is liable if they go bad.

From the latest annual report: During the year, management have performed a review of the accounting associated with invoice factoring arrangements of the Group following earlier changes in credit insurer from the provider of the debt factoring services to an external third party. In the prior year financial statements, the liability owed to the debt provider was offset against the corresponding receivables. Given the change of the credit protection provider in 2012, the debt provider has recourse to the Group for any irrecoverable debt and therefore, it has been concluded that the liability and the corresponding receivable should be presented gross. As a result, the comparative balance sheet has been presented to reflect the full invoice factoring liability within current borrowings. The impact of this is a £9.4m increase in trade receivables and current borrowings compared to the numbers in the previously filed 2013 annual financial statements. There has been no impact on net assets or income statement measures.

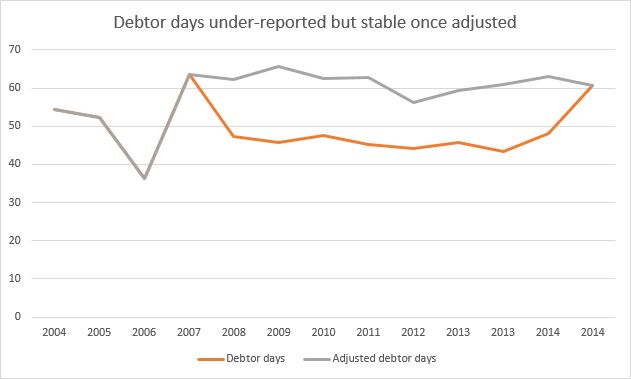

The flip-side of this accounting manipulation is that the outstanding trade receivables figures were also understated (since the invoices had been handed off) and so the debtor day figures looked pretty great too:

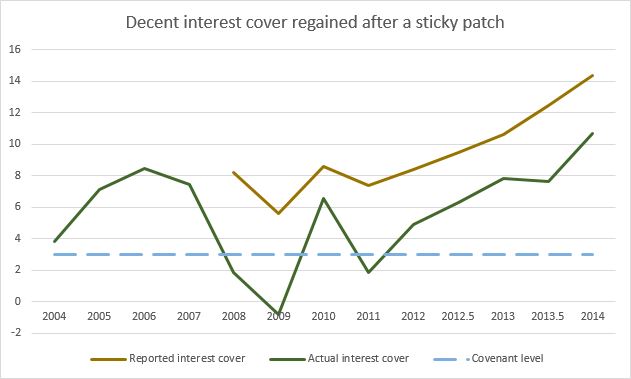

Technically there's nothing wrong with this accounting practice (it was signed off by the auditors for what that's worth) and the FD never pretended that it wasn't happening; it just wasn't very obvious. Fortunately this is all in the past and the reported debt figure of £9.8M is as good as it appears. As a result of this debt reduction the interest cover is on a steady upward trend; this is significant because one of the banking covenants requires a cover in excess of 3 times and if I pessimistically allow for no adjustments to operating profit this limit looks to have been breached (or approached very closely) in the past:

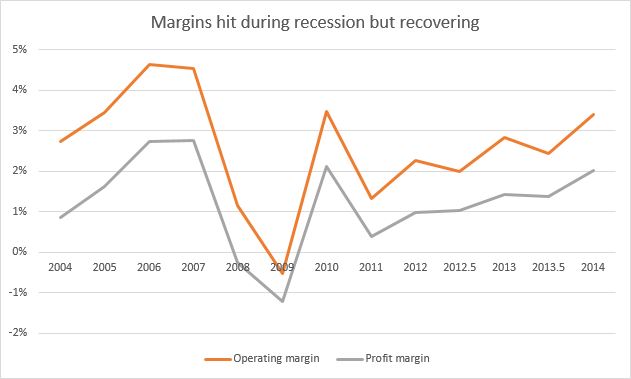

That said this is all, really, a balance sheet issue and primarily important from the perspective of risk management. A strong balance sheet helps any company survive the lean years and Empresaria has demonstrably coped with tough trading environments despite the issues highlighted above. From an operations angle the firm has recovered well from its legal and regulatory problems in Germany and is gaining traction in its efforts to improve margins:

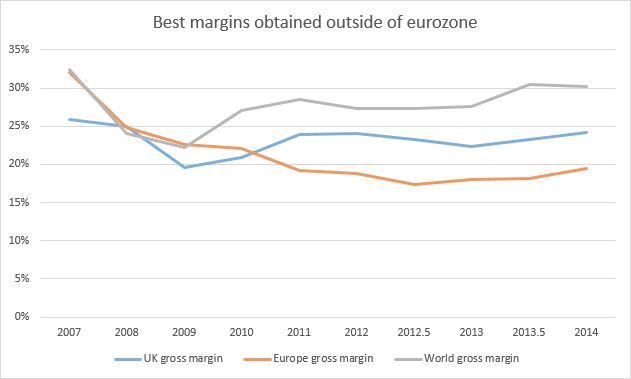

If we consider the regional split, which is UK, Europe and Rest of the World, then the best gross margins are found outside of the Eurozone. The reason for this is that emerging markets are biased towards permanent positions, where a reasonably substantial one-off fee is paid for a successful placement, while UK/Europe feature more temporary positions where the margin is lower (15-16%) but a recurring revenue stream is generated for as long as the position is filled:

