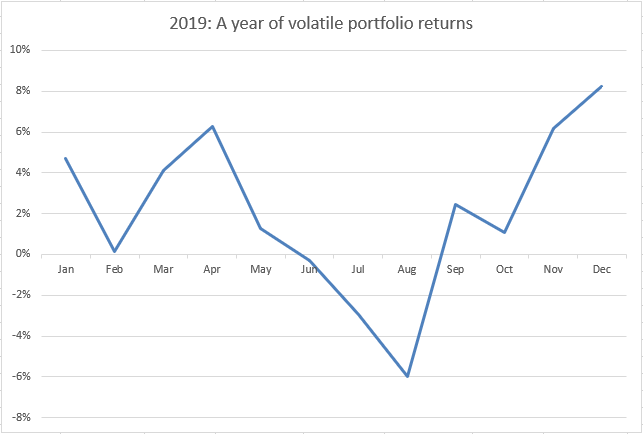

Another year over and a new one just begun. If 2020 ends up anything like 2019 then I'll be very happy as the year ended with a bang despite the stomach-churning ride. Looking back over the year it's striking just how deeply unpleasant it was to be invested over the summer. In fact if I had sold in May and returned on St. Leger's Day I'd have been right on the money. If only investing was that easy.

For December what's happily clear is that I achieved an almost clean sweep of winners with only Burford Capital being the laggard. Story of the year really and their yawning lack of news-flow isn't helping much. On the winning side it's hard to pick out any particular companies although Ramsdens has powered ahead after putting out decent results. Instead I put this punchy performance down to a sense of relief after the election combined with the knowledge that, for better or worse, the Brexit deadlock has been broken. In other words this performance isn't down to my superior stock picking skills so much as the result of a rising tide making every investor's Christmas a little brighter.

Anyway the scores on the doors were:

Risers: RFX 24%, VLX 19%, BOWL 19%, SDI 16%, PCA 15%, FRAN 13%, SBIZ 12%, SPSY 12%, GRG 10%, AFX 9%, IGR 8%, JDG 8%, QTX 7%, KETL 7%, GAW 7%, GAMA 6%, FDM 6%, HYNS 6%, HAT 4%, NRR 3%, III 3%, CRW 2%, SCT 2%

Fallers: PPH -2%, BUR -14%

All of these positive returns created an excellent rise of 8.2%, pushing the YTD remarkably up to 23.4%, which I'm very chuffed about. As a result of my sales early in the month my cash level is up at 15% which is just fine with a new year in the wings. In retrospect selling into the election (as noted below) wasn't my best idea of the year but my new holdings have got off to a good start and it's easier keeping track of a smaller portfolio. The only thing that remains is to wish everyone a very Happy New Year and much great success in 2020.

Purchases

Strix Group Bought at 181p - December 19

This top-up to my initial position in Strix is a bit of an experiment in breakout trading. The backdrop to this is that the share price has been in a rising channel all year with this trend taking it from 130p to 150p. During that time the price has made several attempts (in April, August and October) to break through resistance set at 180p in 2018. Until now every exertion has failed although, at least, each peak has been followed by a higher low. In other words there are buyers out there looking to take advantage of any fall-back. So when the price motored past 185p last week, at some speed, I decided to play my hand when it retreated to just above the resistance level - in the hope that this is about to become a support level. If this doesn't happen then I've got a stop in place to cap my downside exposure but I'll be quite surprised if it retraces so far. From a fundamental perspective Strix still passes my quality and value screens, and retains a very high StockRank of 94, so it's a solid purchase on that score as well.

Computacenter Bought at 1619p - December 19

I have a bit of history with Computacenter in that I originally bought into the company in 2017 on the basis of their high ROCE and sequence of 'exceed expectations' trading statements. Excellent reasons which are still the basis of my trading actions today. However I then sold out in late 2018, on the back of a poorly received trading statement, and the price continued to fall until January. After this it rebounded and I looked again at CCC in March, when their FY results came out. These were ok but forecast growth was low so I decided to maintain a watching brief. Again a reasonable decision. However I then entirely overlooked their strong Q1 update in April when the price jumped on decent volume. Since that point the news-flow has been positive (which didn't stop rather a lot of share price volatility) with this culminating in an unexpected mid-December announcement. Following a review of performance it appears that the group is well ahead of expectations (which already pointed towards 20% growth in profits). Notably the businesses acquired in the US have turned around so the group as a whole is firing on all cylinders. With this backdrop, and the price looking to take out the all-time high of 1632p achieved in 2018, I figured that I should forget what might have been (had I held) and pulled the trigger on CCC once again.

