I first looked at RWS just over a year ago after hearing it mentioned at a Mello investor event. On first glance the numbers looked positive and the excellent track-record of the company from listing in 2003 impressed me. That said it wasn't clear that economic conditions were conducive to this performance continuing; specifically my concerns were:

- Well publicised European legislation, the Unitary Patent, focused squarely on RWS Group's core market

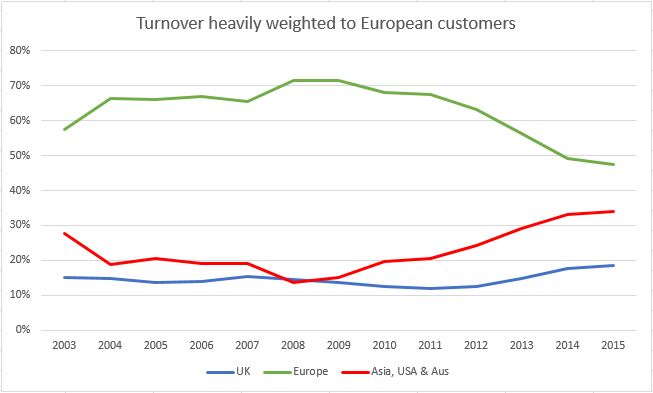

- A lack of geographic diversification left the company exposed to Euro weakness and general malaise in the Eurozone

- A recent acquisition, Inovia, seemed to be struggling to grow and was only profitable at a low margin

- General downward pressures on margins from customers and a falling return on the capital employed

In light of these challenges I decided that the share was likely to tread water for a while until the future trends became clearer; an outlook that was echoed by moderately gloomy trading updates in the first half of the year. As it turns out this is how events played out right up until October when a very positive trading statement emerged and the share price leapt to a new all-time high!

Now, after seeing Andy Brode from RWS Group at a recent ShareSoc event, I've decided to take a fresh look at the company to see whether my previous concerns remain an issue and if it's not to late to take a position in the company.

Concerns and changes

The number one threat to RWS Group's business model is rationalisation of the patent system in Europe since this accounts for both the firm's largest market and division. So it's useful to hear that the earliest implementation is likely to be in 2017 and that there is little appetite amongst high-end clients for an unproven process: Our research indicates that there is currently only marginal interest amongst large corporates and their professional advisers in full adoption of the new system. That being the case, we anticipate minimal incremental loss of revenues in the first few years after the introduction of the Unitary Patent.

Still it's a long-term risk and the board are clearly working hard on markets beyond European shores and have had recent success winning new clients in China and Japan. At the same time the recent acquisition of U.S. business Corporate Translations Inc delivers both a new geography and enhances a valuable, non-patent related sector. On the acquisition front Inovia has finally been integrated into the group and I imagine that this is a relief for management: With effect from 1 October 2015, the Group completed the integration of the Inovia patent filing business into its patent translation business. This integration both reflects customer feedback and was a logical step in order to simplify the Group's sales and product offering, such that all sales team members now sell the full portfolio of the Group's products and services.

Finally headwinds such as the weak Eurozone economy, subdued client research activity and exchange rate fluctuations are outside the control of management but the impact of these factors can be mitigated. So it's reassuring to read that the board try to employ natural hedging where possible and that no one customer accounts for more than 7% of sales; both are sensible ways to limit risk and now I want to examine the full-year results to gauge how successful management have been in practice.

