Introduction

I last looked at Empresaria back in May and in my report concluded that the company turn-around was proceeding very agreeably. At the time my key concerns revolved around the lack of top-line growth, remaining debt load and lack of reward for key shareholders. So with the half-year results recently released now seems like a good time to review progress on these fronts and check if management are following their expressed strategy.

Results and statements

The problem with company results (apart from quarterly reporting companies) is that they provide a snapshot of affairs only twice a year. This is why trading statements are so important; they're a chance to gauge intermediate progress and how bullish management are about the business. Now Empresaria isn't a prolific reporter but they do put out trading updates twice a year and the AGM Statement from May is worth reading - principally because it's positive and projects reasonable confidence:

The Group has made a good start to the year, delivering like for like growth against this period in 2014. Each of our three regions, the UK, Continental Europe and Rest of the World are profitable and growing and the investments made in 2014 are performing well, in line with our expectations.

Four months later the half-year results are similarly positive but with the added twist of business running ahead of expectations:

Based on performance to date, we are confident that results for the full year will be ahead of current market expectations and look forward to delivering further growth. Despite increasing currency headwinds, market conditions are generally favourable and we see further opportunities to grow our business over the coming years.

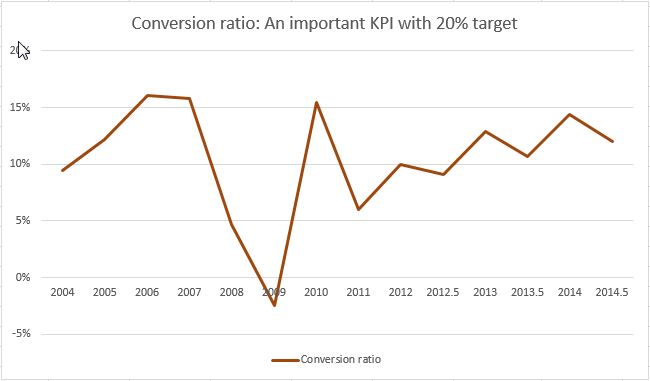

So it all sounds pretty progressive and that's why the share price jumped by around 16% on publication day, to 82.5p, and has maintained this level since. The headline numbers themselves are strong with profits up by a third (44% in constant currency), net debt stable at under £10m and a conversion ratio of 12%. The latter number (operating profit divided by net fee income) is a KPI and its trend in recent years is just one reason why I think that the company has further to go:

Management set an explicit target of 20% for this ratio and since 2011 it has steadily climbed, with clear seasonality, towards both this level and the previous high-water mark of 16% (but without the volatility seen a decade ago). Even better each half-year has seen an improvement over the comparable result for a year before as higher-margin business is retained while lower-margin operations (such as in the Czech Republic and Slovakia) are getting shut down.

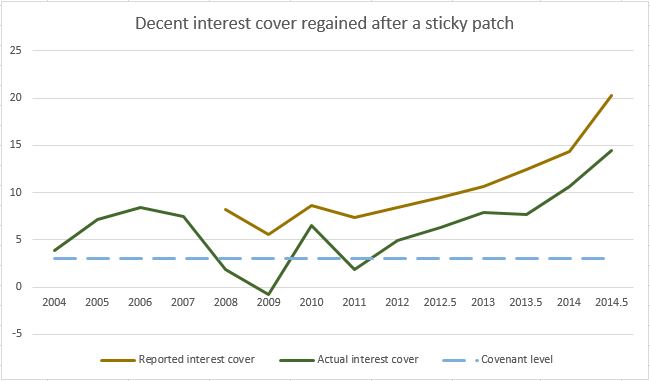

On the debt front these results see Empresaria consolidating previous gains with net debt of £9.9m being essentially unchanged from the full-year. This is actually a more impressive outcome than it appears as £2.8m was sucked into funding working capital, £0.5m cleared the final liability for social-security costs in Germany and £0.3m went on purchasing minority shares in PT Monroe. So keeping the debt liability stable is a decent outcome and improved profits mean that interest cover is far removed from breaching any covenant:

An aspect of Empresaria that hasn't changed is that top-line growth remains elusive although now, at least, the board are somewhat more explicit about why this should be so:

The Group has delivered strong results for the first half of the year having continued to deliver on its stated strategy: strengthening a multi-branded Group with a focus on developing leading brands that are diversified and balanced by geography and sector. We continue to improve the quality of the Group's revenue, which although not showing overall growth at present will continue to drive improvements in profitability.