Driver Group Bought at 66.5p - December 19

OK this is a bit of a punt and no doubt about it. And, no, this isn't the result of a bit too much punch at the Christmas party. Instead a tweet by Simon Hedger alerted me to the fact that Traction AB (a hedge fund) have taken a large position in the company. The big attraction is that this is a pattern that they've followed before, such as with Waterman, with the result being a later sale at some premium. So for a bit of excitement I've taken a starter position in anticipation of some action in the New Year despite having an aversion to low-margin contractors. That said the company is on an improving trend, after 5 poor years, with profits up 26% in 2019 and forecast to rise 12% in 2020. With net cash on the balance sheet and an undemanding P/E of 12 (although I appreciate that cyclical contractors should never attract a high earnings multiple) I don't see this as a hugely risky trade. On this front it's worth reading the recently announced FY results. It's clear that this is a business with limited visibility of contracts or control over whether or not they proceed. At the same time they have significantly reduced their cost base, offer expertise in a very specific niche and seem proactive when handling the ebbs and flows in different regions. This is unlikely to be a long-term holding but I'll be watching future progress with interest.

Medica Group Bought at 160p - December 19

This is a company that I know reasonably well, having written about it earlier in the year. At the time I was pretty impressed by the way that the company was performing but wanted to see how the year progressed (particularly with the CEO moving on). As it turns out the price has been range bound for most of the year with a couple of unsuccessful attempts to break through resistance at 160p. At the same time the CEO transition has been handled well and the company has sensibly been looking to use radiographers abroad and determine whether AI is a threat or an opportunity. On both of these subjects I found the recent results conference call to be quite reassuring - even in the area of gently falling gross margin as customers move to a framework contract. From a quantitative perspective the StockRank has been rising all year up to a comfortable 86 at the present day. This re-rating ties in with Medica passing a number of my quality/momentum screens with almost flying colours and this is very much a buy signal. The other piece of the puzzle is that just a few days ago the price broke through 160p, on reasonable volume, and managed to sustain this rise over the following week. This suggests that quite a few other investors have also been waiting to make a move with Medica and that the recent Conservative election victory has acted as a catalyst in that private enterprise in the NHS is unlikely to be rolled back. The next news should be a pre-close trading update in January and I don't expect too many surprises given the solid HY results in September.

GAN Bought at 159p - December 19

Another situation a little like Driver Group is this loss-making, speculative supplier to the online gaming market. For at least 5 years the company has been losing money, despite increasing revenues, as it has attempted to build its customer base of casino operators and online gaming providers. Ordinarily I shy away from pre-profit situations but there are a few reasons for believing that a maiden FY profit is imminent (beyond analysts forecasting 4p of EPS for 2020). One of these is that the HY results in September saw a 145% increase in sales translating into £3m EBITDA and £0.7m PAT (equivalent to 1p of earnings). Since that point GAN has continued to ride the wave of legalisation in the US with additional states opening up to sports betting. Now the process of states allowing such betting is both a pro and a con for GAN in that there should be a steady stream of new markets becoming available in the future but GAN have no control over when or where this will happen next. Still Pennsylvania and New Jersey are growing well right now with Indiana and Michigan the next states to become open (allowing 21% of Americans to legally gamble online). It makes sense then that the directors are pursuing an additional US listing since that's where the future lies for GAN and this will improve their visibility with clients. From a technical perspective the price hit 160p in November, on high volume, and has consolidated since then. With it once again breaking this resistance level I decided to take out a small position today on the view that all the signs are positive for GAN.

Things I thought about buying (but didn't)

None.

Sales

dotDigital Sold at 91p - December 19 - 2.0% gain

Michelmersh Brick Holdings Sold at 106p - December 19 - 0.5% gain

Robert Walters Sold at 523p - December 19 - 10.9% loss

Keywords Studios Sold at 1344p - December 19 - 11.7% loss

Henry Boot Sold at 272p - December 19 - 16.7% loss

Adept Technology Sold at 320p - December 19 - 16.9% loss

K3 Capital Sold at 175p - December 19 - 18.3% loss

When you read this article we will, assuming no nationwide vote-rigging fiasco, know the result of the General Election. Right now though this knowledge lies in the future and I'm lacking the foresight to predict what is going to happen with the stock-market. As a result I've decided to purchase some insurance by liquidating my most disappointing holdings. The result of this action is to cut a substantial number of losing positions, which is a good discipline in my view, while simultaneously taking me close to a 20% cash position. That feels like enough of a comfort blanket. A point to note is that I don't particularly have a negative view about any of these companies, apart from them being a disappointment in the short-term, but I just feel more positive about my remaining holdings. I know that I could have obtained some insurance another way, perhaps by shorting the FTSE, but I don't have any experience doing this and it doesn't feel like an area that I should rush into without careful thought! Another benefit of this cull is that this takes me down to 26 holdings which means that I've got 4 slots to fill when the time feels right.