How the numbers look

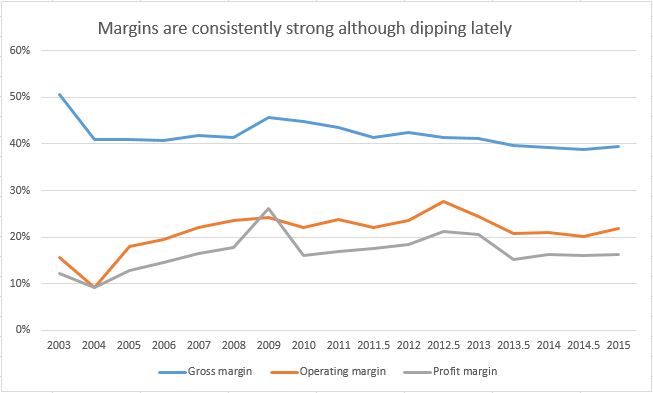

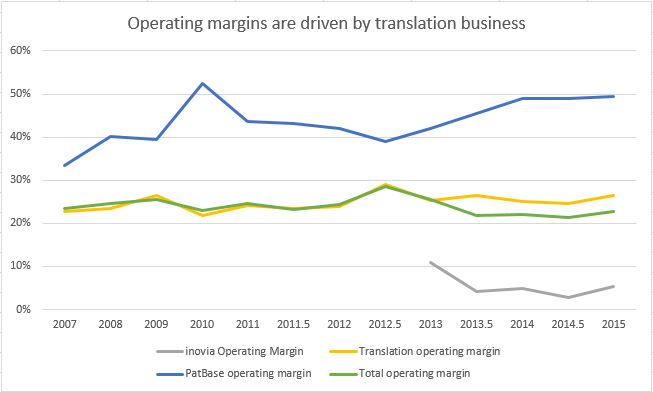

The first half of last year was clearly tough for RWS Group, both in isolation and against decent comparative figures from 2014, but margins bounced back in the second half and remained at a level consistent with the previous decade:

There's no doubt that this stability in earnings is a key driver for certain institutional investors taking decent positions in RWS Group despite its very high P/E ratio of around 28 (falling to a slightly more palatable 20 if 2016 forecasts of 10.1p in earnings are met). Everyone likes reliable earnings and the more this trend continues, through varying economic cycles, then the more people like it.

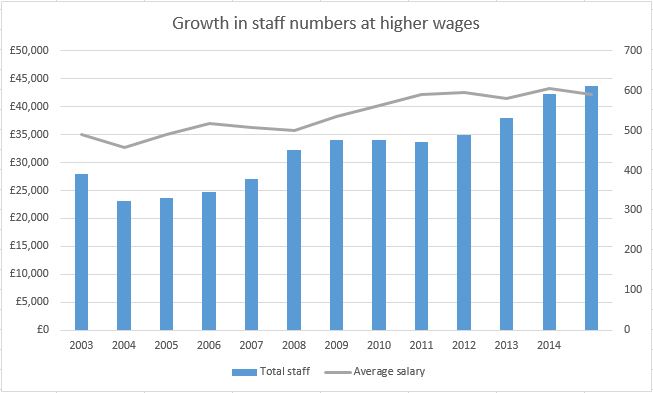

An interesting aspect of these strong margins is that RWS Group hasn't had to cut costs in order to hit their targets (although I'm sure that they maintain solid cost control); quite the reverse in fact. The business has grown every year since flotation and right alongside this staff numbers have increased although only at a measured CAGR of 3.8%. This compares very favourably to the net profit CAGR of 20.1% and I don't have a problem with these more profitable/efficient employees taking home a fatter wage packet:

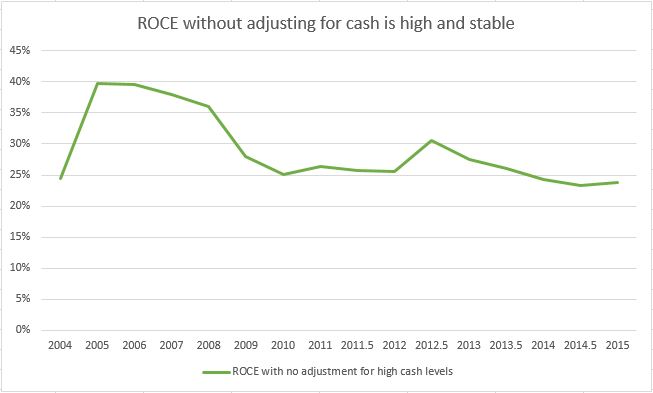

One area where the trend isn't quite so convincing, although the underlying numbers are still very good, is with the ROCE (Return on Capital Employed). The current value of around 25% is high but a decade ago RWS achieved a whole 10% more and that's a huge difference in the quality of earnings:

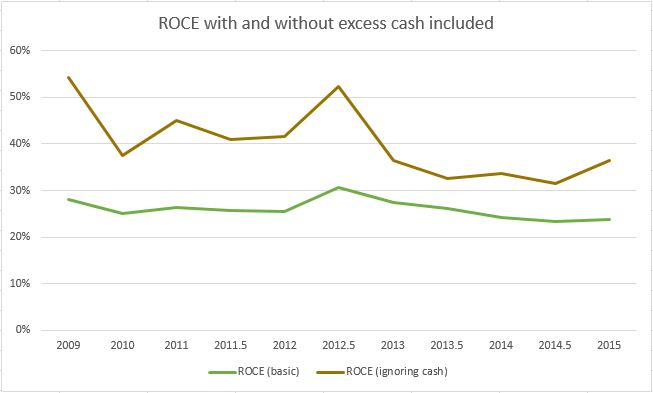

One problem with ROCE is that it becomes distorted when companies hold a lot of excess cash on their balance sheet since this is capital that doesn't generate much of a return (nowadays anyway). It's possible to strip out the cash (and any interest earned on deposit) to get a view on the underlying return being generated but with RWS Group this doesn't make much of a difference to my conclusion - which is that bumper returns were generated about a decade ago as profits grew faster than assets:

However during the last 5 or 6 years profits and assets have increased by almost the same CAGR of 19% even though RWS Group spent £12m buying its office freehold in 2010 and has since taken on intangible assets through acquisition. So I'm inclined to view the current ROCE of 25% as an appropriate baseline for RWS Group and in very broad terms this puts it in the top 100 of all UK shares of reasonable size (>£50M) when considering average ROCE over the last 5 years.