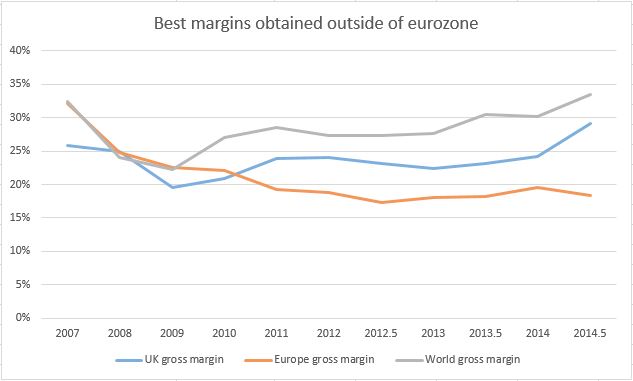

So it's all about quality of revenue, rather than volume, for the time being and that's consistent with the message put out since Joost Kreulen (CEO) came on board. What we would expect then is for margins to be on the rise (which is self-evident since profits can only increase if either the turnover or the margin does the same) and that's certainly true for the gross margin:

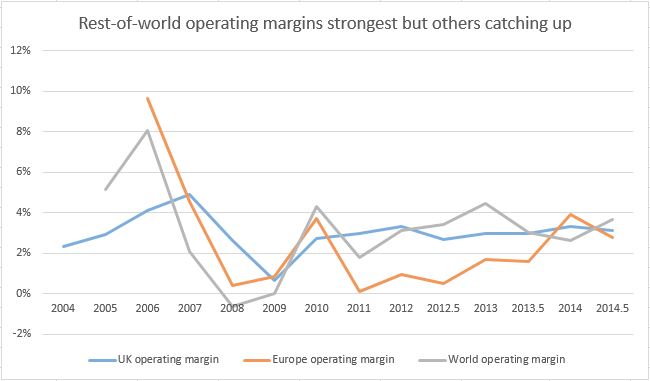

With operating margin the trend remains positive due to improvements in all geographic regions compared to the interim results in 2014 but with a bit of a fall compared to the full-year; particularly in Europe. The reason for this is that management are investing in people with the staff headcount jumping by 17% to 1,056 employees with the bulk of this change taking place in India. This is clearly an expression of confidence and I can see margins improving by the end of the year:

Conclusion

A recent research report from Hardman & Co. concludes that Empresaria are cheap compared to their peers and that the valuation gap should close as delivery of the strategy continues. This certainly makes sense to me when the current-year EPS forecast of 9p puts the company on a forward P/E of 8.8 (and this with the forecasts having barely changed since Joost said that they would beat market expectations). There are cheaper companies, such as St. Ives, in the Professional & Commercial Services sector but there aren't many and they tend to have issues.

Having seen Joost and Spencer Wreford (FD) present at a recent Sharesoc Growth Seminar in London I have to admit that I believe the company to be in safe hands. Joost is proving to be a capable manager of operations (if not a scintillating presenter) while Spencer is both dynamic and unflagging in his desire to reduce debt and simplify the finances of the group. Hence the news that all group businesses with significant temporary sales now have local bank facilities in place and central bank covenants are being relaxed.

In addition Spencer gave some guidance on where he expects the net debt level to settle and how this is largely driven by invoice financing requirements (which are a function of the level of temporary staffing business). At the end of June the ratio of net debt to debtors was 32% and Spencer would like to see this reduce further to a sustainable 25% - which implies net debt of £7.8m. Given the level of cash generation seen in recent years I expect this target to be met in short order.

The only remaining area of uncertainty, which I think that the board could explain with improved clarity, is whether the company is focusing on temporary or permanent staffing. On one hand Empresaria has a stated goal of increasing their exposure to temporary recruitment because this is less subject to the vagaries of the economy; yet on the other hand it's permanent recruitment which is on the rise because that's how most markets outside of Europe and the States operate (and the margins are better). As I understand it this is an intermediate stage as the company strips out low-quality custom but I'd like management to spend some time spelling out the dynamics of this interplay.

Beyond this though I feel that the pros and cons of investing in this firm remain the same as they were six months ago but with the added comfort of knowing that operations are heading in the right direction. There remains upwards pressure on the share price, I believe, and continued operational improvements plus a slackening in the currency depreciation headwind are likely to bode well for further share price appreciation.

Disclosure: the author holds shares in this company