A business looking for a catalyst Laura Ashley frustrates by its inability to leverage such a well-known brand and it's not clear why this is the case.

Introduction

The Laura Ashley story is familiar to anyone of a certain age in the UK. Back in the '70s and '80s it offered a highly successful brand of florals, chintz and a certain form of Englishness. A total contrast to punk and even now the name retains a certain cachet. Sadly this recognition has proven hard to capitalise on over the last quarter century. A nadir was reached in 1998 when loan providers threatened to pull the plug and only the timely intervention of Malayan United Industries (MUI) saved the company - at the cost of MUI becoming the dominant shareholder. Since then the brand has slowly pulled itself back together with profits improving; but only as a result of cost-cutting and sales growth remains elusive.

Right now the group trades in 511 stores worldwide; 208 of which are located in the UK, Ireland and France, with the remaining 303 being franchise stores around the world. They operate five main store types comprising mixed product stores (selling all product categories), home stores (home products only), home concession stores, gift and accessories stores and a clearance outlet. There's also the direct business, encompassing e-commerce and mail order, which is a key part of the group’s multi-channel retail offering. Finally a pair of branded hotels complete the business; unusual but possibly a sound move. So Laura Ashley looks like a business that should prosper in the 21st century.

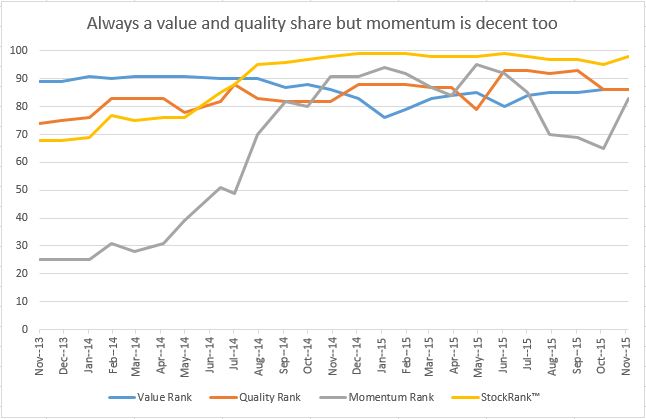

Why am I interested in the shares though? Principally because they boast a very high StockRank of 98 and score highly in all of the areas (value, quality and momentum) that go into calculating this rank. From the value side an amazingly high yield of 7% plays its part but Laura Ashley also has P/E and P/S ratios that are at the cheap end of the market. The sales and earnings underpinning these metrics are also of decent quality with a very high return on capital, >30%, and solid Piotroski and Altman Z-scores. Finally share price and earnings surprise momentum are also pretty good despite price weakness since the summer.

The problem is knowing whether this share will remain a so-so investment in spite of these positive signs; by examining the performance of Laura Ashley over the past decade I hope to divine whether the company is poised for growth or if there's more chance of this being one of those false positives that any mechanical scoring system produces.

What do the numbers tell us?

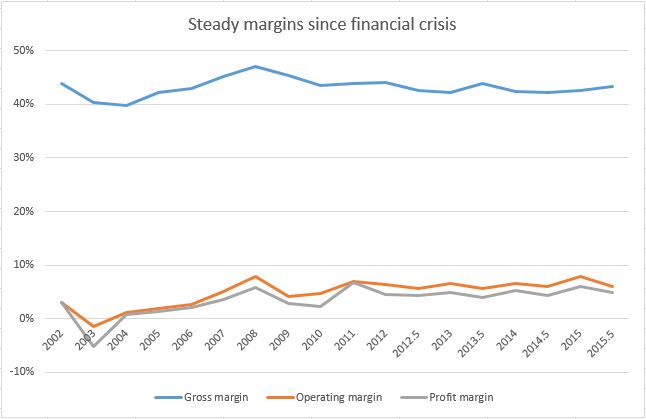

With any retailer margins are important but for a fashion retailer they're fundamental to business success. So it's pleasing to see a high gross margin, over 40%, which held firm during the financial crisis; the Laura Ashley brand has some pricing power. More impressively the operating margin has steadily improved over the last decade and is moving towards the 8% level. While this isn't in the same league as Next or Burberry (who achieve excellent margins around the 20% level) it's more than decent compared to many other speciality retailers:

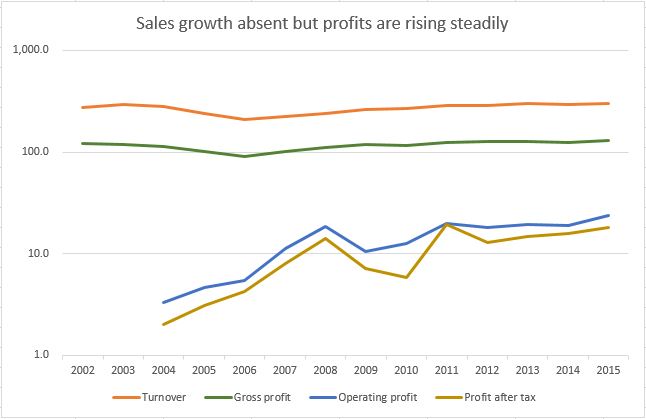

However it's fair to say that the operating margin isn't being driven by strong sales growth outstripping any inflation in a relatively fixed cost base. Quite the contrary. Here profits are improving despite an almost flat-lining turnover because costs are being steadily stripped from the business:

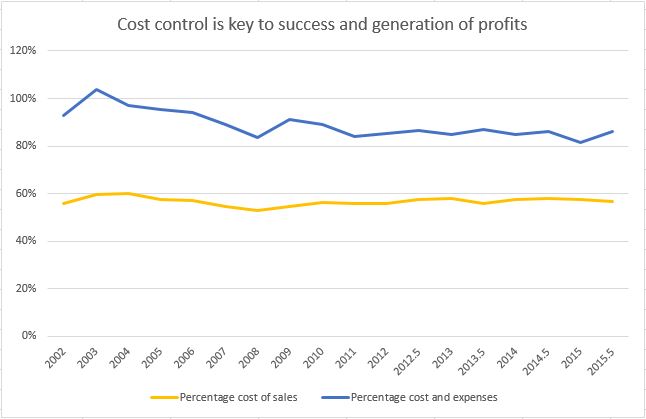

In fact looking at the headline costs it's evident that the cost of sales has remained flat (it's simply the inverse of gross profit). To my mind this is actually an achievement given inflation, material costs and a certain amount of product assembly taking place in the UK. However the real driving force behind profit growth is the reduction in general administration/sales expenses. I imagine that it's taken a long time to rid this business of inefficiency and I doubt that the process is over just yet:

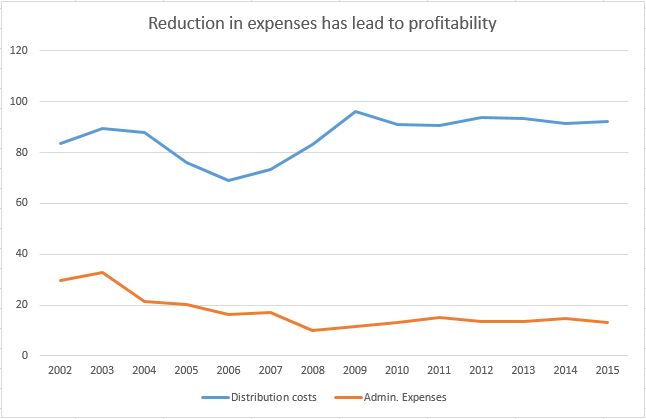

Finally in digging as deep as I am able to, using the annual reports, I've discovered that much of the squeezing has been within the administrative side of the business. The cost base here has more than halved (from a peak of £32.6m down to £13.2m now) and this alone speaks for significantly more than the increase in net profit over this period. A little of these savings have been swallowed by distribution costs but otherwise cost cutting represents the Laura Ashley corporate strategy over the last decade:

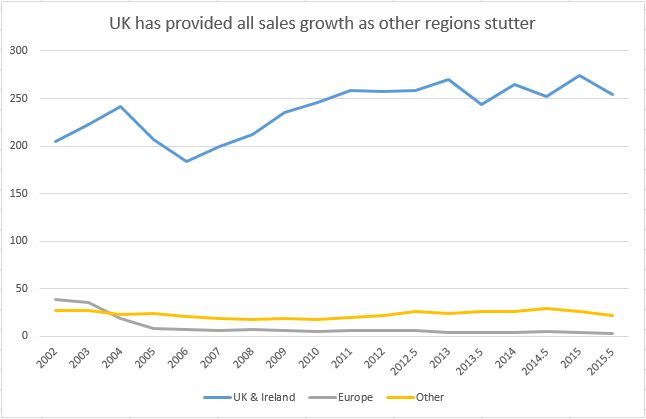

To be absolutely fair it's not quite true that the company is ex-growth as UK turnover has increased by around 25% over the last decade - the problem is that this buoyancy has been fully offset by weakness in all other markets. Right now Europe looks like a dead-duck, and barely worth the effort, while all other markets combined are barely moving the needle compared to the home country:

On the bright side the business does appear to be operationally competent as only around a month's worth of sales are tied up in working capital. This represents a very reasonable turnover of stock and there's nothing here to suggest that Laura Ashley is presently carrying hard-to-shift lines of stock. In comparison times were tough for the 2003-07 period as current assets hung around the balance sheet rather than flew off of the shelves:

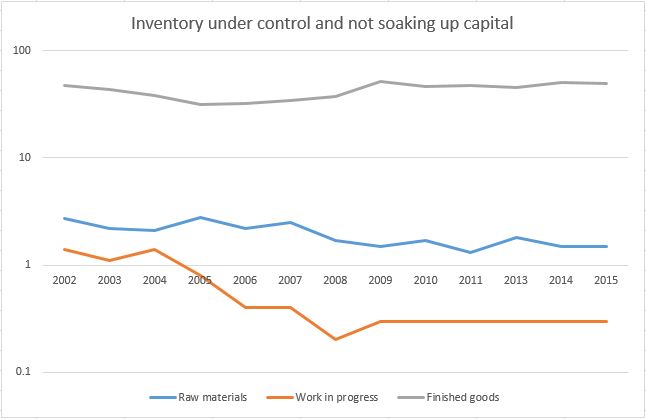

Viewed in a little more detail inventory management is very much under control with low levels of raw materials and work in progress being held; over 95% of stock material exists as finished goods and we already know that these are being turned over quickly. So there should be little need for margin-destroying sales here and I can't see much evidence on-line that these are a regular feature for the chain.

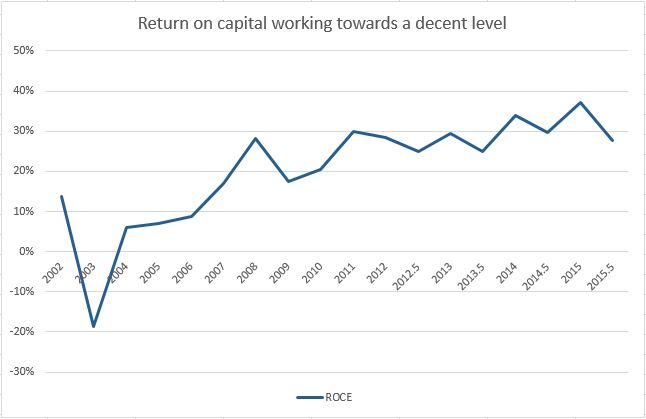

From a financial perspective one of my reasons for liking Laura Ashley is the consistent level of cash - up to £38.5m in 2011 although somewhat reduced now following a big property purchase in Singapore. Despite this seemingly inefficient balance sheet the return on capital has been marching upwards for a decade now as management eke out higher profits from the same capital base. In fact the number of shares in issue hasn't changed since 2003, when a rights issue was required to keep the business afloat, and all capital has been internally generated:

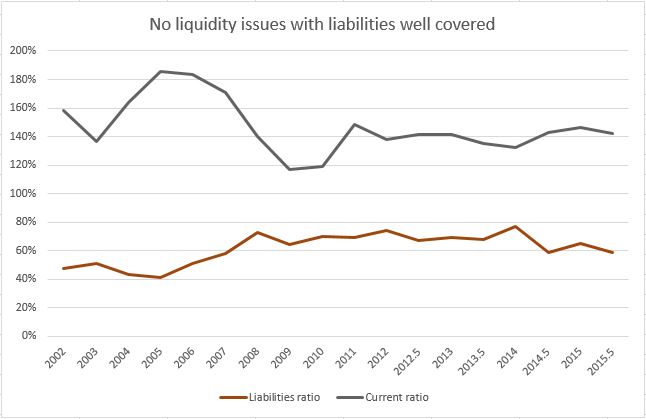

As you might expect with such decent financial oversight the business is very liquid, with all of that cash, and current liabilities are very well covered by current assets. This must feel pretty comfortable for the CFO and rightfully so:

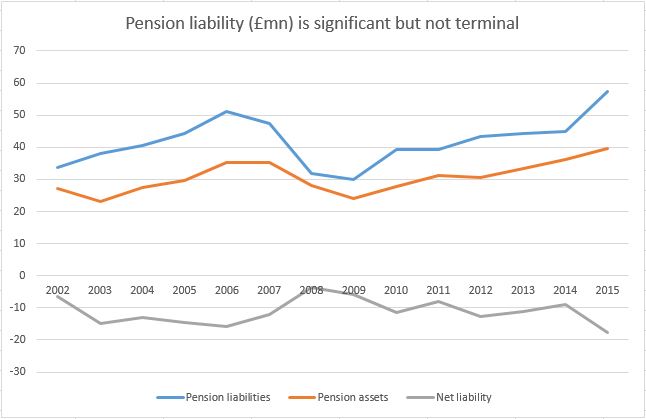

On the other hand if there's one aspect of the company likely to give the board ulcers it's the final-salary pension scheme which runs at a sizeable, although manageable, deficit. This rather offsets the cash (and freehold property) and while a smart deal to remove certain liabilities helped back in 2008-09 it's clear that the nasty old liability is creeping back up again. I don't think that it's a company-killer, at about a year's profits, but I can see the trustees forcing an increase in reparations at some point:

A few obvious questions

What gives me pause for thought with Laura Ashley is that while the numbers look solid the non-financial aspects of the business are unusual.

For a start the dominant shareholder, Chairman Tan Sri Dr Khoo Kay Peng, owns 35% of the company through MUI while his private investment vehicle, Bonham Industries Limited, speaks for another 25%. So besides the fact that MUI have the right to appoint three directors to the board he practically controls the company through the size of his stake. While he hasn't explicitly disadvantaged minority shareholders in the last 15 years he certainly benefits from his position; above a hefty dividend payout he also pulls in a £200K salary (which outstrips that of the CEO).

Now I believe that shareholders and businesses benefit from competent, imaginative and open management. Here the first is true as Laura Ashley is being managed efficiently and trades a long way from the basket-case it was at the turn of the century. However I am uncertain about the second. For many years there has been talk of e-commerce and international growth leading the way to a brighter future and yet on the foreign sales front the firm has, if anything, gone backwards. This may explain why, since Lillian Tan left in 2012, there has been such a flurry of changes to the non-executive directors (NEDs) working for the company. It's almost as if the executive directors, who've been around for much longer, are looking for a magic bullet from the NEDs and yet find themselves disappointed. Either way quite a few NEDs have lasted less than a year and this rate of churn is out of line compared to the time when Lillian Tan was in charge. On the final point the directors of the company put out as little information as they can and even in the regulated commentary available it's hard to grasp what their real thoughts and intentions are.

As an example the reporting date of the company was very recently changed from January to June for this reason: The Board considers that the change of the accounting reference date will facilitate the preparation of the Company's consolidated financial statements. However this makes very little sense to me. Christmas is a key trading period for most retailers and, as such, it's beneficial to shareholders for results to be made available as soon as possible after this date. Any retailer with half-decent reporting systems should be able to pull these numbers together quite quickly. So I don't understand the motivation behind this change, after so many years, and I can't see how it's of benefit. Does this make it a red flag though? Will it allow for a longer gap until the next audited results? I can't decide.

Similarly out of the blue came this summer's decision to acquire large commercial premises in Singapore for a substantial £31m. Understandably this transaction has rocked investor confidence and for good reason as the company now has £10.9m less cash and £20.2m of debt to pay back over the next 15 years. In practice capital payments of roughly £140K per month will siphon off nearly £1.7m per annum from profits (just under 10% of last year's after-tax profit) and result in £36.1m being paid out in total. The real question though is whether this new office will somehow invigorate the presently sluggish growth in Asia? I'm inclined to give the board the benefit of the doubt but I remain to be convinced of the incremental return on capital here.

Conclusion

I asked my wife how she viewed Laura Ashley, as a potential customer, and she said that the brand is good quality, especially in fabrics, but it's also expensive and caters to a specific niche of English folksiness. This places a limit on growth but on the other hand there aren't really any competitors in this space. The shops are also small (on average around 3712 sq ft or twice the floor space of the average UK house) with not many of them about; for a particular type of wealthy, country-set female this probably isn't an issue but you're unlikely to stumble into one by accident. That said profits were pretty resilient during the financial crisis and I sense that Laura Ashley customers are quite "sticky".