An area where RWS Group encountered a headwind last year was with exchange rates and the fact that they hedged their Euro exposure at a level which cost them money; hardly a desirable state of affairs. This is why, partially, the board have a two-pronged strategy for expanding away from Europe where half of their turnover originates. Firstly they are focusing attention on winning business in Japan (a tough nut to crack) and opening up the patent translation market in China. With traction being gained in both places the impact is apparent:

Secondly the board are looking at expansion in America and for obvious reasons half of their translation business (the part that translates from a source language to English) makes no sense here - which just leaves the other half that covers English to any target language. So it's been hard to get off the ground and this is why the recent acquisition of Corporate Translations Inc makes real sense; it's a very complementary business with blue-chip clients and reasonable potential for cross-selling. Even better the new business is growing and is expected to be immediately and significantly earnings enhancing.

My final thoughts on the reported numbers are that margins for the separate business lines are really quite disparate. PatBase is an absolute cash-cow which generates excellent profits and it's a shame that the company only owns half of the business; they'd certainly like to buy the whole thing from Minesoft Ltd! At the opposite end of the spectrum Inovia generates about a half of PatBase's profit on 4x the turnover and hasn't been a great purchase so far; hopefully it's funnelling a lot of translation business towards RWS Group because it's low quality in its own right:

That said the board recognise that they haven't managed the Inovia integration professionally and this is why the divisional CEO has stepped down and Inovia is now entirely subsumed into the corporate body of RWS Group. As the chairman, Andrew Brode, mentioned they were too hands-off with this acquisition and didn't structure the deal very effectively; mistakes which they don't plan to repeat with Corporate Translations Inc. So it's quite likely that Inovia will start to generate a better return from now on (although this division will no longer be reported separately so we'll never know for sure).

Conclusion

I remain convinced that RWS Group is a quality outfit and I believe that their operational performance over the last year, in a difficult market, backs this up. Unfortunately it is also a highly-rated company, now more than ever, with a large chunk of future performance baked into the price. Expectations are high for a step-change in profits and their 2016 broker forecast requires a 38% jump in profits; heady stuff and almost worth the current P/E around 28.

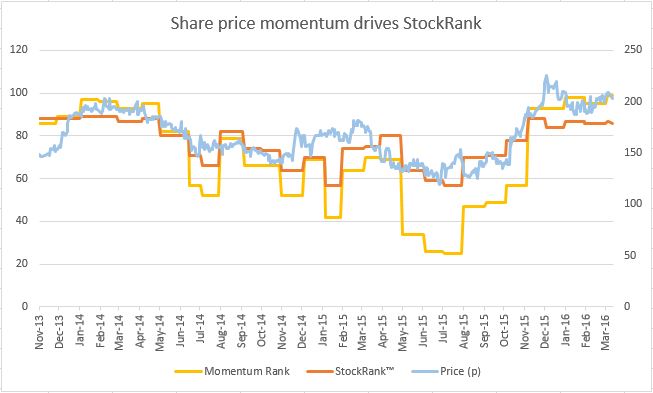

The odd thing is that I also believe that RWS Group have a fighting chance of producing a profit surprise this year given the strength of their recent acquisition and the current tailwind of a weak Euro. So I can almost convince myself that RWS Group is worth buying even at the £2 level; the problem is that from a Stock Rank perspective this is a momentum share all the way and share-price momentum is not a leading indicator of performance. So ranking signals with RWS Group do not help you get into the share before it's taken off - they just confirm that the trend is holding:

In fact recent momentum in the share price, from last October it's up by 50%, probably explains the fairly muted reaction to an excellent AGM statement in early February. Even so it's hard to believe that two-months later an investor can buy in at almost the same price after an update like this: The Group has performed significantly ahead of the Board's expectations during the first three months of the current financial year. This has reflected an excellent quarter for the fully integrated patent translation and filing division, including inovia and a strong two months' contribution from CTi. Maybe this is all in the price already and everyone is waiting for the half-year trading statement due in a couple of weeks?

Disclaimer: The author does not hold shares in this company.