There are some brands that are ubiquitous; cleaning companies perhaps or white-label bakeries. They're everywhere and yet no one notices them. Photo-Me International is just such a company with its 27,600 photo-booths sited worldwide together with those children's rides you see in shopping malls and a number of fully automated laundromats.

All in all the company operates more than 47,300 vending locations in 18 countries (primarily the UK, France and Japan) and is the world's leading operator of photo-booths; although that's something of a poisoned chalice given the meteoric ascent of digital photography since the turn of the century. This, I think, is just one of the reasons why the shares have lagged since 2000 despite having been fully listed since 1962 and presumably profitable over most of this half-century.

That said this article from 2000 suggests that the company managed to create its own problems too with accounting irregularities leading to a shock profit warning at the time. Then, in 2007, another profit warning arrived courtesy of a deal going sour and the board being in disarray; issues which led to a hefty fine from the FSA. Looking back it seems that this was just the latest in a sequence of problems for the company.

So with all of that in mind what's the attraction here? I must admit that I'm starting to wonder with the latest misstep being reported in June 2016 with the Japanese roll-out of identity cards failing to be as smooth as expected. Nevertheless this is a business that dominates its niche, generates excellent cash-flow and directs this to develop new markets (as well as pay shareholders a decent dividend). The current management appear to be making sensible decisions and the CEO, Serge Crasnianski, has a lot to lose by virtue of owning over 20% of the company.

How do the numbers look?

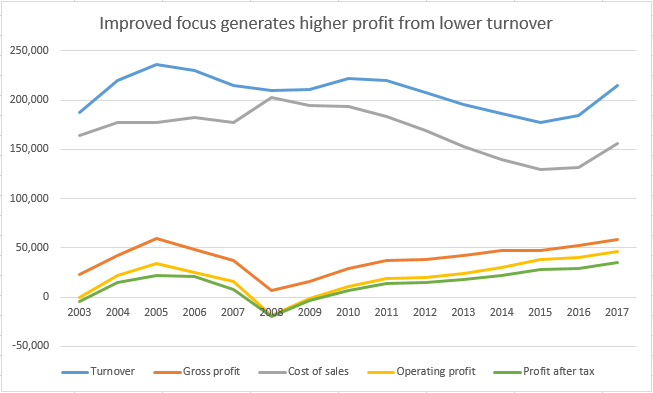

The key question that I want to answer is whether Photo-Me is a value trap. Qualitatively I know that it's operating in a challenging, if not actively shrinking, market and that new sources of revenue are needed; however I wonder if a quantitative analysis backs up this assessment? Much like Empresaria, another recent holding of mine, turnover has gone nowhere for years and is only now rebounding from a recent decline:

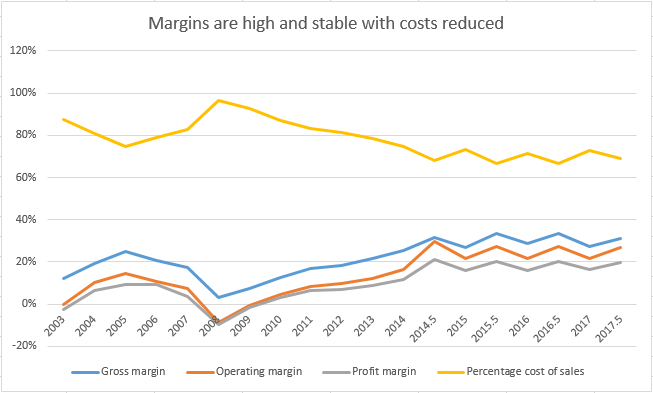

Still profits have very steadily rebounded from the 2008 debacle and, with a CAGR of 7% over the last 13 years, are over 50% higher than they were a decade ago. This improvement is reflected in the way in which margins at all points have improved towards a level more representative of a healthy business while the cost of generating these profits has been slowly whittled away:

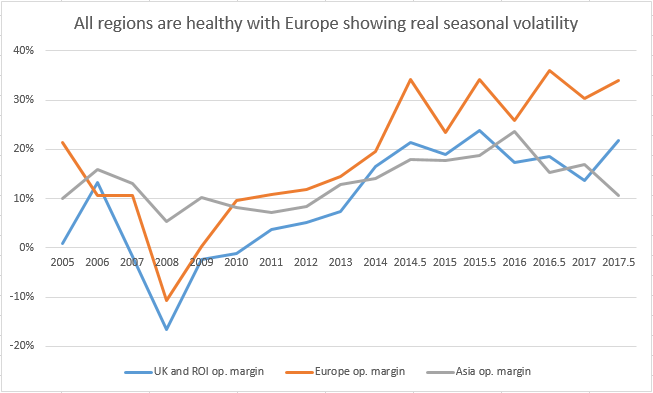

Something that I notice in this graph is just how much of a first-half bias there is to the results - this is why there are peaks at the half-year mark where I've included the interim results for comparison. Roughly 60-70% of the annual profits are generated in this happy period and the margin on this business is much higher, at around 20%, than the full-year margin of 16%. Actually staying with the issue of margins it's remarkable just how much better these are in Europe as compared to either the UK/ROI or Asia:

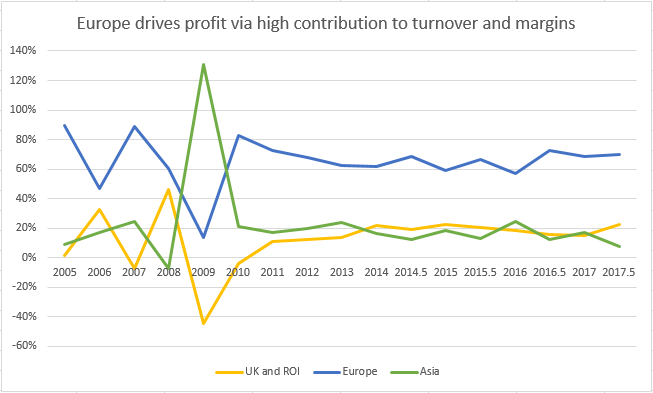

Clearly the Photo-Me business is just much more profitable in Europe (perhaps it's the laundrettes?) but that isn't the aspect that I like here; instead I'm happy to see such an improvement in the UK/ROI margin, as this looks to have been a real dog for years, and I just hope that all regions continue on this track (although Asia is showing signs of becoming the problem child). Still the fact the Europe is both the most profitable region and also the one generating more than 50% of all revenue is an arrangement that works well:

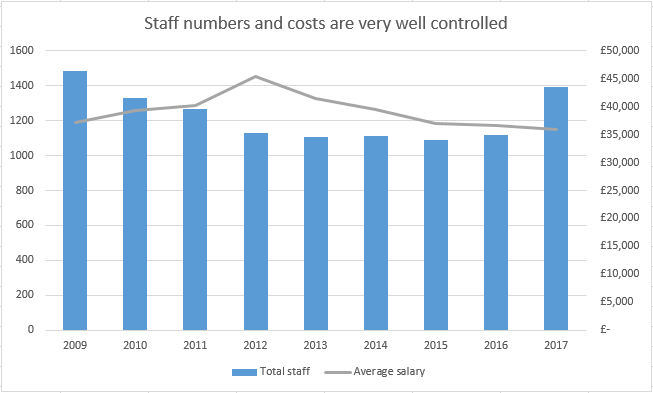

Part of this margin improvement is no doubt down to management concentrating on more profitable lines of business, while cutting back on the laggards, but they've also focused on reducing fixed costs. This makes a lot of sense as the board are rightly proud of their trained field engineers, who are apparently versatile enough to turn their hand to most things, but there's a big fixed cost base to deal with here when the market goes sour. In any event the head-count has reduced sharply in recent years without any impact on the average salary of employees (with the jump last year probably down to the Asda estate acquisition):