So unlike the 1990s, where the business went bust through inefficiency, over-expansion and losing touch with fashion, the current incarnation of Laura Ashley appears quite focused on turning a profit. One aspect that resonates with this lost decade though is the high-churn rate of non-executive directors (whereas previously a succession of CEOs flitted through the hot-seat). Lately Ms Frances Boon Wah Ling lasted less than a year (Oct 2013 to Aug 2014), Ms Ho Kuan Lai made just more than a year (Jun 2013 to Aug 2014) and Dato' Ahmad Johari bin Tun Abdul Razak became eligible for a gold watch by serving just over 3 years (Sep 11 to Nov 14).

Along with quite a few changes to the company secretary, plus a number of joint and alternate positions, it feel like there have been just a few too many warm bodies passing through the boardroom at Laura Ashley. It's hard to see how anyone is adding value, with such short tenures, and I am concerned that the board are flailing about for a growth strategy since the new CEO, Mr. Ng Kwan Cheong, returned in Jan 2012. One positive is that the executive board is pretty stable with essentially the same CEO, CFO and COO having run the business for the last 3-4 years. However even longevity has its downside and this year the Deputy Chairman, David Walton Masters, faced a shareholder rebellion for having been in-situ since 1998. Clearly he can't be considered to be independent of Tan Sri Dr Khoo Kay Peng.

Strong points:

- Low valuation suggests a decent upside if sales begin growing

- Margins are improving as costs are reduced and sales maintained

- Very good at converting profits into cash

- Excellent balance sheet with £10m of depreciated freehold property

- Freehold property has previously been sold above book value

- Very high stock ranks on Stockopedia

- Havn't issued any shares since putting out a 1 for 4 rights issue in 2003

- Dominant shareholder hasn't disadvantaged minority owners in last 15 years

- Head Office in Fulham is not ostentatious and more a light industrial unit

- Final salary pension scheme deficit was handled well by incentivising people to transfer out

- Confidence in company is low and probably explains the subdued share price

- Fairly consistent strategy of refining UK store portfolio by closing less profitable stores

- Online offering is growing steadily

- Branded hotels are an innovative way of exposing customers to products and fashions

Weak points:

- Dividend is very high but its coverage by profits is low

- History of dividend payments is erratic with no stated plan

- Property and share sales have been used to maintain cash balance in recent years

- Future profits will be reduced by extra rent in Singapore and payments to pension scheme

- Business essentially went to the wall in the '90s

- Doesn't compare well to other similar retailers such as Next

- Hasn't quantified the impact of the Living Wage on the company

- Deficit in final salary pension scheme has increased recently and is material

- Why spend so much buying a head office in Singapore rather than renting it?

- No growth seen in Asia; hardly seems like the business was constrained by space?

- Unclear why year-end has been changed and reason given makes no sense

- Plans that the dominant shareholder has for business are unknown

- Chairman is no spring chicken, at 76, and CEO is clocking in at 66

- Chairman is also facing an exceptionally high divorce settlement

- Hotels are related to MUI as they lie within the Corus chain and may be a conflict of interest

- Board have authority to issue up to 33% of the share capital which is rather high

That said the latest comments from the chairman are very positive: I am pleased to report that our business has maintained the robust performance of recent years with a healthy increase in like-for-like, retail sales. Our U.K. business, buoyed by a strong performance from our online channel, has shown resilience and potential for continued growth. The hotel is realising its potential and is proving to be a valuable asset to the brand.

So it's possible that the high StockRank, which fuses together the value, quality and momentum numbers, may be accurately indicating a business worth investing in. Of course exactly the same thing could have been said a year ago and since then the share price has gone absolutely nowhere. Even so this is exactly the sort of graph that I like to see for any share worth buying:

On the whole Laura Ashley feels like a business in good shape but one that's lacking in scale and that certain catalyst to trigger substantive sales growth. If something good can happen here, as a result of the Singapore purchase, and corporate ownership issues don't become a problem then I can see the share breaking out from the 27-28p level which has held for the last three years. With a trading statement due in mid-December we haven't got long to wait!

Disclaimer: the author holds shares in this company.