Things I thought about selling (but didn't)

None.

Announcements

Ramsdens Holdings

For a company on a PE ratio of ~10 I'd say that a full-year forecast for 21% growth in earnings (with these estimates rising over the last year) suggests that investors are behind the curve with Ramsdens. Add on a ROCE ~20%, net cash on the balance sheet and a yield of 3.3% to this mis-pricing and you've got a solid investment opportunity. Coming onto these interim results we have sales up 30% to £32.5m and EPS up 22% to 15.9p with analysts expecting just 20.5p of earnings for the year as a whole. OK there's no point getting carried away here because H1 is always much stronger than H2, due to foreign exchange earnings being a large chunk of revenue, but last year Ramsdens earned 3.6p in the second-half and they only need to bring in 4.6p this year to hit the forecasts. Much depends on how jewellery retail performs over the Christmas period but since listing the board have shown themselves to be excellent custodians of our capital and capable of balancing their four core income streams. I know that some people are concerned that companies like Revolut will eat Ramsdens' lunch when it comes to FX but the group have serviced 12% more customers, year-on-year, and boosted income by 15% on 8% higher currency volume so they must be doing something right. My view is that with an average transaction size of £600 customers prefer the convenience and customer service of Ramsdens over chasing a slightly better exchange rate. This is their moat. Combine this with real expertise in pawnbroking, jewellery and precious metals and you have a resilient business that meets the needs of their community. (Results)

Haynes Publishing

This is a winning pre-close update with profit before tax expected to be up by ~37%. Impressively this all comes from organic growth with previous investment in product innovation, content integration and growing data coverage really starting to pay off. It's a shame that the company is up for sale as it's still only priced on a P/E of ~18 despite the share price doubling in the last quarter. Let's just hope that the board don't roll over and accept the very first offer that comes across their desk. (Update)

Hollywood Bowl

These are some excellent FY results with sales up 7.8% (or 5.5% like-for-like) with this leading to an excellent 19% rise in EPS to 14.86p (forecasts were for 12-13%). With debt a negligible £2m the cash-flow from these earnings is allowing BOWL to offer a 4.5p special dividend alongside its 5.16p final dividend. Welcome news indeed with this extending the special dividend trend from 2017 and 2018. Notably this growth isn't driven by acquisitions or, primarily, by the opening of new centres; only two were opened in the year and this pace looks set to continue over the next three years. Instead management like to sweat their assets with incremental improvements such as targeted refurbishments, new technology (such as 'pins with strings') and their new mini-golf concept 'Puttstars'. I rather like this measured approach that works with what they have, rather than going for maximum growth, since it seems to value longevity over impressing investment bankers. On a similar note the board have reviewed the useful life of their mechanical pinspotters and have determined that their economic life is shorter than expected - leading to a higher depreciation charge which has reduced profits. Another example of long-term thinking since they shouldn't have to take a write-off when the machines are retired. Looking forward analysts reckon that earnings growth will be 5-6% over the next two years. However the consensus EPS figure for 2020 is only 14.9p, which the company has just about managed this year, so these forecasts need to be upgraded to be of use. So while the share looks fully priced on a P/E of 17-18 I reckon that updated forecasts will bring this down to the mid-teens which is very reasonable for such a well managed business. (Results)

SDI Group

Looking at the forecasts for SDI it's clear that analysts have high expectations with them seeing EPS rising 50% to 4.3p on the back of sales rising 30-40%. At the current price of 75p you're getting all of this growth for a P/E of ~20 which could look like a bargain if everything goes to plan. Still these interim results need to be good, to match this enthusiasm, and they mostly deliver. At the top-line sales are up 42% with this splitting into 6.4% organic and 35.8% acquisition growth. At the bottom-line adjusted EPS increases a lower 28% and acquisition/fund-raising costs have been excluded, along with more acceptable items, to reach this figure. The difference isn't particularly material though as intangible amortisation and share payments make up 88% of the adjustment. Operationally I find it reassuring that the board chose not to complete any new purchases within the period - instead focusing on integrating new and existing companies. This suggests that they're not pursuing growth for its own sake (which I didn't believe anyway) and that there are cross-company benefits available to them. An example of this is the relocation of Fistreem to the Synoptics site in Cambridge which gets rid of one site and fully utilises the joint site. Similarly Atik Cameras in Lisbon is moving to a new site, with scope to more than double manufacturing output. This rather suggests that Atik is trading very robustly. Decent results then with all segments of the group performing well and a likely uplift from acquisitions in H2. (Results)

Disclaimer: the author holds, or used to hold, all of the shares discussed here