One line summary:

Impressive growth trajectory and strong management team but with two big acquisitions to digest, a diminishing ability to wield capital effectively and a sky-high P/E I'm not going to join the queue for Accesso.

Introduction

A few years ago Accesso was known as Lo-Q and if you've been to a theme park recently you might have seen its key product: the Q-Bot. These nifty devices allow you to join a virtual queue and while you're waiting you can take in some less popular rides or just relax and spend money. Much more fun for the customer (well those who've splashed out on the devices anyway) and an opportunity for the park owner to squeeze some extra revenue.

This is an exceptionally successful niche for Accesso and they boast of an impressive client base (although with more dependence on Six Flags in America than is comfortable; 95% of revenue stems from the US). However the writing is on the wall with mobile-phone queueing apps set to muscle out their bespoke hardware offering. So management have been on the acquisition trail and swept up the original Accesso along with SiriusWare; all in just over twelve months.

The last year has been a period of great change (and opportunity) for Accesso as it digests these acquisitions. Simultaneously the share price has endured a rather high level of volatility with it breaching 750p at the end of 2013 before deflating to just below 450p in July. The question I aim to answer then: is this just a blip in the monumental growth of Accesso (ten years ago you could have filled your boots at less than 5p) or are we looking at a stall scenario?

Full year accounts for 2013

The annual accounts for Accesso are a little distorted as they cover a 14-month period due to a change in the year end date. The adjustment is reasonable as Accesso is a very seasonable business (busy summers, quiet winters) and annualising the figures isn't hard. On the other hand the year end date for Accesso was 31st December right up until 2008; so it's a bit odd to flip-flop this way in just 5 years.

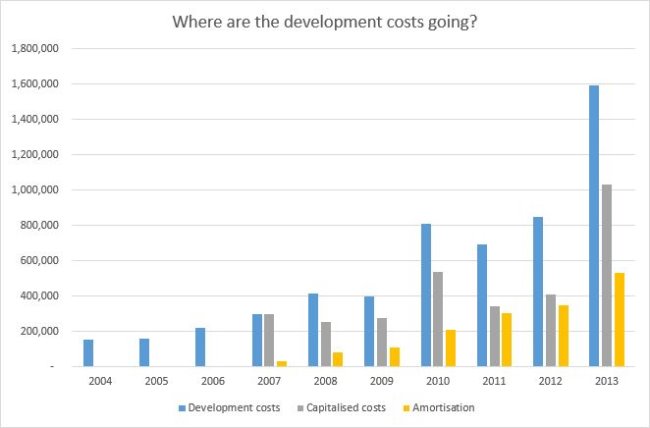

In thumbing through this report I'm trying to get a feel for the honesty of the management and how well they are coping with two chunky acquisitions. They've been undeniably successful at organic growth in the past but can they maintain this momentum without resorting to accounting trickery such as capitalising development costs or some other way of shifting losses to the balance sheet rather than leaving them in the profit and loss account where they belong? I'm also curious as to how margins are holding up in the enlarged business and whether the share price weakness heralds some other malaise.

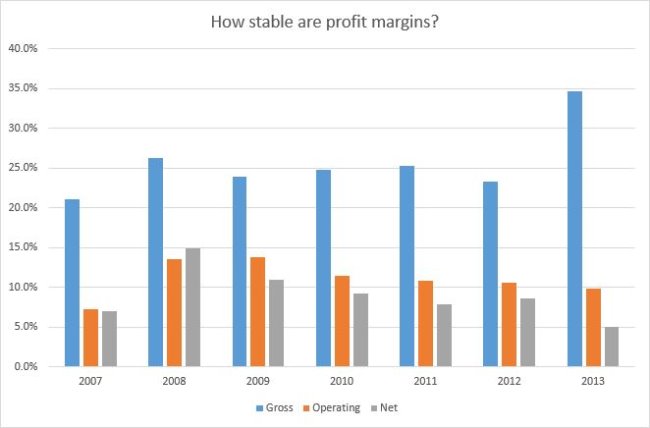

On the face of it the report meets the criteria for a company in 'good health' with adjusted revenue up by just over 10% and a 34% gross profit margin compared to 23% in 2012. However much higher expenses (up by over 160% annualised) mean that the operating margin slips to under 10% while the net profit margin falls to under 8%. There's some scope for adjustment here, depending on how you want to treat acquisition and amortisation costs, but the margins are clearly under some pressure:

So what's going on with costs? Well due to the acquisitions the non-seasonal head-count has leapt from 44 to 113 and that's doubled the total salary cost from £5M to £10M. It's a big investment in people but Accesso needs to put in the R&D if it's to compete in a mobile world. On the expense front park operating costs form the lions share and are down by 5% compared to 2012; otherwise staff costs are the next biggest expense at 28% of park costs.

Looking at the balance sheet the two acquisitions have stuffed the balance sheet full of intangibles (up from 9% of total assets to 60%). At the same time Accesso have been capitalising a decent proportion (50-70%) of their development costs since 2007 with these being amortised over 3-5 years. The result of this is to flatter the P&L in the year of the cost and this effect is especially pronounced when development effort is increasing:

On balance thought I appreciate the fact that Accesso don't window-dress their accounts. For example the reported eps is down by a whopping 30%, due to acquisition costs and adverse FX movements mostly although higher finance interest plays a part, and there's no sense that the board are trying to fudge this. Usefully the acquisition costs are broken out and adjusting for these brings the net margin up to 8.4%; a little lower than the historic average but not disastrously so.