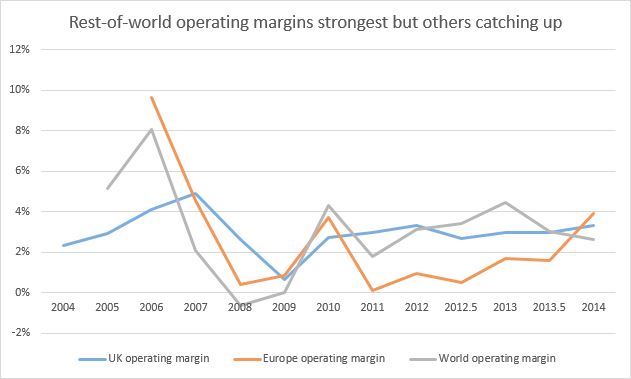

At the operating profit level the margin picture is less clear-cut across the different regions. Since the GFC both the UK and ROTW have enjoyed a similar margin, roughly 3%, while Europe has lagged hugely due to the problems in Germany. Recently though these issues have been resolved, through cost-cutting and reorganisation, and it looks as though all operations globally are becoming profitable at the same level:

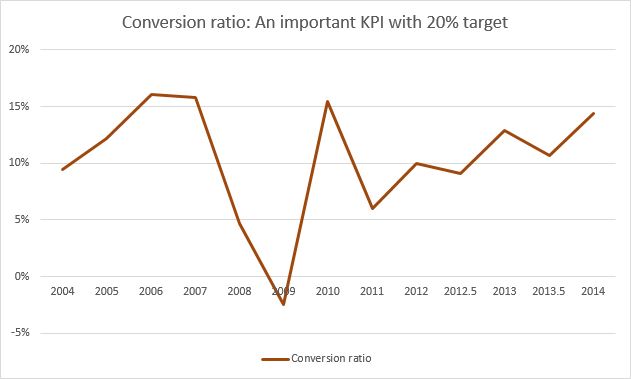

The reason why these margins are important is that a key KPI for Empresaria is something called the conversion ratio. This is a measure of how much of the net fee income (gross profit) gets turned into operating profit; as such it's the inverse of the costs and expenses line and thus a measure of business efficiency. The plan is for this to reach 20% and recent results show a decent trend in the right direction. However the company has never been this efficient so I don't know if they'll hit their target:

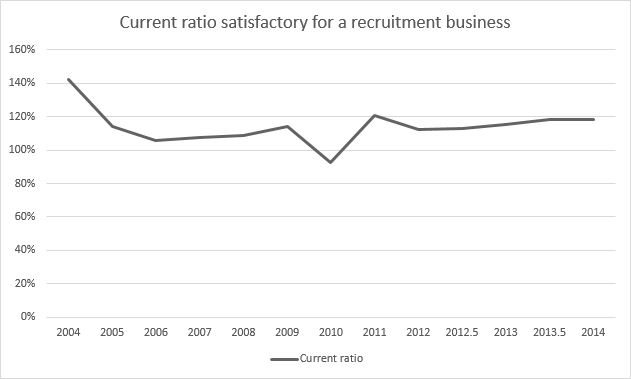

Something that I do find both interesting and reassuring is that the company has managed to keep control of its assets and liabilities throughout both the GFC and its German troubles. This is no mean feat as trading shortfalls, such as those in 2008-12, can often lead to a cash-crunch and liabilities being kicked down the street. Fortunately one saving grace of the recruitment industry is that there's no stock to be maintained, or fed with working capital, and customers naturally pay recruitment fees as they pay their employees. Even so the very stable current ratio history here is impressive:

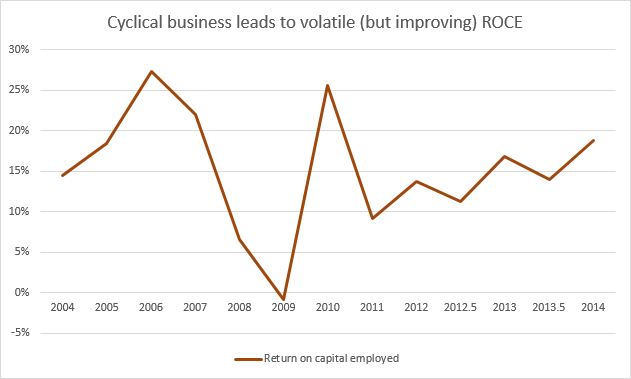

Rather more erratic, as befits a cyclical business like Empresaria is the ROCE track-record. Despite the fact that the capital employed in the business has remained close to £35M since 2007, give or take a few million, the return on this capital has fluctuated violently. While it's clear that the ROCE can hit 20% in the good times, and recent trends suggest a reversion to these levels, the company will never be able to achieve this consistently year after year. For this reason alone it's not surprising that the company is rated so cheaply:

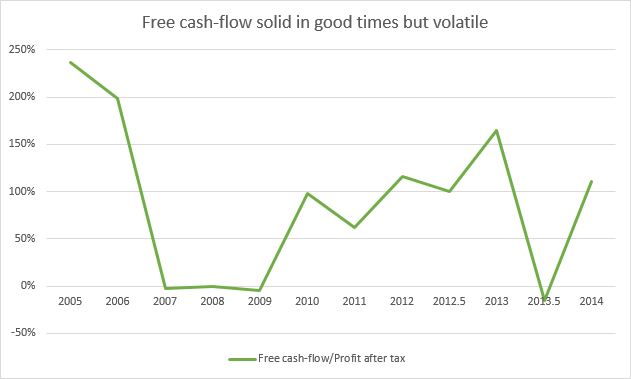

Finally I like to see reported profits being turned into cash; if a company can't do this and support itself then that's a big red flag. Usefully this can be looked at in two ways, which provides some validation: the first way is to check whether the firm is issuing shares or raising debt to cover its outgoings. If neither of these two cash-raising avenues is being utilised, which they aren't here, then it's likely that the company is generating cash internally. The second way is to look at the free cash-flow and compare it to the bottom-line profit; if most of this profit is converting to cash then that's a good sign:

Forecasts and the future

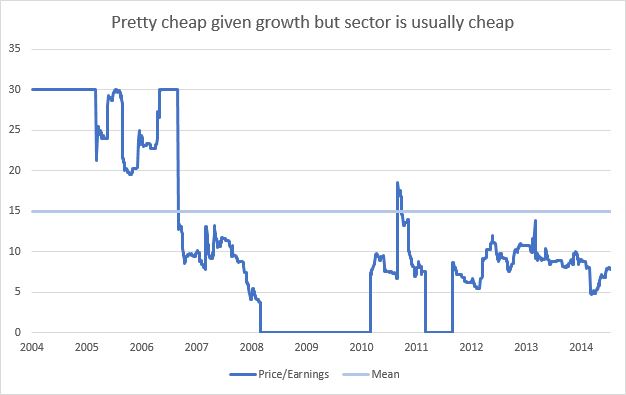

Taking a valuation perspective Empresaria looks pretty cheap compared to both its own record and the valuations being placed against peers such as RTC Group or Networkers International. Both of these are on a P/E of 10 or more while Empresaria languishes at 8 or below. Historically its average P/E is just under 15 but this is distorted by results prior to the GFC. In recent years, since mid-2007, the average has hovered around 8 and this is where we are today:

So growth expectations are low and given that the annual report for 2014 has only recently been published we don't have any updates on trading for 2015 so far beyond a generic outlook statement: The Group has delivered strong growth in profit and earnings per share, and has continued to deliver against the clear growth strategy. The Board is focused on driving further growth to build the business and enhance shareholder value. We see exciting opportunities for growth across our network, particularly from the investments made in 2014, and look forward to the year ahead with confidence.

There is, however, a slight note of caution elsewhere in the narrative of the report: Market conditions have generally been good during the year, particularly in the UK. However we are mindful that our markets continue to be influenced by uncertainty, illustrated by the recent drop in oil price and the impact of the Greek elections on the Euro currency.

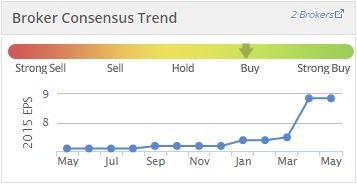

So the AGM statement, that should come out on May 20th, will hopefully be positive and suggestive of continued operational improvement. I don't think that this is too much wishful thinking either as the broker estimates for 2015 have risen from 7.1p a year ago to 8.85p now, a 25% uplift, and the same earnings upgrade pattern occurred last year:

Director and ex-director holdings

I like to see board members maintaining decent, but not controlling, shareholdings in the companies that they manage with these holdings growing by any means other than generous, free-money option packages. Done properly such holdings provide directors with an incentive to align themselves with smaller shareholders and act as a signal that they too are prepared to put hard cash on the line. With Empresaria, however, some directors have taken this alignment to another level!