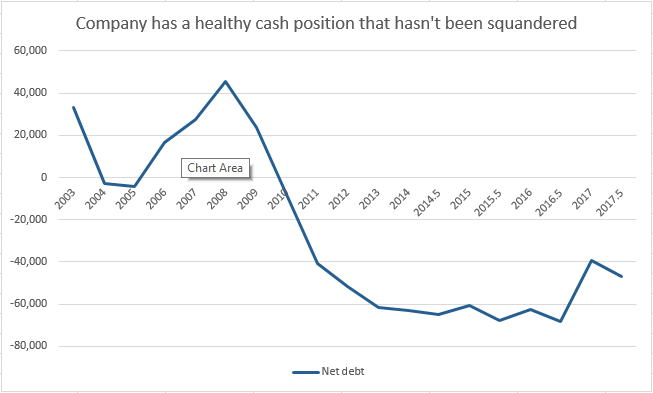

Looked at from a different angle I find it hard to invest in companies that don't convert their profits into cash and this is where Photo-Me's legacy of heavy investment in previous years is paying off (though it didn't at the time) through a high depreciation charge ensuring that profits are suppressed relative to the underlying cash generation. The consequence of this is that, following the last corporate meltdown, the balance sheet has moved from a net debt position of £45M to having over £47M in cash available (and that's after paying a special dividend):

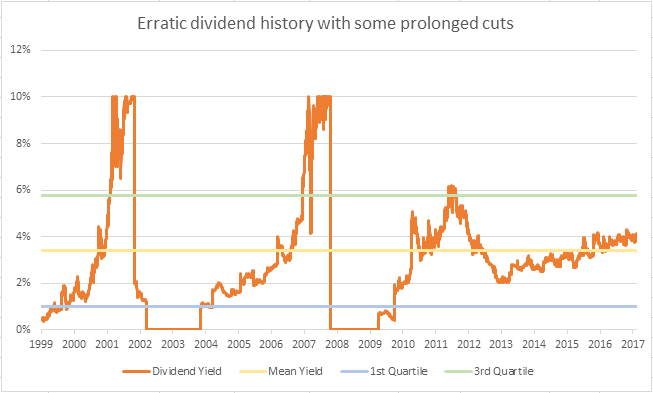

A nice side-effect of this balance sheet strength (and a show of confidence by management) is that the board have committed themselves to returning any net cash in excess of £50M to shareholders as a special dividend. In addition for the next two years, at least, the ordinary dividend will be raised by 20% and that implies a pretty decent yield of around 5% in a year or two (at the present share price). That said this is a share with a patchy payout record (two total cuts so far this century) and I won't be relying on it to pay my pension! I just hope that the directors aren't over-stretching the finances of the company by setting such a public goal:

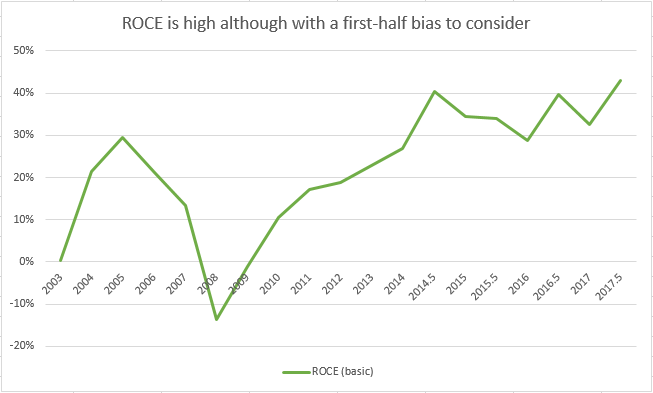

A final area that I want to examine is whether the company is managing to make a decent return on its assets; something that can be tricky when 10% of the market cap is sitting in the bank earning a derisory return. In the past this has been a real problem, and the ROCE has thrashed around as wildly as the share price, but in recent years it seems that some measure of stability has set in:

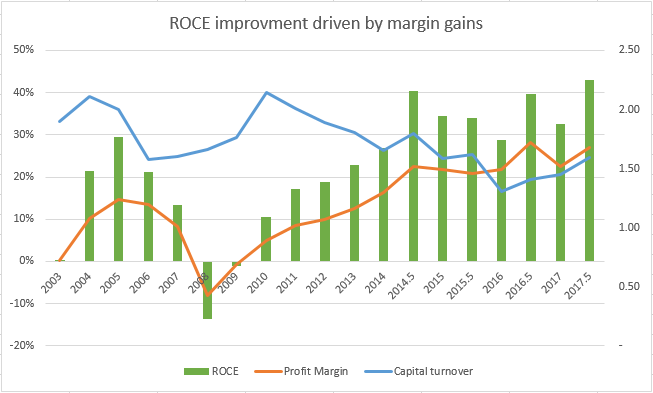

If we then perform a DuPont analysis it's possible to see what's driving this improving return; is it that profit margins are increasing or that capital is being used more effectively? Well it turns out that it's all about the margins with growth here being a function of cost control combined with a move into more profitable types of business. Personally I think that margins have gone as far as they can, at around 20%, but this is just fine when it leads to a ROCE north of 30%:

Conclusions

Having worked through the numbers I don't believe that Photo-Me is a value trap; instead it's using operational cash-flow to reinvent itself through the medium of laundrettes. Equally I don't believe that it's fundamentally a quality business even though its reliance on many, small transactions is typical of defensive sector firms such as Unilever (and it very much has a moat in its large estate of machines).

What it does have is a clear goal that makes sense: "Our stated strategy is to use the significant cash flow generated from our long-established photobooth business to develop new and complementary products which will drive our future growth. Alongside this, we are keen to penetrate new geographic markets, which offer the potential of long-term growth. It is also part of our strategy to be financially independent as far as we can be, and to concentrate on increasing our returns to shareholders."

To help myself decide on how convincing this statement is I've tried to distill the pros and cons of this business into a short list:

Strong Points:

- Very cash generative with high cash balance providing stability and security

- Committed to returning excess cash and paying an improving dividend

- Succeeding with the laundrette business and researching new areas

- Managing decline in photo-booth industry with technical improvements

- Manned retail outlets are being closed which will cut costs and improve margins

- Serge will want to retire wealthy and has recently been buying in size

- Recent confident statement suggests that business is on a roll

- Sterling depreciation is helpful even if just a one-off boost and prone to reversal

Weak Points:

- Photo-booths are in secular decline and seem obsolete in the medium term

- Reliant on Revolution laundry to drive top and bottom-line growth

- Chequered history shows reliance on Serge and he's no spring chicken

- Regions outside Europe aren't pulling their weight in terms of margins and profits

- Other directors don't have much skin in the game and are maybe overshadowed?

- Japanese issues with My Number are looking structural with margin under pressure

- Government requirements drive the photobooth industry and they are fickle

Such an even split very much reflects my inner thoughts on Photo-Me and of at least one other blogger: the board are doing just as much as they can with what they have to hand but perhaps it still won't be enough? Serge Crasnianski is clearly convinced enough to spend £7.5M on buying more shares just a year ago, taking his stake to 22.48% of the company or about £130M, and that's no chump change. On the other hand his base salary is £540K and for every year since re-joining in 2010 he's received a 100% bonus which leads to a total annual payout around the £1M mark (suggesting that the performance hurdles are nowhere near tough enough!).

Still with the recent article on selfies being allowed by the Passport Office, and anecdotal evidence that this is a pretty slick process, I do wonder if the board are underestimating the threat from this quarter? Of course this isn't new news but perception is all in some ways. I tend to agree that this move by the authorities isn't terminal (with Europe accounting for >70% of profits and their focus on security via directly-linked 3D booths) but neither can it be lightly dismissed. The world is changing and Photo-Me is being priced, with a P/E near 20, on the expectation that it'll be able to change pretty nimbly without much scope for error. Good luck with that!

Disclaimer: The author holds shares in this company