In line with this I get the sense that the directors aren't playing fast and loose with the balance sheet. There are share options, of course, and the vast majority vest a long way below the current share price - but even if all are taken this only amounts to a dilution of 5%. With the two complementary acquisitions the financing has been a sensible mix of bank debt and new shares; the latter bumping up the share count by about 10%. So the eps has a bit of headwind here but the company is very comfortably on top of its gearing and should revert to being cash positive in a year or two.

This caution is reflected in other areas of the business. Despite headline profits being down by 30% the cash flow from operations remains healthy at £4.6M; essentially the same as for 2012 once adjusted for the 14-month reporting period. In fact operating cash flow has historically been strong for Accesso, since turning positive in 2005, and around 12-15% of turnover consistently converts into this cash flow.

A factor in this cash generation is that the average credit period for theme parks, when paying queuing system revenue, is 14 days. This short cycle has matched the debtor days figure for a number of years although in 2013 the debtor days jumps to just under 24 days. Probably not a cause for concern but something to watch in case acquired debtors become a problem.

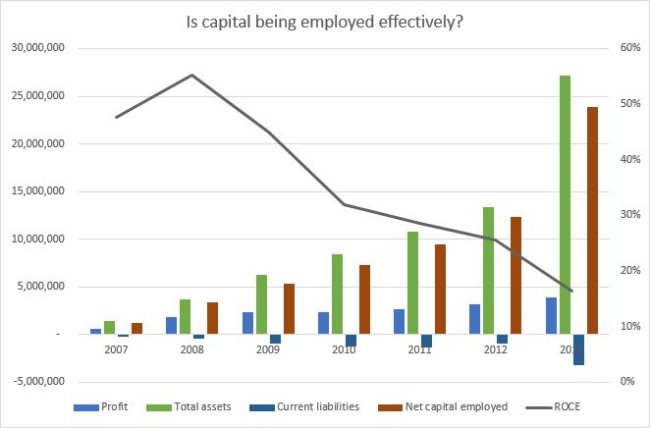

Everything so far is pretty tickety-boo (pun intended) but my real concern is that the capital base of the company is growing much faster than the profits. In 2007 the ROCE was 48% as £1.2M of assets generated £566K of profit; by last year the asset base had mushroomed to 20x (£23.8M) the 2007 figure while profit increased by less than 7x (£1.3M) over the same period. So the quality of earnings has been diminishing for some time and that worries me:

What does this really mean for Accesso? In isolation an operating margin of 10% and an ROCE of 16-18% doesn't sound awful and compared to other companies in the Software & IT Services sector this is a first-quartile performance; there are plenty of less effective companies out there burning through investor funds. But the decline over the last 5 years suggests that the company is under some pressure and I'd like to see this trend flatten out.

On the whole the accounts for 2013 are indicative of a well-run, honestly-reported growth company. The management are focused on a few related niches in the leisure industry, their client base is of the highest quality and they are actively preparing for the impact of smartphone apps in their sector. And yet I can't quite ignore the fact that they're not benefiting from the increased capital being employed and that the stock market is placing a high premium on them not putting a foot wrong.

NB For contrast Edison Investments have a detailed research note on these accounts.

Interims for first-half 2014

So with the interim accounts for 2014 do the trends continue? Well operating profits are up by 10%, to $1.3M (note the change of currency), on a broadly unchanged capital base. If this uplift carries through into the full year then the ROCE might rise to 18% although that's still low compared to previous periods. At the same time the eps figure is flattered by new tax credits and while that makes the headline figures look good it's not sustainable in the long term.

While there's no breakdown of debtors in these unaudited accounts, to provide a trade receivables figure, the trade and other receivables value jumps by 56% to $6.6M (from $4.2M) while the trade and other payables value drops by 18%. So cash is being sucked into working capital and that's an unwelcome trend; of course this might just be a fact of life for Accesso but analysis of earlier interim accounts is required to determine this.

That said the narrative for these accounts is one of continued growth, new agreements and contracts, a desire to expand into Asian markets and investment in technology. There's no doubt that the theme park operator's value this queueless functionality and Accesso seem to be in exactly the right place to help them out-source this part of the experience. Whether it will all pay off for the company I don't know but I do look forward to seeing the full-year results in six month's time.

NB Once again Edison Investments have a detailed research note on these interims.

Conclusion

Personally I like the services that Accesso provide, having used them at Legoland, and I like the fact that they aren't trying to game the market with their results reporting. They have a sharp focus on growth and aren't putting the company at risk to achieve it; debt load is low, cash generation is good and liquidity is excellent due to minimal stock requirements.

Also the management has its interests well-aligned with smaller shareholders since they hold quite a lot of stock themselves (although a decent slug was sold to meet institutional demand earlier in the year) and a fair, but not outrageous, volume of options. However the current price, while reduced from its high point, is still assuming a lot of future growth. So this doesn't strike me as a sensible point to buy into the Accesso story but I doubt that I'd be selling if I was already on the register.

Disclosure: the author holds no shares in this company.