Tony Martin, the chairman, started out with 1,126,090 shares (5.6% holding) when the company was admitted to AIM and has spent the last decade steadily acquiring shares bit by bit. In the fullness of time he's multiplied his holding by more than 10 times and now commands 12.9M shares (29% of the company). A hefty investment by any measure; if he buys any more he'll be forced to make an offer for the whole company!

By contrast the remaining serving directors have negligible stakes in the business but this doesn't hold true for several former directors. Miles Hunt and Timothy Sheffield both began with even larger holdings (2,637,569 [13.2%] and 2,254,308 [11.3%] shares respectively) and still maintain sizeable positions even now. This suggests to me that these founders continue to see real value in the company and harbour expectations of future growth.

On the other hand the largest institutional shareholder, Caledonia Investments, has been selling into recent strength for the best part of a year now and has dropped from >22% to <3% over this period! Despite this overhang the share price has remained more than robust (up 36% in the last year) which suggests a decent level of demand in the marketplace. What will happen when Caledonia finally leaves the register, if they haven't done so already, no one knows but I see this additional liquidity as broadly positive.

Conclusion

A quality that I like with Empresaria is that they spelt out a strategy in 2004, when moving to AIM, and have stuck with it for the last decade. This suggests to me that the underlying business is sound and that the board, despite changes, have sufficient confidence and focus to turn this strategy into reality. An important element here, I believe, is long-term chairman Tony Martin and his substantial holding in the company; I get the feeling that he's a real guiding hand on the tiller.

I also like the fact that the board lay out a short but sensible Investment Case for the company. This refers explicitly to the original growth strategy (both organic and via investment) and expands on the strengths of their decentralised approach when targeting emerging markets. I find this level of clarity, together with the small set of relevant KPIs, suggestive of a board who know their business inside-out and can communicate this understanding to all stakeholders.

A side-effect of this unusual model, where managers are encouraged to retain minority shareholdings in acquired companies, is that the group can buy out these minority interests (and does so). Doing so leads to an immediate boost in group earnings (rather like a share buy-back) with earnings split across fewer shares, but with a more direct effect. The only downside is that such action diverts free cash away from debt reduction and, presumably, removes the principal incentive for managers in these minority businesses. Still it's another way in which the board act like investment managers.

Reasons not to invest

- Lack of top-line growth may persist and eventually fall through to bottom-line

- Potential for new staffing legislation such as that enacted in Germany

- Permanent staffing higher-margin business more volatile during economic slowdowns

- Continuing net debt position even after recent reduction

- Weak balance sheet with negative tangible assets due to multiple acquisitions

- Low, static yield for many years means that shareholders aren't being rewarded

Reasons to invest

- Concentration on higher-margin business has driven profit growth

- Clear focus on costs in the tough times bodes well for the future

- Consistent corporate strategy maintained since day one

- Chairman has gradually built holding to 29% while former directors remain large holders

- Net debt has fallen to acceptable level and non-recourse debt is no longer hidden

- Stable board and directors who understand the recruitment business

- External (GFC & German) problems are now in the past and business is poised for growth

- Financial reports are clear and include much detail that isn't mandatory

- Stockopedia rank of 100; it doesn't get better than this!

I suppose that my real fear with Empresaria is that it'll turn into remain a bit of a value trap - but without the generous dividends that you usually receive. Critically speaking the company hasn't done much for shareholders since listing and a quick glance at the price history suggests that buying into any strength has been a frustrating experience. So is this one of those eternally cheap companies that never quite manage to scale up? It's certainly received its fair share of positive write-ups from Stock Tips, Money Week and Wheelie Dealer; could this be just another bulletin-board favourite?

On the whole I don't think so but I do feel that the group has been dragged down by both external (GFC/Germany) and internal (debt) factors throughout most of its listed history. Only now do all of these appear to be heading in the right direction with the company in a position to benefit as a leaner, sharper operation all round. This can be seen from the recent H2 bias to results with the second-halves of 2013 and 2014 both stronger (almost double the earnings) than the first-halves with much of this down to an improved conversion ratio i.e. H1 2014 had ratio of 10.6% but this changed to 17.8% in H2 (14.3% for year as a whole). So since 2012 the business has been evolving to be more efficient and that's an excellent trend which should hopefully continue.

If Empresaria can just find a bit of headline growth in one of their geographic areas (ROTW would be best given its higher margins) then I can see this falling straight to the bottom line and transforming profits. At the same time if the currency depreciation headwind diminishes, which it should as the global economy stabilises, then the benefits of recent reorganisation and acquisitions will also come through more robustly. So that's the investment thesis in my mind: the company hasn't been in such a good place, both operationally and financially, for a very long time and yet the share price is the same as it was ten years ago. Something has to give!

Disclosure: the author holds shares in this company